Staunch-world asset tokenization launchpad Collateralize has jumped 310% since Would possibly per chance per chance well 17 after Solana Labs co-founder Anatoly Yakovenko reposted a product demonstration X put up.

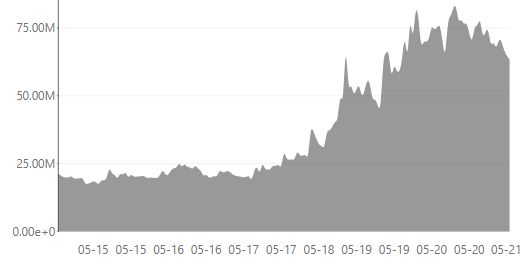

Its COLLAT token’s market capitalization jumped to bigger than $82 million on Would possibly per chance per chance well 20 from $20 million on Would possibly per chance per chance well 17, based mostly fully on The Defiant’s ticket feeds. It has since retreated somewhat to $61 million.

Collateralize enables tokenizing any accurate-world asset (RWA), from baseball cards to accurate estate. The protocol uses a dynamic bonding curve, and as soon as that purpose has been reached, the asset begins procuring and selling on the Meteora decentralized alternate (DEX). Meteora has audited the bonding curve program.

The Solana-based mostly fully protocol prices a 1% rate on transactions and a 5% rate upon migration to Meteora. One other 15% goes to the Meteora liquidity pool.

“Tokenizing RWAs is wonderful when it enables something that wasn’t previously that that you would be succesful to well be ready to imagine—cherish liquidity, programmability, or broader entry,” talked about Collateralize co-founder Pierre Hoffman via Telegram. “We’re beginning to perceive early examples of this, especially with publicly traded RWAs cherish U.S. Treasuries or equities. That’s already a meaningful shift.”

However, he added, there’s an even bigger replacement in non-public property, which don’t for the time being private entry to deep liquid markets

“If we can notify these onchain—under very best frameworks and with transparency—we can let markets when it comes to a resolution which of them are precious enough to be traded, collateralized, and aged,” Hoffman talked about. “It feels early, nonetheless the basics are lining up.”

Boosting Liquidity

Solving liquidity is a massive replacement, Collateralize talked about in its pitch deck, noting that while crypto has a market cap of about $3 trillion, the marketplace for illiquid RWAs is a whopping $750 trillion.

With a 15% rate allocated to liquidity when an asset migrates to Meteora, Collateralize hopes it has solved that distress.

“Liquidity is a prerequisite for any asset to be worthwhile onchain,” Hoffman talked about. “So, in our model, a section of every token aquire goes straight right into a trusty liquidity pool. This ensures that as soon as an asset is tokenized, it’s also straight tradable. We don’t perceive this as an overhead ticket, nonetheless rather as a structural fair—something that helps bridge the gap between illiquid, offchain property and the mercurial, composable nature of DeFi.”