Hedera (HBAR) has honest lately proven indicators of slowing momentum after a formidable leap in early May per chance honest. With the unusual tag hovering shut to $0.192 and each and each the hourly and each day charts flashing mixed signals, traders are split on whether or no longer HBAR tag is getting ready for but another leg up or a potential fall beneath key toughen. Let’s damage down the charts and tag action to predict what’s next.

HBAR Imprint Prediction: Is Hedera Imprint Dropping Steam After Fresh Restoration?

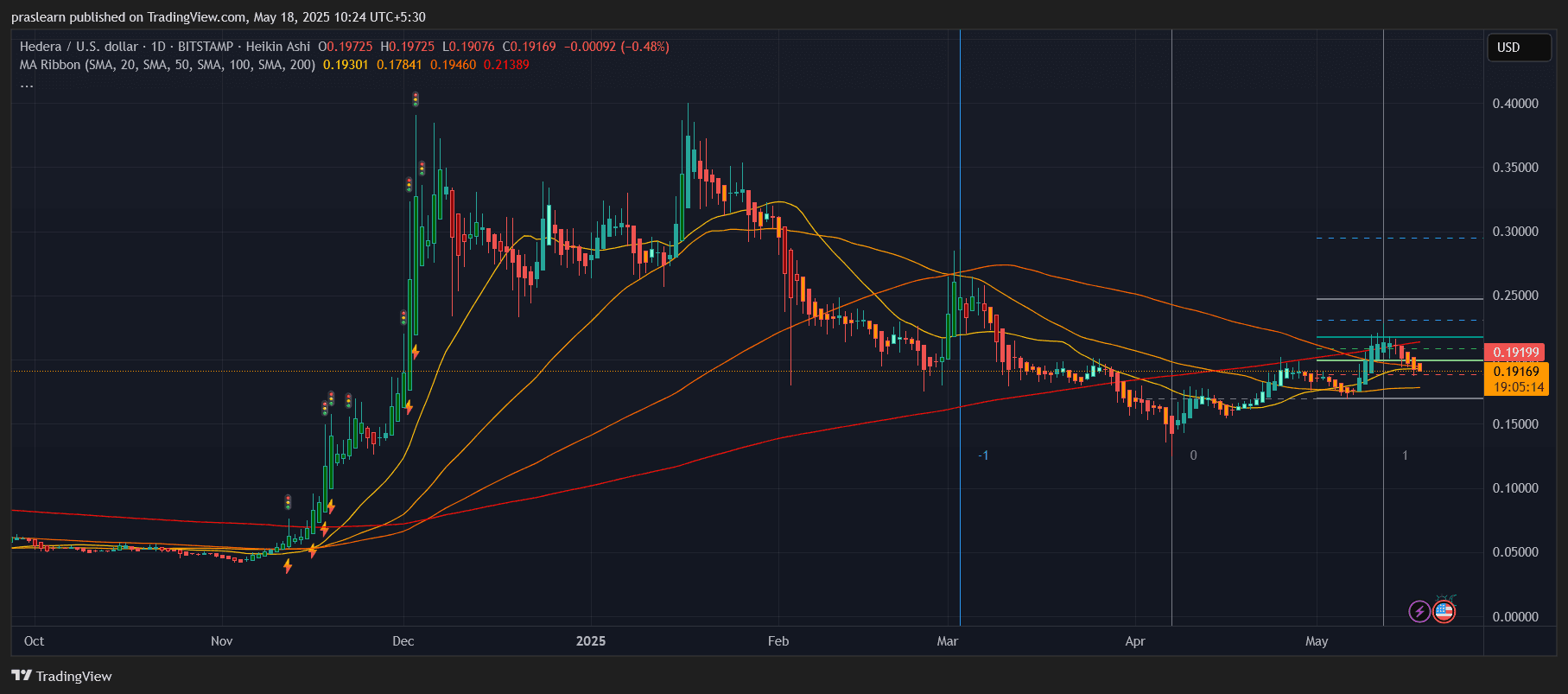

On the each day chart, HBAR tag managed to depraved above the 50-day and 100-day easy transferring averages (SMA), however it’s now going via exact resistance around the $0.21–$0.22 build apart. This order coincides with the 200-day SMA within the imply time sitting shut to $0.213, which in overall acts as a exact dynamic barrier in crypto traits. As of May per chance honest 18, the tag has slipped again beneath this stage and is trading at $0.19169, elevating considerations that the unusual bullish momentum could possibly moreover be stalling.

The approach resembles a rounding high pattern, suggesting a loss of bullish strength. The uptrend from April found exact patrons around $0.14, however failed to come by away above $0.24, where a couple of wick rejections came about. This zone now acts as a psychological barrier.

What Does the Hourly Chart Present About Attain-Timeframe Strikes?

Zooming into the hourly chart, we can stare a clearer image of instantaneous tag action. After peaking around $0.22 earlier this week, HBAR tag started a unhurried, grinding descent with decrease highs and decrease lows. The hourly 20, 50, and 100 SMAs are all sloping downward, with the unusual tag caught under the 100-hour SMA at $0.19974.

This Hedera tag compression has formed a descending wedge, in overall a bullish reversal pattern. If this wedge breaks upward with quantity, HBAR could possibly moreover are trying and reclaim $0.205 and then test $0.22 over again. Nonetheless, failure to come by away soon could possibly moreover honest push the tag again to the $0.18 and $0.165 supports—each and each clearly marked by earlier demand zones and horizontal lines to your chart.

HBAR Imprint Prediction: How Far Can Hedera Imprint Topple or Upward push?

To estimate possibility and potential upside, let’s use Fibonacci retracement from the unusual high of $0.305 to the swing low of $0.14:

- 38.2% Fib retracement sits around $0.21 (acting as resistance now)

- 50% retracement is shut to $0.225

- 61.8% retracement is around $0.24, a key rejection stage seen earlier

On the design back, Hedera tag is shut to the 23.6% retracement from the identical transfer, around $0.185. A damage beneath this will seemingly possibly moreover build off a fall to $0.165, which aligns with past quantity profile toughen.

Assuming a transfer from $0.192 to $0.24:

- That’s a carry out of 25%. But when it drops to $0.165:

- That’s a loss of ~14% from unusual levels.

This possibility-reward ratio (1.78) favors bulls handiest if the $0.19 toughen holds.

What’s the Imprint Forecast for This Week?

Unless HBAR tag can damage decisively above $0.205 and protect above the 200-day SMA, the final pattern remains cautious. For bullish affirmation, we need:

- A breakout above $0.213

- Quantity spike crossing $0.22

Failure to enact so could possibly moreover honest plod the tag down toward $0.165, where we could possibly moreover stare accumulation over again. Demand consolidation between $0.185–$0.205 over the next 3–5 days, with volatility deciding on up if Bitcoin or broader altcoins pattern strongly.

Closing Thoughts: Warning or Self perception?

Hedera tag is within the imply time in a possess-or-damage zone. Whereas it has room to climb again toward $0.24 if market sentiment improves, technicals counsel the bears win some short-term administration. Unless we stare a quantity-pushed breakout, the plod of least resistance looks sideways or a dinky downward.

Fast-Timeframe Target (Bullish): $0.213

Fast-Timeframe Give a enhance to (Bearish): $0.165

Neutral Zone: $0.185–$0.205