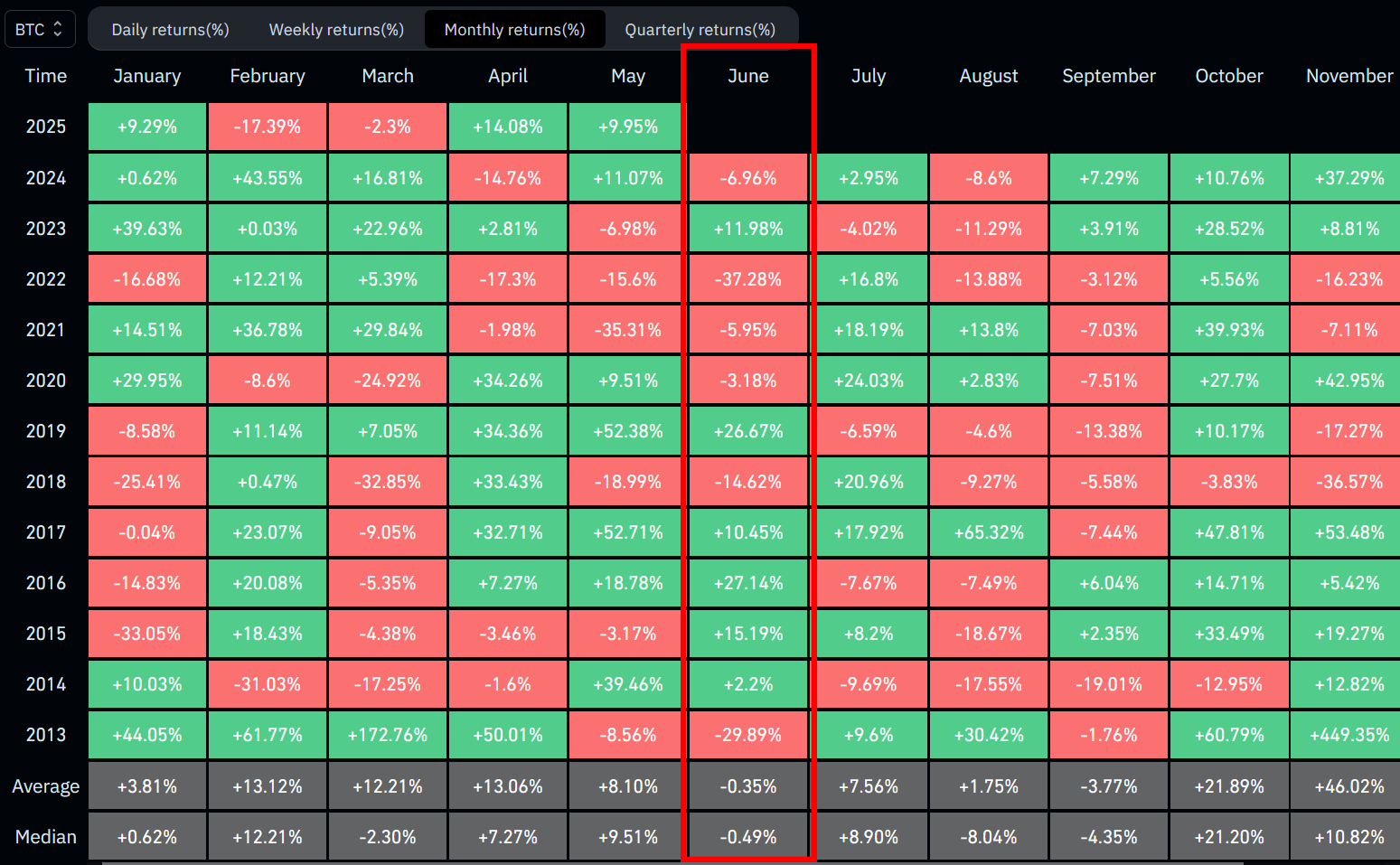

June is a demanding month for Bitcoin, raising concerns among merchants. Historical records exhibits that the cryptocurrency regularly brings disappointing returns in June. Many investors beget change into interested in this pattern. Since this has came about over and over, merchants are wondering if this can preserve going.

Per historic records, Bitcoin’s note fell by 3.18% in June 2020, and in June 2021, it lowered by 5.95%. The problem worsened in June 2022, when the associated payment of Bitcoin declined by 37.28%. June 2022 was one among the worst months for Bitcoin, marked by necessary note declines. The a lot of loss helped forge the notion that June tends to be a demanding month for Bitcoin. Many of us within the monetary world rapid connected the month with the next chance of losses.

In June 2024, Bitcoin skilled one more negative return, with the cryptocurrency shedding by 6.96%. No topic diversifications in a vary of months, June persevered to demonstrate a ragged efficiency. This underperformance has led many Bitcoin merchants to undertake a more cautious potential to trading throughout this month. Bitcoin regularly experiences overall whisper in note, but June nonetheless tends to bring increased volatility and decrease returns.

Even supposing Bitcoin tends to manufacture well in most a vary of months, June is quiet one among its weakest months. Therefore, few merchants are desirous to commence positions in June since it is customarily a more uncertain time. As of press time, BTC is trading at $103,520, down by 2.08% true thru the final day.

Bitcoin customarily encounters hurdles within the month of June. Per previous records, it is evident that efficiency is regularly subpar. Even supposing many global traits affect Bitcoin’s note, every year in June exhibits a conventional drop. As time passes, merchants will continue to note the market to search out out if the pattern persists or begins to shift.

Associated: Bitcoin with a Safety Accumulate: Cantor Fitzgerald’s Gold-Powered Funding Fund

Disclaimer: The records presented in this article is for informational and academic applications most effective. The article does now not portray monetary advice or advice of any kind. Coin Edition just isn’t any longer accountable for any losses incurred on epic of the utilization of stammer, merchandise, or products and companies mentioned. Readers are instructed to advise warning sooner than taking any motion linked to the corporate.