Shiba Inu (SHIB) price has been teetering on the threshold recently, with price circulation growing weaker each and per week. Merchants and traders alike are beginning to surprise: might well SHIB price be heading toward an total collapse? June 2025 has started on a cautious display conceal for the meme coin, and the charts are signaling hazard forward.

Shiba Inu Label Rupture: Is SHIB Exhibiting Indicators of Weakness Already?

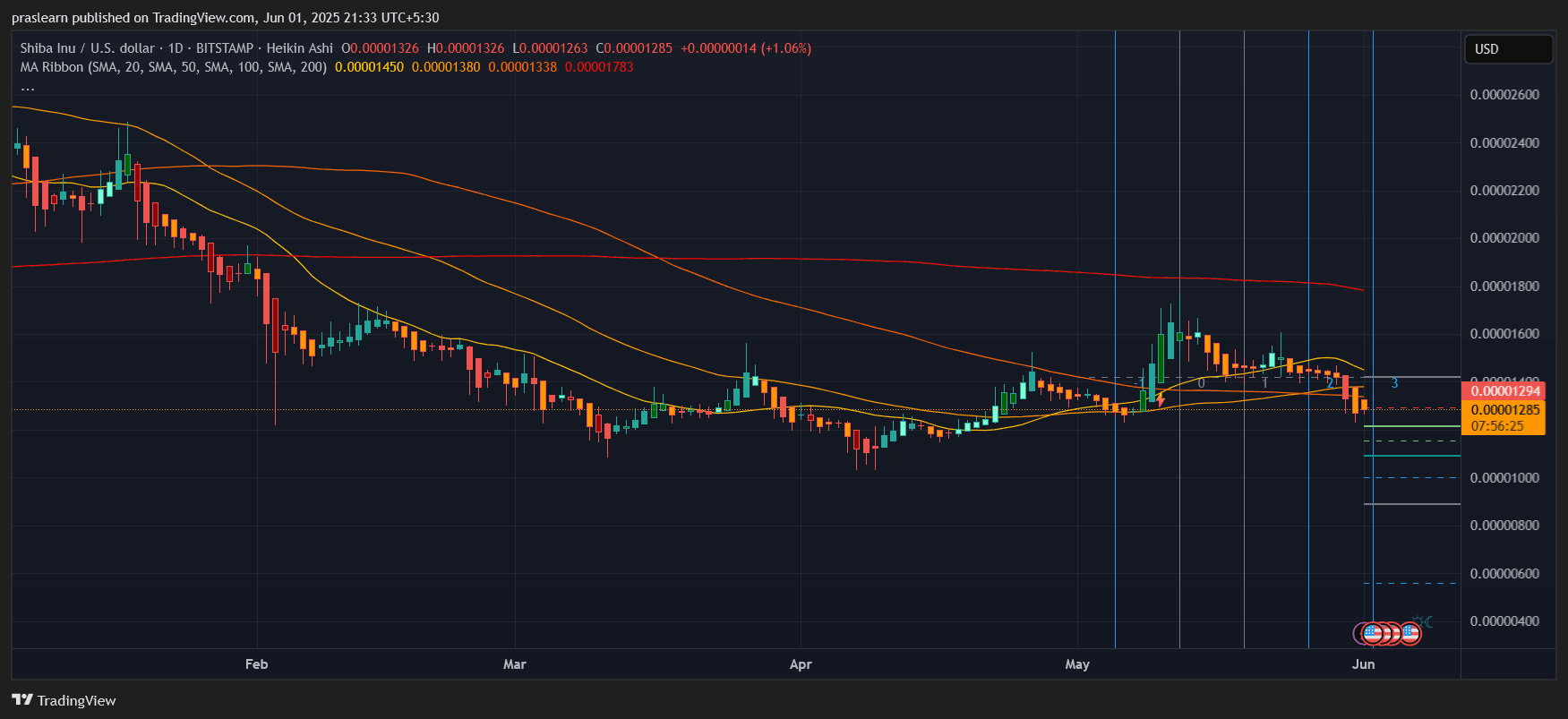

Taking a overview at the every day chart, Shiba Inu price has lost serious toughen attain the $0.00001500 place and is now trading around $0.00001285, with a bearish Heikin Ashi candle building confirming continued downside stress. The price is now smartly beneath the 20-day, 50-day, and 100-day transferring averages, which sit around $0.00001380 to $0.00001450. This confirms that SHIB is entrenched in a bearish pattern.

A principal scenario is the loss of life injurious formation that took place weeks within the past when the 50-day MA crossed beneath the 200-day MA, at the moment around $0.00001783. Historically, this form of setup precedes prolonged downturns unless invalidated by sharp breakouts. Given contemporary volume ranges and momentum, a reversal appears to be like no longer going within the attain term.

Hourly Chart Confirms Bearish Continuation Pattern

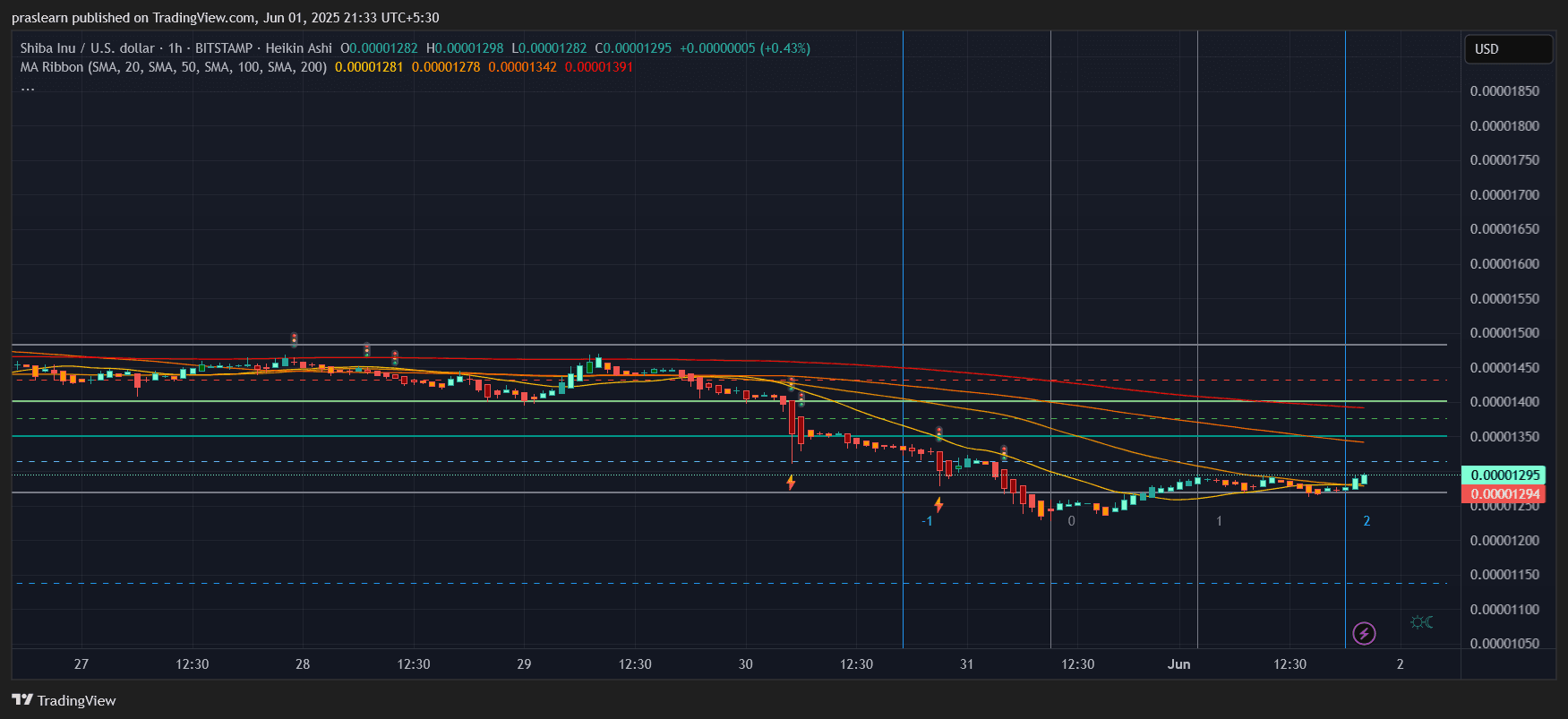

Zooming into the hourly chart, SHIB’s non eternal price circulation is struggling to reclaim even traditional resistances. As of now, the token is barely retaining at $0.00001295, while the hourly resistance at $0.00001342 (100-hour SMA) and $0.00001391 (200-hour SMA) are acting as stable rejection capabilities.

There used to be a most modern are trying at a minor rebound, but each and every uptick used to be met with solid selling stress, notably attain the MA ribbon. Moreover, a descending wedge building that temporarily broke upward has already failed to carry momentum. This rejection aligns with the classic “dangle flag breakdown”, a sample that normally finally ends up in extra declines.

If we project the breakdown target the usage of the flagpole means:

- Top of the outdated flagpole: $0.00001550 – $0.00001200 = $0.00000350

- Breakdown level: ~$0.00001200

- Measured scamper target: $0.00001200 – $0.00000350 = $0.00000850

This implies that SHIB price might well tumble to $0.00000850 within the impending weeks unless a essential reversal invalidates the sample.

What Label Ranges Would possibly perchance Assign off a Alarm Sell-Off?

The important thing toughen to scamper looking out for is $0.00001200. If this level is lost, there’s nearly no essential horizontal toughen till $0.00000950, which served because the final indispensable accumulation vary abet in early 2024. A breach beneath this is able to well spark off automated reside losses and consequence in apprehension selling.

Even extra alarming is the probability of SHIB price entering a “capitulation zone” between $0.00000700 and $0.00000500, where prolonged-term holders might well additionally originate exiting. These zones align with historical volume nodes viewed on volume profile diagnosis.

Shiba Inu Label Prediction: Would possibly perchance Shiba Inu Plug to Zero? Let’s Attain the Math

Let’s break down what it would take for SHIB price to hit zero. Currently, SHIB’s supply is around 589 trillion tokens. With a recent price of $0.00001285, that affords a market cap of around $7.58 billion. For SHIB to wreck to $0.00000001, the market cap would must plunge to beneath $6 million — a 99.99% collapse. That’s extremely wonderful without an total failure of the ecosystem or total market exit from all meme money.

So while crashing to absolute zero is extra theoretical than likely, the real looking hazard is a cost collapse to sub-$0.000007 ranges, which aloof means a 45%–60% drawdown from contemporary prices.

Shiba Inu Label Rupture: What Would possibly perchance Assign off the Fall down?

Several factors might well act as catalysts:

- Bitcoin weakness: If BTC drops beneath $60,000 again, meme money cherish SHIB will bleed extra indispensable.

- Lack of utility account: Shibarium has no longer delivered ecosystem traction to counteract the hype cycle downturn.

- Whale exits: Any indispensable pockets unloading positions will spook retail traders.

- Macro stress: Rising ardour charges or a U.S. recession might well drain liquidity from speculative property.

Shiba Inu Label Prediction: What’s the Verdict for June 2025?

Whereas a literal wreck to zero is extremely no longer going ensuing from vary delisting safeguards and whale holdings, the charts clearly display conceal a breakdown building with extra room to tumble. If Shiba Inu fails to help the $0.00001200 level within the principle week of June, we would completely peer it spiral toward $0.00000850 or decrease.

Investors might well aloof brace for volatility and be cautious of fakeouts. The momentum, pattern indicators, and volume behavior all at the moment toughen a bearish bias for Shiba Inu in June 2025.