The week is popping out to be enormous for set apart Bitcoin ETFs as they started the week with a $520 million influx on Monday and recorded but one more solid influx of $577 million on Tuesday. The massive influx got right here on the aid of BlackRock iShares Bitcoin ETF witnessing an influx of $520 million on my own, pointing out high odds of BTC label rally to $60,000.

BlackRock Leads Convey Bitcoin ETF Inflow

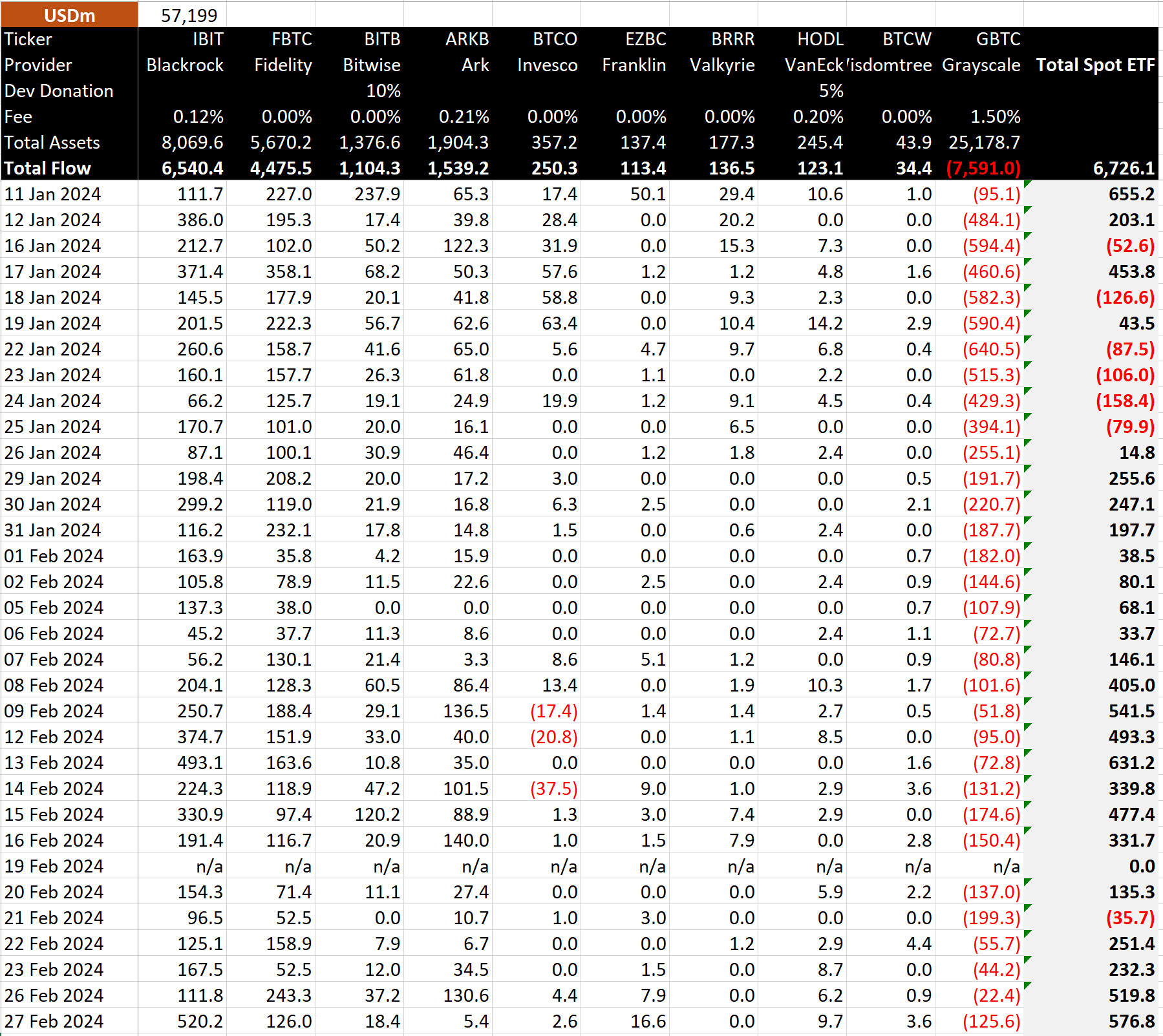

Convey Bitcoin substitute-traded funds (ETF) witnessed $577 million fetch influx (or 10,167.5 BTC fetch influx) on February 27, per recordsdata by BitMEX Analysis. This changed into as soon as the third-finest influx until initiate, as all nine set apart Bitcoin ETFs recorded big procuring and selling volumes. Alternatively, Grayscale’s GBTC outflow elevated again on Tuesday after losing to $22.4 million a day sooner than.

BlackRock iShares Bitcoin ETF (IBIT) saw over $520 million, breaking its finest influx as a lot as now file. IBIT furthermore saw a file $1.3 billion procuring and selling quantity, exceeding the on a regular basis substitute quantity of most vivid-cap US stocks. Following the most up-to-date influx, BlackRock’s fetch influx hit over $6.5 billion and asset holdings jumped over 141,000 BTC.

Constancy Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL), and others set apart Bitcoin furthermore saw spacious inflows, indicating solid bullish sentiment amongst retail and institutional investors.

Critically, GBTC saw a $125.6 million outflow, an elevate from Monday’s $22.4 million outflow, environment apart hopes of a paradigm shift. Bloomberg senior ETF analyst Eric Balchunas acknowledged the on a regular basis procuring and selling quantity of nine original set apart Bitcoin ETFs moreover GBTC exceeded $2 billion for the second consecutive day as BTC label holds strongly above $57K.

Moreover Read: Sam Bankman-Fried’s Defense Counsel Proposes 6 Yr Sentence or Much less

BTC Designate Breaks Above $59,000

Crypto Apprehension & Greed Index has reached a 4-year high worth of 82 currently, with the market sentiment for the time being within the ‘Crude Greed’ zone. The FOMO reaches into Wall Road as traders’ passion in BTC is incredibly high. Experts predicted BTC label to hit $60,000 sooner than bitcoin halving.

BTC label skyrocketed to $59,000, lower than 15% a long way off from the $68.6K high established 27 months within the past. The 24-hour low and high are $56,219 and $59,000, respectively. Moreover, the procuring and selling quantity has elevated a miniature within the final 24 hours, indicating passion amongst traders.

Swish morning,#Bitcoin is above $58K, where funding rates are going by the roof.

Extraordinary energy, positively areas to commence shopping for income. pic.twitter.com/WXRzkEkaBA

— Michaël van de Poppe (@CryptoMichNL) February 28, 2024

Moreover Read: US SEC Search recordsdata from Assume Torres to Prolong Treatments Briefing Prick-off dates in Ripple Case