Goldman Sachs emerges as indispensable player in crypto investments with increased acquisition of BlackRock shares.

Key Takeaways

- Goldman Sachs increased its stake in BlackRock’s iShares Bitcoin Belief to 30.8 million shares value over $1.4 billion.

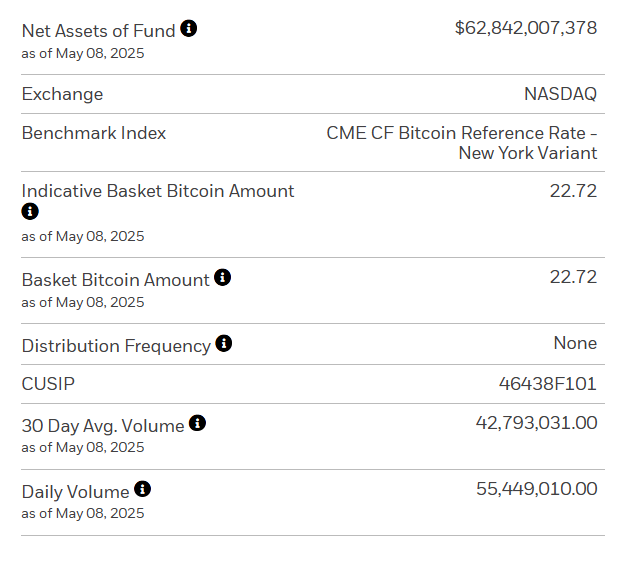

- IBIT leads Bitcoin ETFs with roughly $62.8 billion in resources below management.

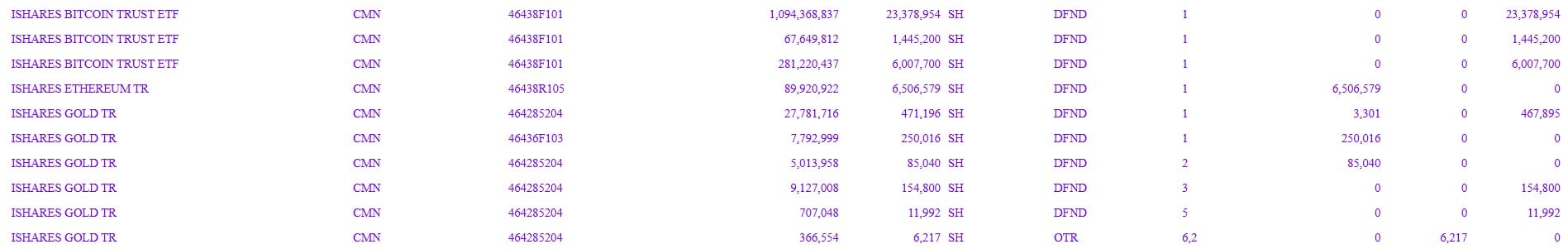

Goldman Sachs has grown its situation in BlackRock’s iShares Bitcoin Belief (IBIT) by 28%, disclosing a preserving of 30.8 million shares valued at over $1.4 billion in some unspecified time in the future of the length ending March 31, up from 24 million shares, essentially based totally on a brand recent SEC submitting first reported by MacroScope.

Encourage in February, Goldman Sachs disclosed over $1.5 billion in US situation Bitcoin ETF holdings, including roughly $1.2 billion in BlackRock’s IBIT and $288 million in Fidelity’s Bitcoin fund (FBTC). Its hottest submitting reveals no important trade in its FBTC situation.

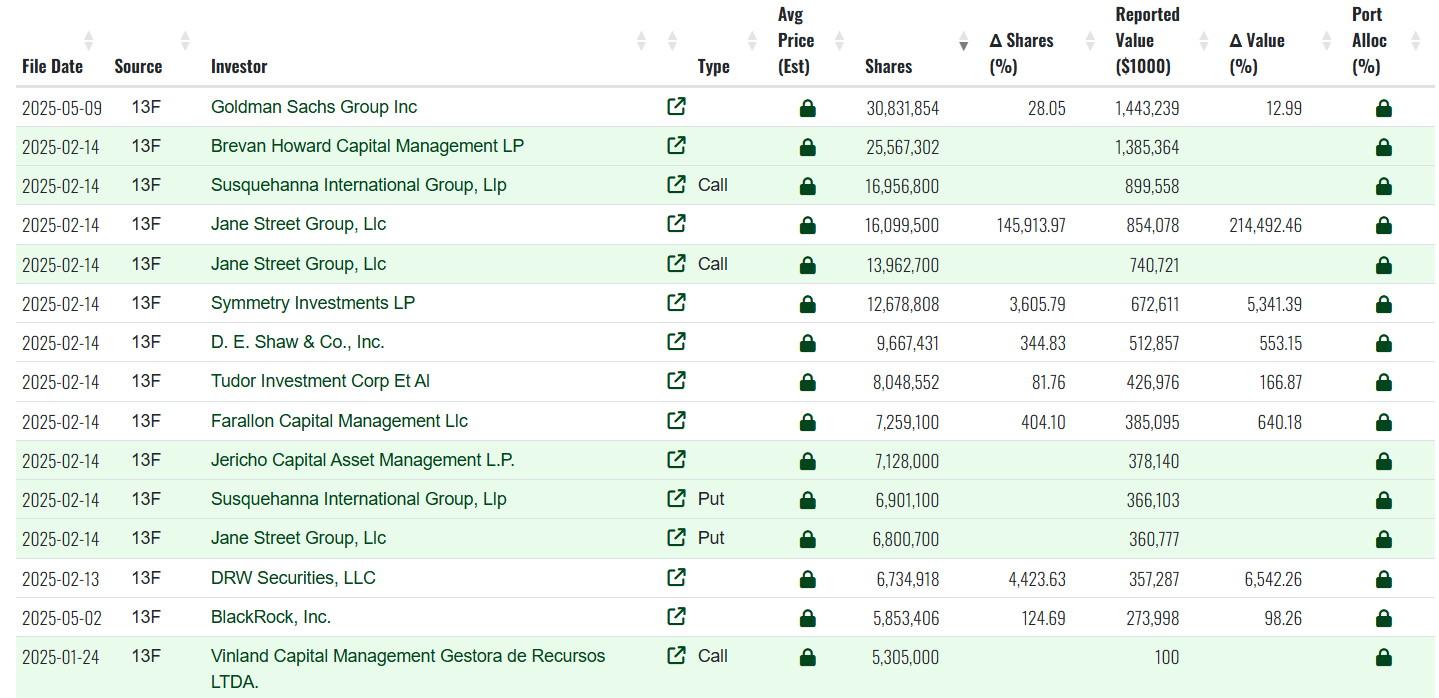

As of the hottest knowledge tracked by Fintel, the investment bank stands because the finest institutional holder of IBIT. Brevan Howard ranks second, preserving extra than 25 million shares value almost $1.4 billion. Assorted indispensable stakeholders consist of Jane Boulevard, Symmetry Investments, and D.E. Shaw & Co.

In its December disclosure, Goldman Sachs reported preserving alternate strategies tied to Bitcoin ETFs — including $157 million in call alternate strategies (which income if the value goes up) and $527 million in build alternate strategies (which income if the value goes down) for IBIT, along with $84 million in build alternate strategies for Fidelity’s situation Bitcoin fund (FBTC), MacroScope famed.

On the other hand, in the most present submitting, none of these alternate strategies appear, which attain Goldman has doubtless closed out or allowed these contracts to expire.

IBIT stays the finest Bitcoin ETF, with roughly $62.8 billion in resources below management.

Since its open in January, the fund has attracted over $44 billion in rating inflows, and thus a ways this week, it has logged round $674 million, per Farside Investors.

The ETF’s shares rose $1.04 in some unspecified time in the future of Friday’s trading session, reaching $58.66, essentially based totally on Yahoo Finance knowledge.