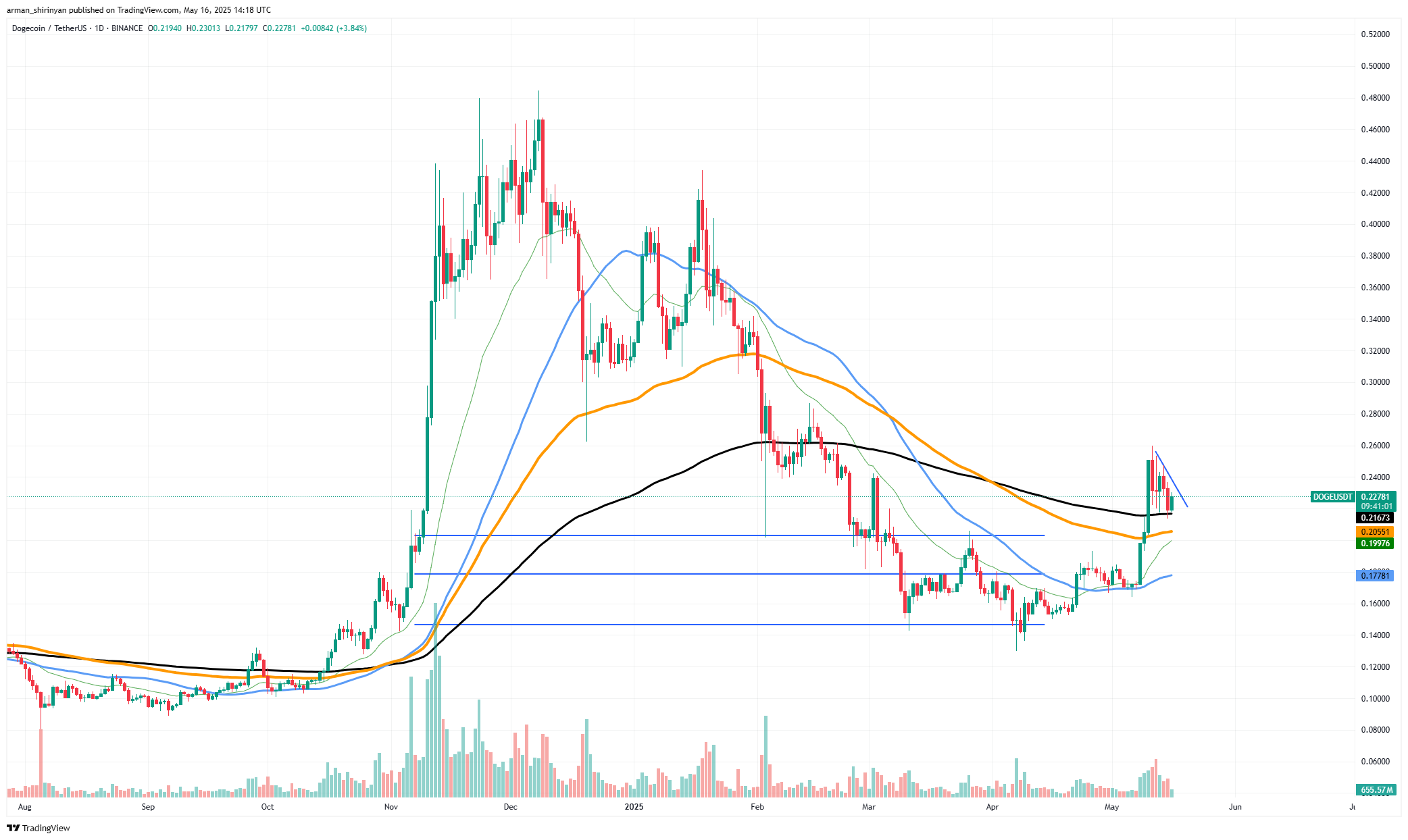

The infamous death nefarious mute has a fundamental impact on Dogecoin’s midterm mark efficiency, and the cryptocurrency is mute captivating in an unsteady manner. Even supposing a transient rebound above $0.22 indicates some energy, the technical structure as an whole is mute brittle and susceptible to every other leg down. It has been hovering over DOGE for a few weeks now, the death nefarious where the 50-day captivating realistic crosses underneath the 200-day captivating realistic.

This sample has historically indicated prolonged bearish momentum, and since early 2025, DOGE has extinct it as a true indicator of its ongoing downward construction. Even though Dogecoin lately recovered from the $0.20 level and temporarily regained the 200 EMA (unlit line), it’s a ways mute unable to generate essential momentum.

Once it peaked around $0.26, the rally strive misplaced momentum rapidly, creating a local rejection zone that has no longer been challenged but. Now the mark action is trapped between fundamental captivating averages, namely the 100 and 200 EMA, suggesting that sideways or downward stress can also persist except bulls can convincingly in finding ground above $0.

Quantity is mute no longer very spectacular, and neither institutional nor retail merchants look like making a fundamental push. A conventional consolidation setup, the RSI indicator is in honest territory, indicating that neither investors nor sellers are currently as a lot as scoot of the market.

Market confidence is doubtlessly going to live low except DOGE clearly breaks above the long-time frame resistance construction and disproves the death nefarious thought. The community’s sentiment, which modified into once stoked by Elon Musk’s tweets and meme mania, looks to have waned due to waning hype cycles and broader macro uncertainty.

Solana’s rally no longer over

According to its present technical structure, Solana can also finest be halfway via its spectacular 64% rally that has been occurring for a few weeks. The asset is currently conveniently above all the fundamental captivating averages, together with the 26, 50, 100 and even 200-day ones, after lately breaking via fundamental resistance ranges.

A pending technical crossover is the strongest indication of a imaginable continuation. A length of speedy momentum constructing can also originate up if the 26 EMA is ready to damage via the 200 EMA from underneath, which is an odd and potent bullish signal. In trending markets, this type of crossover has generally come sooner than solid upward mark action.

The probability of an whole 100% return from native bottoms increases if this arena materializes. SOL has tremendously elevated in quantity in some unspecified time in the future of this present uptrend, indicating that most contemporary mark action is supported by solid conviction. Furthermore, the bullish argument is reinforced by Solana’s solid recovery from the $120 set and a hit defense of the $160-$165 make stronger zone.

Its distinct separation from the key resistance clusters is what distinguishes Solana presently. The runway against the $200 and even $240-$250 range looks extra and extra feasible, with the 200 EMA already reclaimed and shorter-time frame EMAs stacking bullishly. The latter would signify a wisely-organized 100% establish from its most contemporary bottom.

In spite of a diverse altcoin panorama, Solana is restful a number of the upper performers in the upper market context. SOL has an valid probability of turning into the altcoin leader of the upcoming mini-cycle if momentum continues and key crossover affirmation is bought. Triple-digit returns are mute imaginable.

Bitcoin pushed up

A technical sample that will subtly have an effect on the upper cryptocurrency market is ready to create on Bitcoin. Indicating that medium-time frame momentum is outpacing long-time frame mark conduct, this sample looks when the 50-day EMA crosses above the 100-day EMA. Even supposing the conventional golden nefarious is the 50 EMA vs. 200 EMA, this crossover stays a fundamental momentum signal.

Following a fundamental spike earlier this month, the present structure of Bitcoin’s mark action exhibits a actual consolidation zone between $103,000 and $105,000. Constantly holding ranges above the psychological threshold of $100,000 suggests increasing make stronger, even when the mark has stalled underneath most contemporary highs. If the mark holds or pushes a little bit greater, the mini-golden nefarious – a particular indication that momentum is mute in the bulls’ prefer – will doubtlessly create in the coming sessions.

The fee is shopping and selling conveniently above all the fundamental EMAs – the 26, 50, 100 and 200 – and the amount is mute comparatively actual, indicating a generally bullish outlook. Crucially, this configuration has the aptitude to revive have confidence in altcoins as wisely nevertheless it undoubtedly also carries dangers: if Bitcoin beneficial properties momentum after the crossover, it will also divert funds from smaller property, leading to short-time frame market corrections or stagnation.

In due direction, a recent rally against the pre-all-time-high zone of $109,000 can also very wisely be sparked by the mini-golden nefarious. Fast positions would must unwind if there were a transparent demolish above this level, which might per chance per chance well doubtlessly unleash a wave of breakout investors.