Stellar (XLM) impress is taking pictures trader attention as bullish momentum builds following a intriguing impress rally and rising market activity. A basic inverse head and shoulders pattern is forming on the 4-hour chart, pointing to a doable pattern reversal.

With quick liquidations surging and volume hiking, bulls seem like gaining regulate. If enhance holds, XLM also can fair be on the verge of a breakout above key resistance levels.

Bullish Sample Develops on XLM Keep Chart

Stellar (XLM) is shopping and selling at $0.2967 after peaking above $0.305 and dipping to $0.2735 earlier within the day, reflecting solid intraday bullish momentum. The impress is up over 8%, supported by a 190.74% surge in shopping and selling volume to $473.9 million. Market cap has climbed to $9.19 billion, with a fully diluted valuation of $14.83 billion. XLM’s circulating provide stands at 30.98 billion out of fifty billion complete.

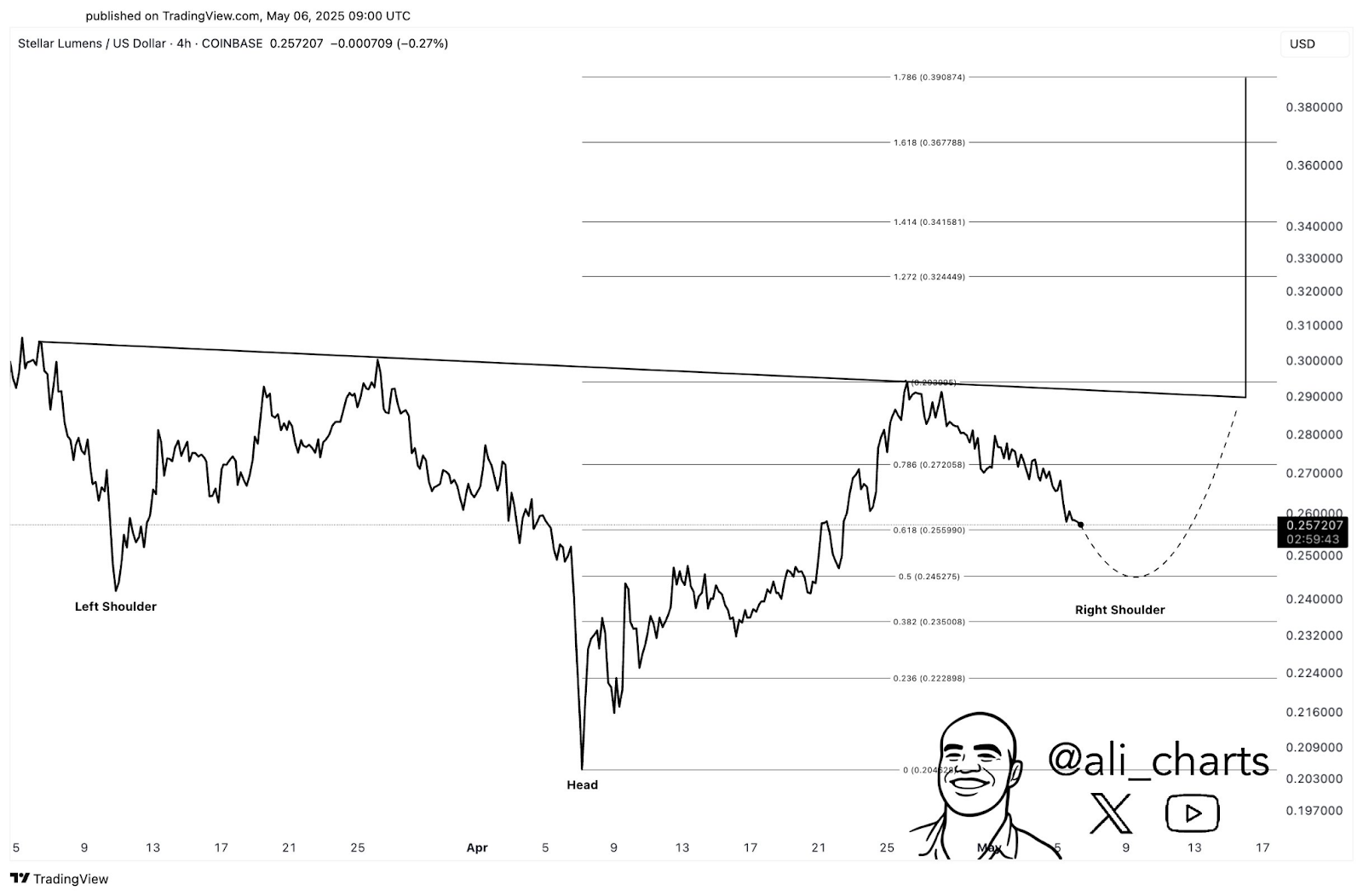

Technically, XLM’s 4-hour impress chart reveals an inverse head and shoulders pattern forming, on the overall signaling a bullish reversal. The neckline between $0.28 and $0.29 serves as a key resistance zone.

A breakout above this neckline also can propel costs in direction of Fibonacci extension targets of $0.324, $0.341, and $0.368, with a long-term operate end to $0.390. The combo of a bullish pattern, rising volume, and solid market pastime suggests persisted upside doable if affirmation occurs.

Liquidation Recordsdata Reveals Brief Traders Hit Exhausting

Recordsdata from Coinglass reveals that quick positions are being closed today as costs upward push. On May per chance perhaps 8–9, quick liquidations rose, with merchants masking their positions as XLM moved past $0.30. The liquidation chart reveals a balanced derivatives market with bursts of volatility tied to rate spikes.

The final observe lengthy liquidations took place on April 6–7, reaching $931,500, following a sudden dip in XLM’s impress. On April 9, a intriguing upward push in impress precipitated a wave of quick liquidations. Since mid-April, liquidation numbers were get until early May per chance perhaps, when some other wave of quick closures took place.

Most current quick touching highlights that merchants were ill ready for the most up-to-date bullish switch. This reduction in these positions has created extra shopping stress alongside the trend to pressure the associated rate even bigger.

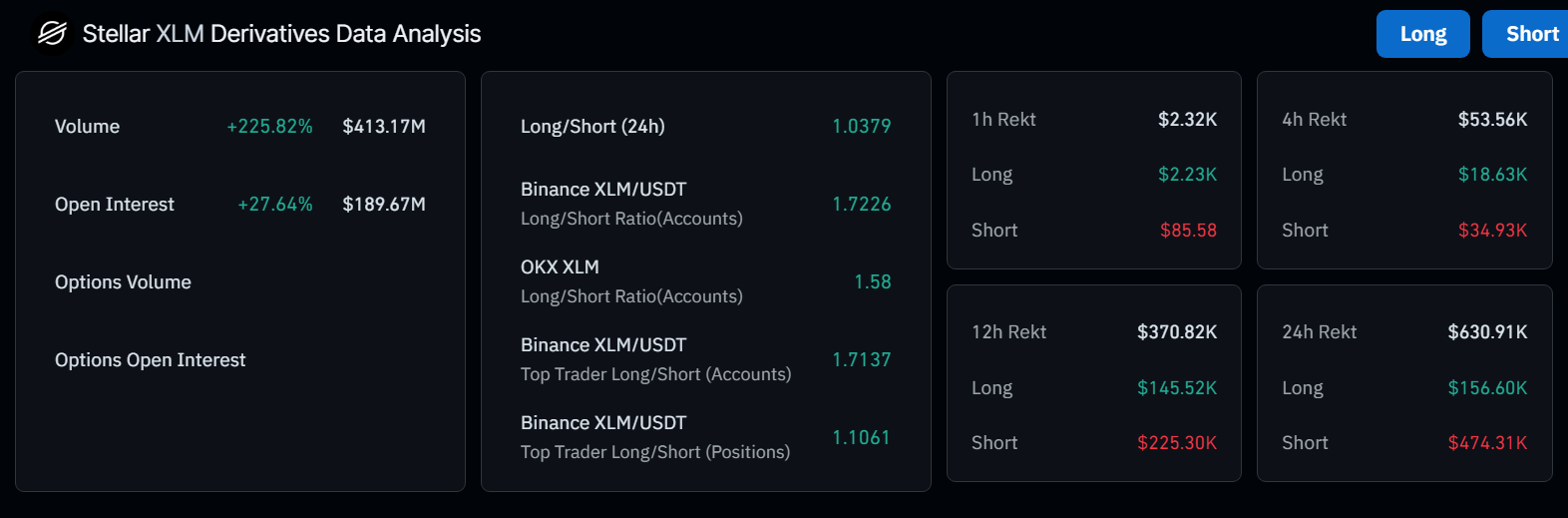

Derivatives Metrics Show cowl Rising Supplier Commitment

The stellar spinoff market is witnessing an alarming growth rate in actions. Initiate pastime elevated by 27.64% to $189.67 million, exhibiting that extra merchants are getting into positions. At the equivalent time, shopping and selling volume surged 225.82% to $413.17 million over 24 hours.

The lengthy/quick ratio reveals a itsy-bitsy bullish need at 1.0379. On Binance, it stands at 1.7226, and on OKX, it is 1.58. Right here’s an illustration of elevated merchants hoping the associated rate will lengthen. To boot to, high merchants desire lengthy positions the set Binance accounts maintain a ratio of 1.7137 and set essentially essentially essentially based records 1.1061.

The general liquidations within the past 24hrs amounted to $630,910. From this sum $474,310 were derived from quick positions.. This records supports the watch that rising XLM costs are catching quick sellers off guard.

Key Make stronger Ranges Withhold While XLM Keep Breakout Nears

In accordance to crypto analyst Ali Martinez, XLM’s impress is end to the slay of its inverse head and shoulders pattern. He identified that if the enhance at $0.24 holds, the right shoulder can originate rapidly. From there the associated rate also can fair breakout above the neckline and head in direction of new levels.

Each Fibonacci retracement levels at $0.255 (0.618) and $0.273 (0.786) can change into quick term enhance all thru pullbacks. He shared that market sentiment remains optimistic as merchants sit down up for a confirmed breakout.

As of now, technical and derivatives records counsel that bulls are on high of things. The right volume lengthen, alongside with rising open pastime and quick liquidations, supports the recent uptrend. If XLM’s costs live above key enhance levels, a switch past $0.30 also can open the path in direction of the $0.324 to $0.390 zone within the coming days.