Amid Bitcoin’s (BTC) rally, consultants at QCP Capital puzzled whether BTC might per chance well hit all-time highs sooner than the quit of March.

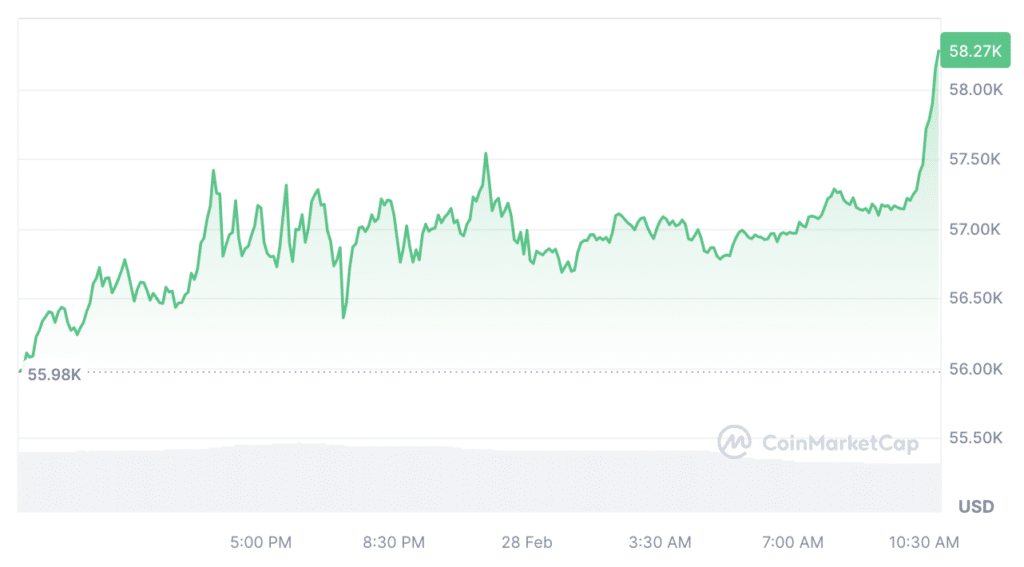

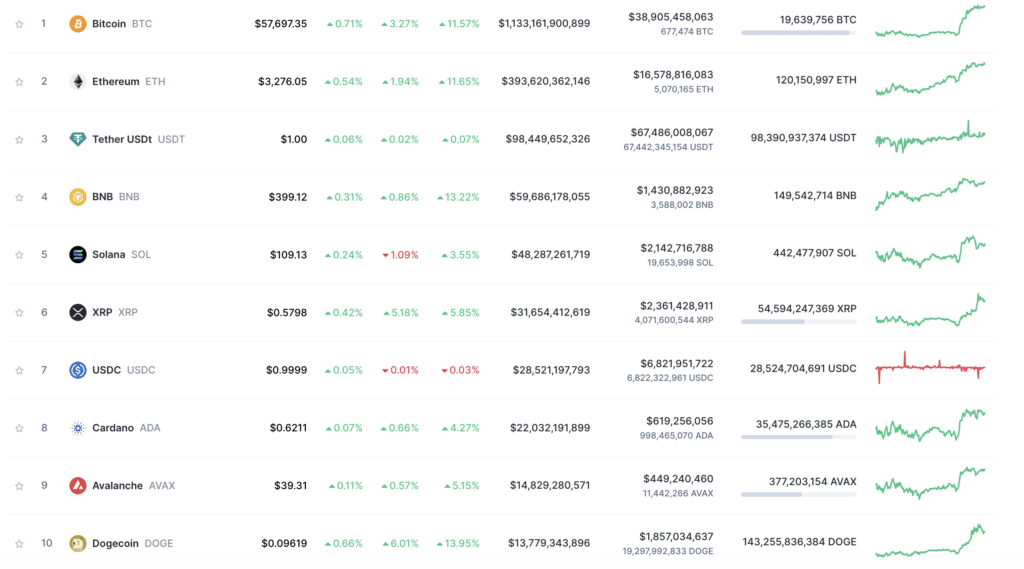

At the time of writing, BTC is shopping and selling at $58,300, up 4% in 24 hours and 13% in the final seven days, in response to CoinMarketCap data. Following the short snarl of the first cryptocurrency, analysts at QCP Capital puzzled whether BTC would attain all-time excessive earlier than the quit of March 2024.

In their most modern analysis, consultants introduced bullish and bearish eventualities for Bitcoin. The necessary is that ongoing spacious capital inflows into effort Bitcoin ETFs will continue the uptrend as halving is predicted quickly.

Thus, the volumes of effort ETFs exceeded $3.2 billion, and the win influx amounted to $520 million, analysts recount. The short designate surge precipitated short liquidation and a speculative attempting to search out frenzy, with funding charges on native exchanges skyrocketing and even longer-dated futures shopping and selling at up to +16% over the bother market.

“Search recordsdata from for vols has picked up, however vol spikes hang been quickly equipped into. No subject the size of the transfer, its one-arrangement nature ability that the realized quantity stays stop to 40%. We idea the spacious 60k strike as a natural diagram for March expiry.”

QCP Capital consultants

In step with the 2nd forecast, unstable funding charges can also restrict speculative fervor, and the crypto industry can also idea some reduction in leverage in the short term and per chance a pullback in direction of the $50,000 level.

That it’s doubtless you’ll also treasure: Bitcoin surpasses $56k, merchants making a bet on additional upward thrust

For the rationale that starting of this year, Bitcoin has risen in designate by 35%, and for the rationale that starting of final year, by practically 250%. It is far now 16% far from its all-time excessive of $69,000 put in November 2021. Amid the BTC rally, the remainder of the quit 10 cryptocurrencies by market capitalization are also showing well-known snarl.

Crypto market participants highlight several causes for the rally. Thus, there is snarl in the influx of funds into crypto funds, the formula of halving, and expectations of the Federal Reserve System (FRS) switching to decreasing essentially the most well-known interest fee.

Read extra: The flippening debate: can Ethereum surpass Bitcoin?