“The social object of expert funding needs to be to defeat the darkish forces of time and lack of knowledge which envelop our future.”

— John Maynard Keynes

Despite the full numbers concerned, investing is widely acknowledged to be more art than science.

“Overall inventory selection is a worldly art,” Benjamin Graham cautioned.

Graham’s existence-lengthy pupil, Warren Buffett, specified that “investing is theart…of laying out cash now to derive quite lots of more money in a while.”

Somewhat well-known all investing boils all the manner down to predicting those cash flows.

However traders “who’ve been expert to rigidly quantify every part have a colossal drawback,” Peter Lynch warned.

That does now now not, however, imply that “valuation is a meme,” as financial nihilists cherish to pronounce.

In its build, it manner that applying and interpreting quantifiable valuation metrics is a ingenious endeavor.

What valuation metric to make expend of for which investments is a subjective decision — and shimmering make clear the outcomes is even more so.

A low valuation, to illustrate, doesn’t imply a inventory is cheap and a high one doesn’t imply a inventory is dear (it’s staunch as veritably the unreal).

A inventory can survey appealingly cheap on one metric and appallingly costly on one more.

And none of this stuff are clearly correlated to returns.

This is on the full reason for despair — if cheap shares don’t stride up and pricey ones don’t stride down, why bother trying to figure it all out?

It’s worth figuring out, I feel, because that’s what makes investing fun and consuming — and, if that is so, the fun of crypto investing is finest staunch getting started.

Unless currently, crypto traders didn’t have many numbers to work with past token designate and market capitalization.

That made every part in crypto a “memoir” — which is okay!

Investing is ready telling tales.

However the most intriguing investing tales are told with numbers and crypto an increasing selection of has them because more protocols are incomes revenue and more of that revenue is being handed on to token holders.

Also, these numbers are turning into more accessible thanks to the likes of Blockworks Analysis, whose analysts equipment them up in digestible charts and characterize them for us.

This is helping crypto come to a greater stage of storytelling: storytelling with numbers.

Let’s take a look at some fresh ones.

Ethereum vs. Solana

Judging by Crypto Twitter and podcasting, it looks to be evident that sentiment on Ethereum has sunk to new lows, especially relative to Solana.

However an uninitiated TradFi refugee going straight to the numbers would likely bet in another case.

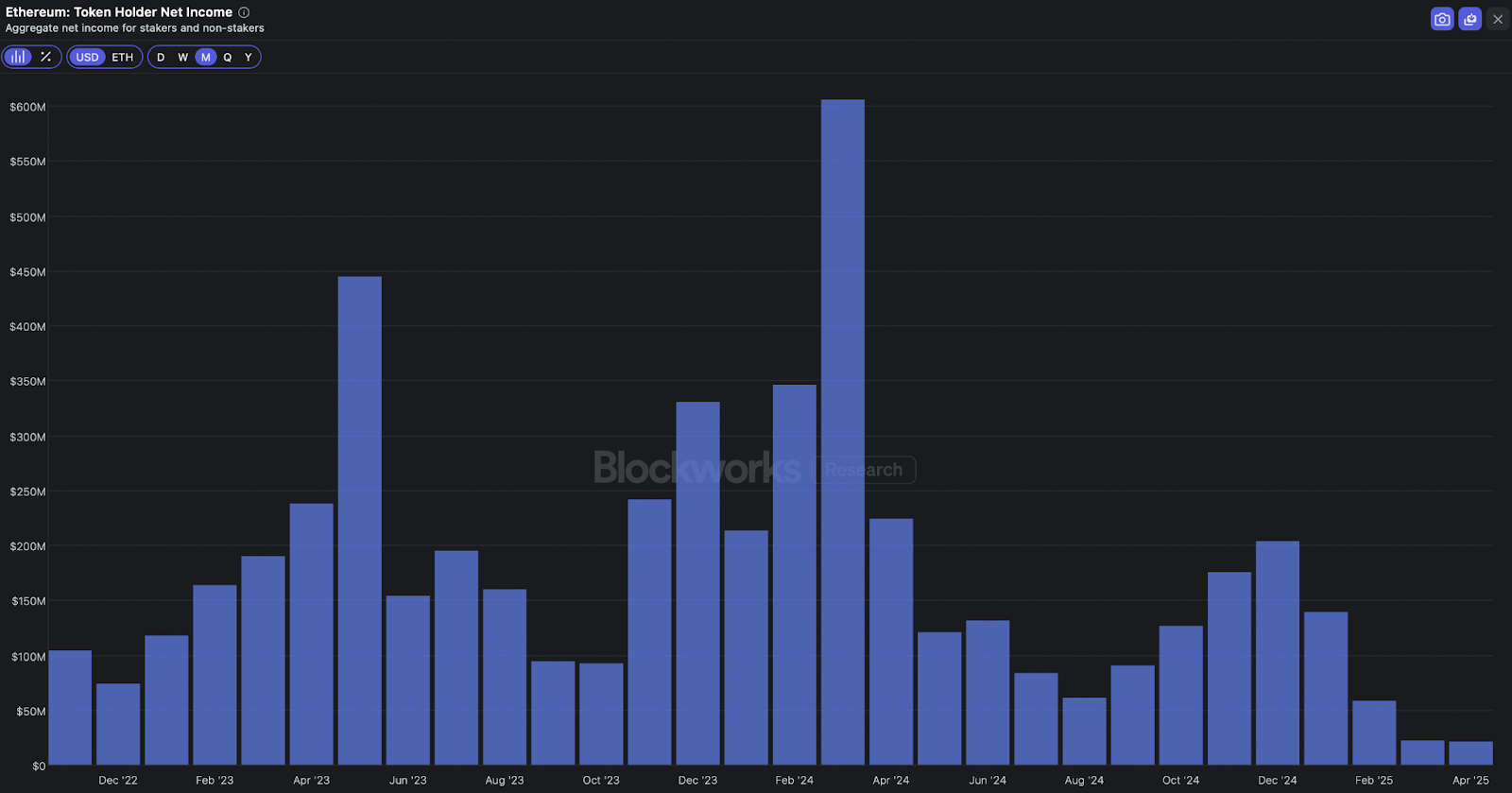

Solana recorded $36 million of “token holder derive earnings” in April, per Blockworks Analysis files, which places the SOL token on 178x annualized earnings — a prosperous, however presumably consuming a pair of while you watched fresh scream ranges are low.

Ethereum, by distinction, did $21 million in token holder derive earnings for April, inserting the ETH token on 841x earnings.

A TradFi refugee seeing ETH trading at 5x the a pair of of SOL wouldn’t correct now think, “wow, why is everybody so bearish on Ethereum?”

However they wouldn’t correct now think other folks are 5x less obvious on Solana, both.

In its build, they could elevate out Solana’s revenue will get a low a pair of because it largely comes from “low-quality” memecoin scream — while Ethereum’s revenue instructions a greater a pair of, now now not less than in portion, because it entails greater-quality scream cherish precise-world resources.

Now we now have got something to work with: Within the occasion you watched memecoin scream isn’t so low-quality, SOL is probably going to be undervalued, and while you watched RWAs are the future, ETH is now now not going to be so overrated.

You would possibly want to maybe well presumably additionally dig a itsy-bitsy of deeper.

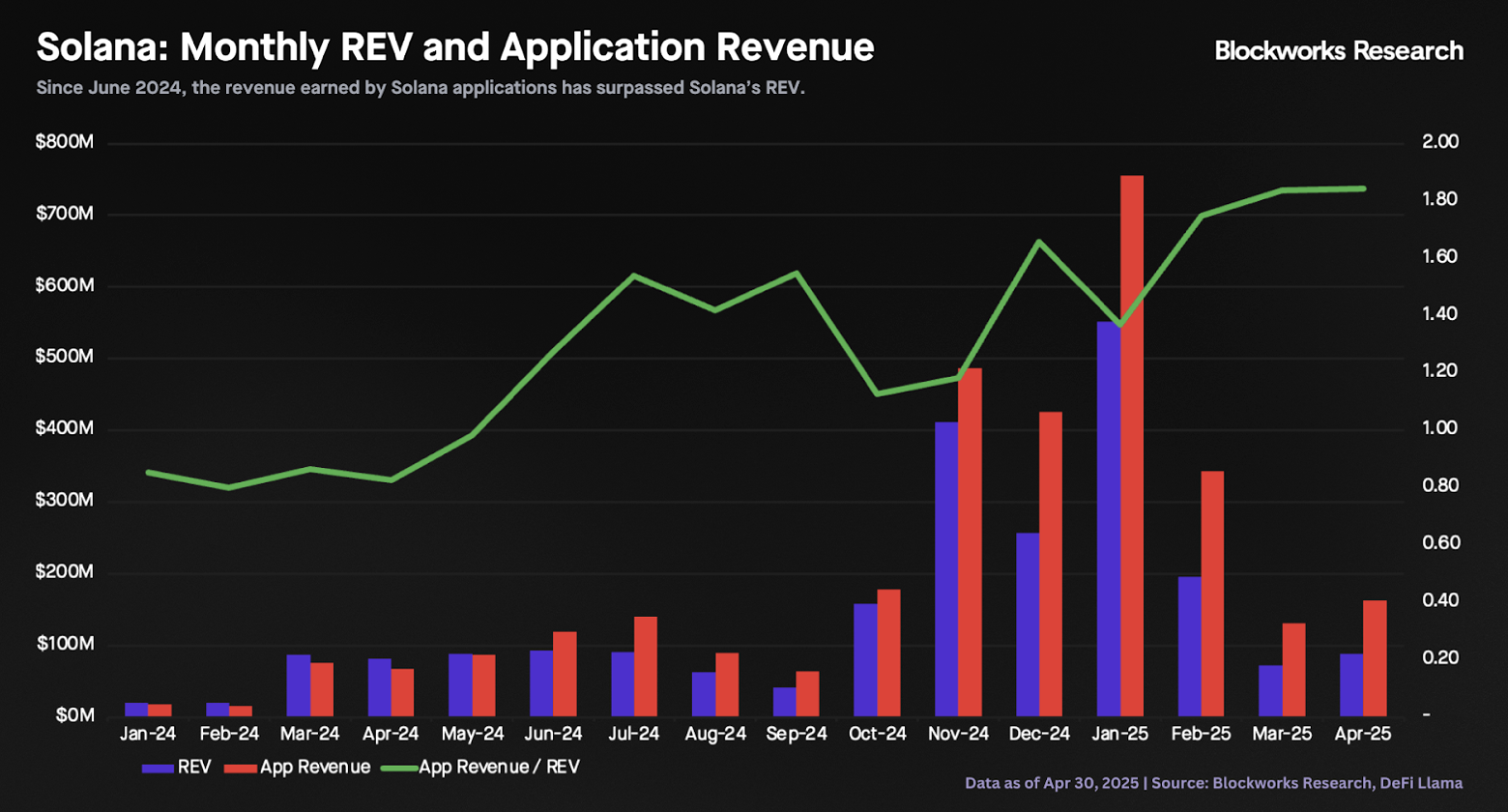

Blockworks Analysis files displays that the revenue composed by all Solana apps is finest about 1.8x increased than the revenue composed by Solana.

As platform businesses stride, that could be a very high take rate — well-known greater than the most 30% take rate at Apple, which the US government thinks is monopolistic.

This could perchance imply that Solana is overearning and that its token ought to silent therefore alternate at a low a pair of of earnings — or that Solana has a enterprise moat and its token ought to silent therefore alternate at a high a pair of of earnings.

Either manner, it’s a fable.

Hyperliquid

Hyperliquid, a semi-decentralized crypto alternate, is the arresting memoir of a protocol that earns slightly a itsy-bitsy in revenue ($43 million in April) and will pay almost all of it out to token holders.

This has unsurprisingly helped the token outperform currently: “The support fund uses trading prices for token buybacks every 10 minutes,” the one-named Boccaccio great in a fresh characterize for Blockworks Analysis, “creating consistent aquire tension.”

Every 10 minutes!

It’s laborious to know what to make of that because there is now not any such thing in TradFi as a company that returns 100% of its revenue to shareholders — let by myself every 10 minutes.

Judging by its valuation, crypto looks to be a itsy-bitsy of unsafe too.

The HYPE token trades on about 17x annualized revenue (basically basically basically based on market capitalization), which could perchance on the full be notion of as costly.

However, on this case, revenue and earnings seem to be the same thing, so it looks to be dazzling cheap — while you watched the memoir that HYPE will continue to procure enterprise from centralized exchanges.

Boccaccio cautions that HYPE is trading at a drastically greater a pair of than its decentralized pals, however additionally that these is now now not going to be the supreme kind pals to evaluate it.

“The Hyperliquid L1 would must take a extremely little percentage of overall Binance each day quantity to meaningfully make bigger its volumes…Taking staunch 10-15% of finest the BTC/USDT pairs quantity [from Binance], would lead to a 50% make bigger in the HyperCore quantity.”

“A roar a pair of is warranted,” Boccaccio concludes.

How well-known of one depends on how well-known you watched the memoir, for optimistic.

Jupiter

Jupiter, a Solana DEX aggregator, returns a comparatively modest 50% of revenue to token holders (additionally by process of buybacks) — however equally has slightly a itsy-bitsy of it.

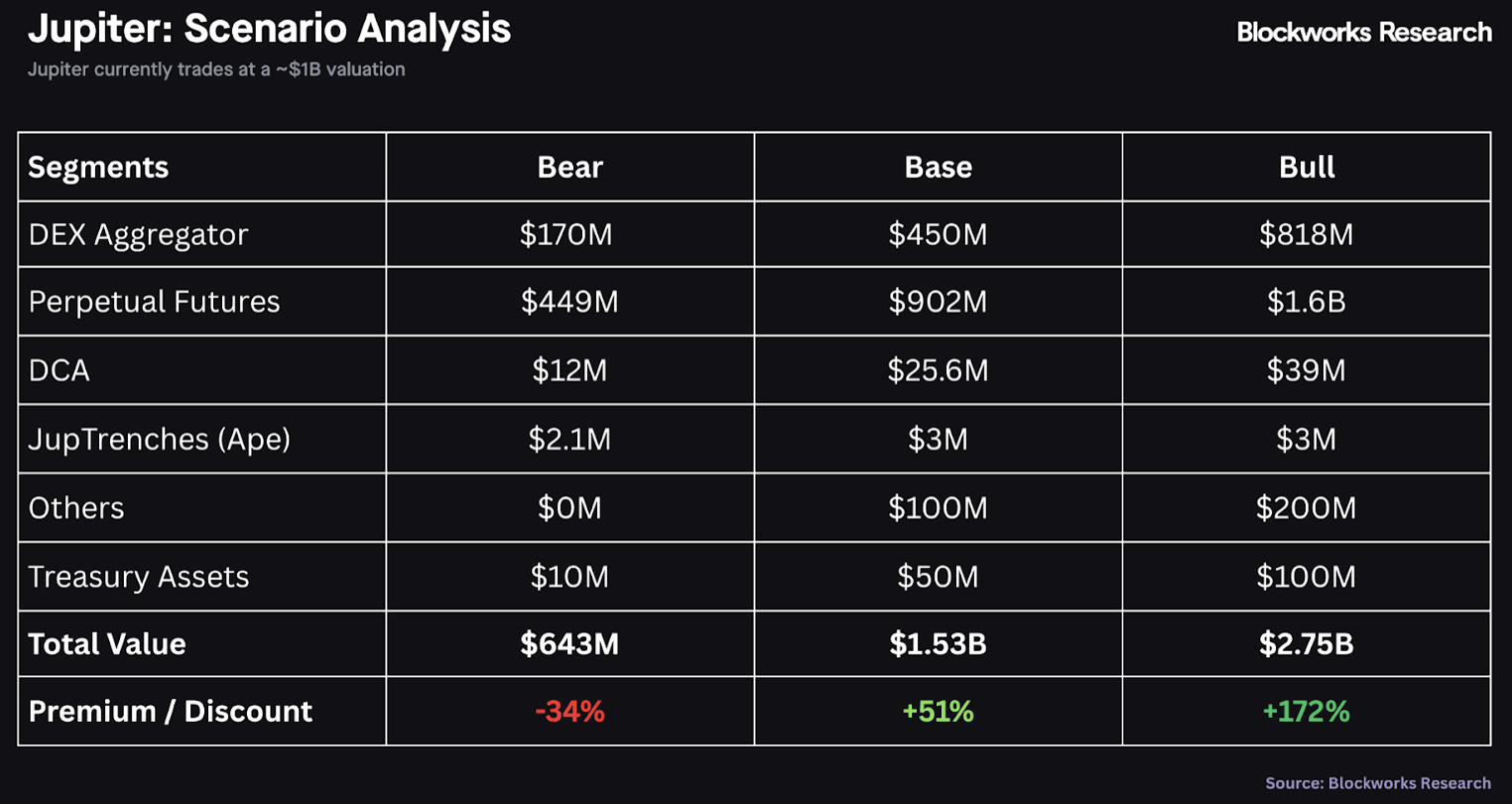

Marc Arjoon estimates that Jupiter could maybe well fair assign $280 million of revenue over the next Three hundred and sixty five days, which could perchance assign the JUP token on a yield of about 11.5% yield, basically basically basically based on market cap.

In equities, an 11.5% yield would imply that the underlying enterprise is distressed, however that does now now not seem to be the case here.

Jupiter is “the default router” on Solana, Arjoon writes, “currently has no equal in aggregation,” and is “the fourth-perfect revenue-producing application among all crypto dapps.”

Better yet, it’s slide cherish a enterprise: “Jupiter’s strategic maneuvers at some level of 2024-2025 replicate an organization aggressively entering a hyper-roar portion, ambitiously positioning itself as Solana’s premier crypto trim-app.”

That hardly sounds cherish a enterprise that ought to silent yield something shut to 11.5%.

There are a range of risks, for optimistic, which Arjoon facts in his latest present.

However his takeaway is that “Jupiter currently trades at compellingly low multiples relative to its pals, suggesting appreciable upside doubtless even without a pair of expansion.”

He even quantifies this in a sum-of-the-parts scenario prognosis, which warms my TradFi heart:

Appears to be cherish an even memoir.

Helium

Helium, a decentralized telecom provider, has been a crypto memoir for a lengthy time now — it become once founded manner befriend in 2013.

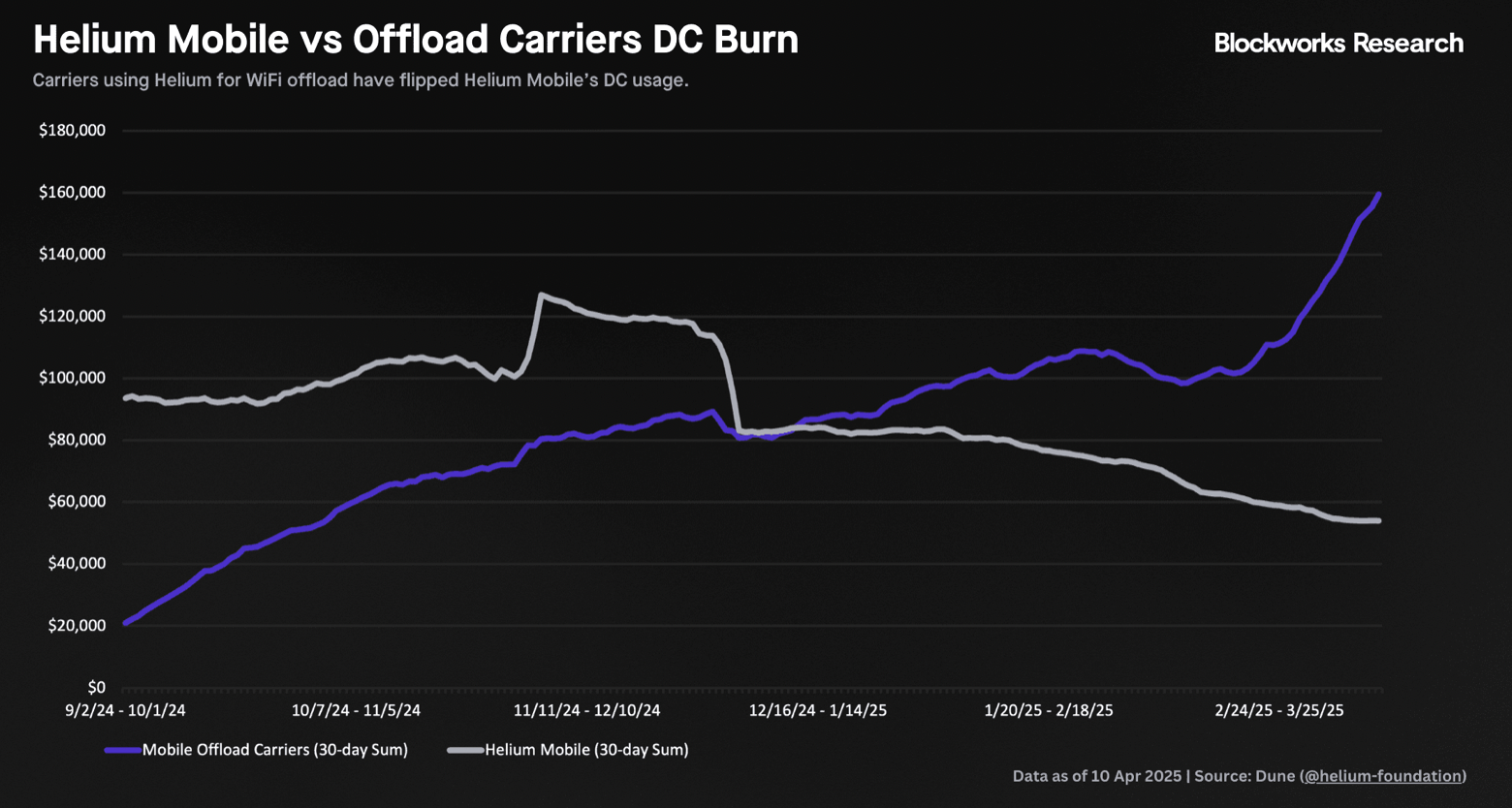

However now it’s a fable with numbers: “Earnings as measured by files credit burn is accelerating, rising at 43% QoQ,” Blockworks Analysis’s Cleave Carpinito wrote in a fresh present.

“Importantly, Helium’s mix of revenue is shifting from Helium Cell to Cell Offload, with the latter now accounting for roughly 3x more DC burn, and rising at almost 180% QoQ, an astounding rate for a DePIN protocol selling into enterprise budgets.”

“Cell Offload” is the blue line above and its quarterly roar rate of 180% is an astounding amount for any individual, in fact.

Helium’s HNT token could maybe well seem to be priced for it, trading on about 120x annualized gross sales.

However Carpinito told the 0xResearch podcast that he expects revenue to bustle thanks to a “surge in files credit expend through AT&T allowing its subscribers in the US to connect to Helium.”

Which capability that, “there’s a high probability that we discover about some HNT designate appreciation over the next Three hundred and sixty five days that is unprecedented and additionally a ways more exact than any Helium designate appreciation we’ve viewed prior to now, which become once largely basically basically basically based on speculation.”

It’s arresting in crypto to listen to any individual make that stamp of designate prediction basically basically basically based on something assorted than speculation.

And refreshing.

Pendle

Lastly, Pendle is a “yield trading” protocol whose new offering, dubbed “Boros,” will allow users to make investments on any off-chain or onchain yield, foundation with funding charges.

“The implementation will survey same to a classical passion rate swap market, the build traders pays a floating rate to receive a fastened rate, or pay a fastened rate to receive a floating rate, on margin,” Blockworks Analysis’s Luke Leasure defined.

That doesn’t imply too well-known to an equities guy cherish myself, however it completely’s interestingly a colossal market: “With perpetual futures markets settling almost $60 trillion yearly with hundreds of billions in originate passion, Boros will enter a wholly new, huge and untapped market,” per Leasure, who expects that Boros could maybe well double Pendle’s revenue rate.

That’s now now not something you hear well-known in TradFi.

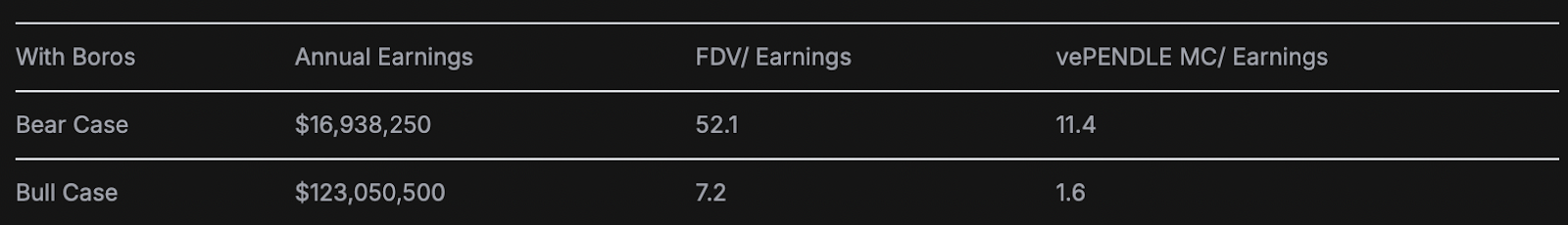

In a bull case, Leasure estimates that the “vote-escrowed” model of Pendle’s token is probably going to be trading on staunch 1.6x earnings:

1.6x!