Ethereum (ETH) is exhibiting indicators of lifestyles after a duration of sideways trading, and the brand new Pectra upgrade going live shall be the important thing catalyst in the encourage of a peculiar wave of momentum. With the everyday and hourly charts painting a cautiously bullish image, is ETH gearing up for a rally beyond $1,900?

Ethereum Imprint Prediction: What’s Riding Ethereum’s Imprint Sincere Now?

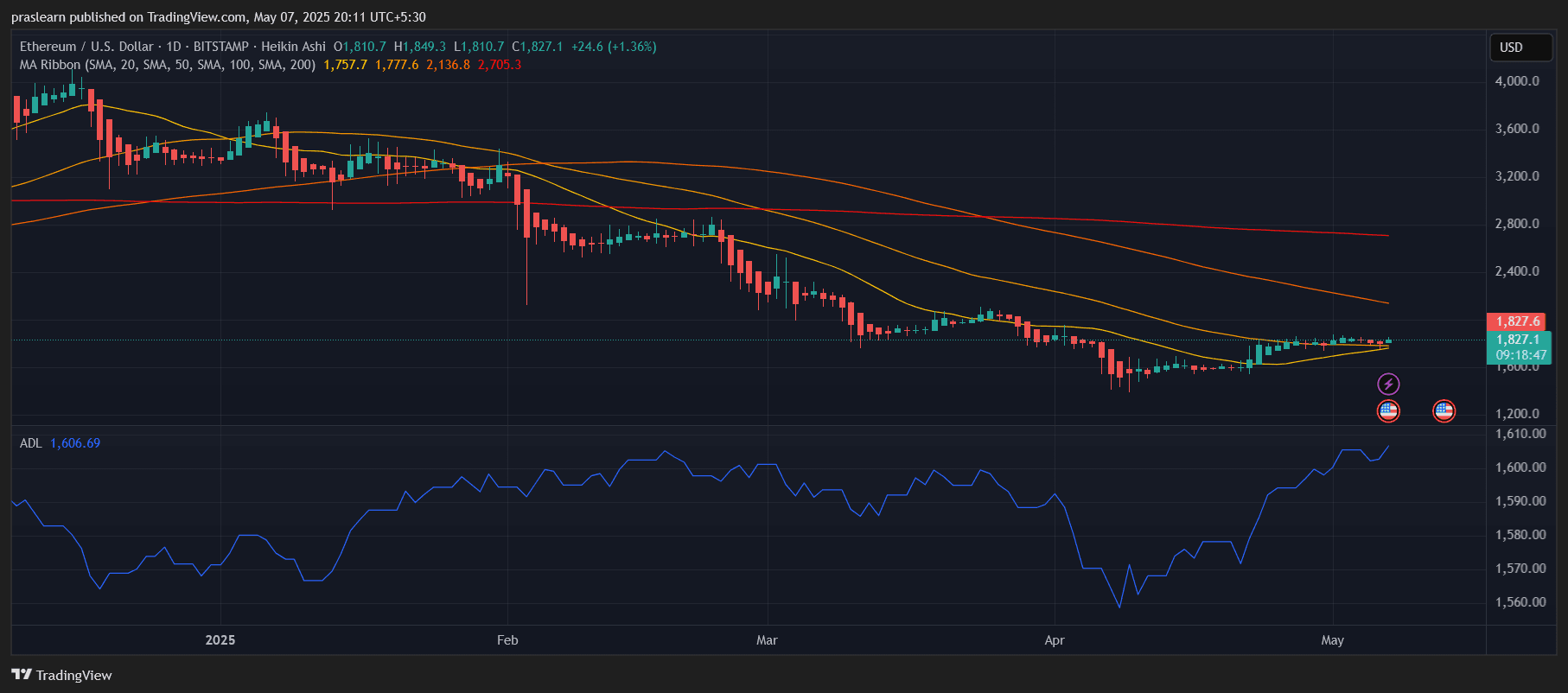

As of Could perchance 7, Ethereum mark is trading around $1,827, up 1.36% in the last 24 hours. On the everyday chart, ETH has established a firm unfavorable above its 20-day and 50-day transferring averages, suggesting that bullish merchants are regaining adjust. The ADL (Accumulation/Distribution Line) continues to pattern upward, indicating that cash is flowing encourage into ETH after a month-long cooldown.

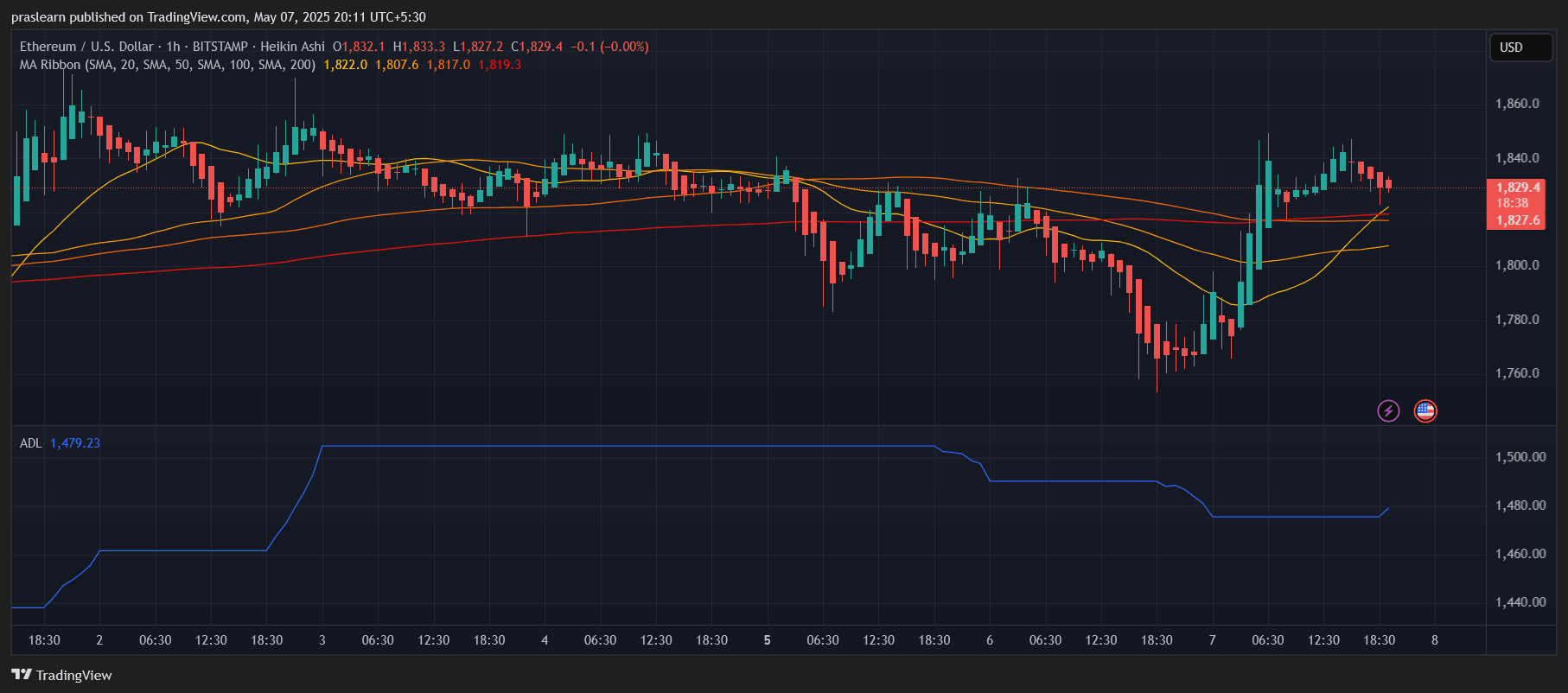

In the intervening time, the hourly chart exhibits ETH mark breaking above the 200-hour SMA earlier than retesting it as toughen—a conventional breakout pattern. A non everlasting consolidation near $1,830 is forming a doable bullish flag, and if volume will increase, a breakout toward $1,880–$1,920 appears to be like to be likely in the near duration of time.

What’s the Ethereum Pectra Fortify?

The Ethereum Pectra upgrade is a monumental step forward for the Ethereum community. Combining two tracks—Prague (execution layer) and Electra (consensus layer)—Pectra introduces EIP-7702, a recreation-changer that transforms fashioned Ethereum wallets into spruce-contract-cherish entities.

This means users can now batch transactions, pay gas in non-ETH tokens, and employ session keys when interacting with decentralized apps. These upgrades drastically toughen usability, especially for DeFi, NFT platforms, and gaming dApps.

For validators and institutional stakeholders, the validator stake cap will increase from 32 ETH to 2,048 ETH, simplifying operations for substantial-scale node operators. Additionally, Pectra brings higher Layer 2 files potential, leading to faster and more cost effective transactions—a long-awaited fix for congestion and gas rate components.

The Pectra upgrade, launched on Could perchance 7, 2025, marks a first-rate milestone in Ethereum’s evolution by merging two main model tracks: Prague (execution layer) and Electra (consensus layer). Among its standout facets is EIP-7702, which permits fashioned Ethereum wallets (externally owned accounts) to operate cherish spruce contracts.

This introduces legend abstraction at the protocol diploma, enabling users to pay gas fees in non-ETH tokens, automate dApp interactions, batch transactions, and delegate permissions—all without switching wallets. These changes a great deal toughen Ethereum’s person skills (UX), bringing it closer to the seamless in truth feel of Web2 apps, and decrease friction for beginners to DeFi, gaming, and on-chain commerce.

Every other key enchancment is EIP-7251, which raises the validator staking limit from 32 ETH to 2,048 ETH, simplifying operations for institutions and substantial-scale validators. In the intervening time, EIP-7691 will increase the assortment of files blobs per block, boosting Ethereum’s potential to toughen scalable Layer-2 networks and lowering transaction fees.

Diversified underneath-the-hood upgrades cherish EIP-6110 wait on streamline validator deposits and exit mechanisms, lowering delays and extending reliability. Whereas the brand new spruce legend map introduces more extremely efficient capabilities, experts warning it must also furthermore inaugurate new phishing risks if users aren’t cautious. Silent, the total consensus from builders and staking suppliers is positive: Pectra modernizes Ethereum’s unfavorable layer and sets the stage for faster, safer, and more scalable blockchain applications.

How Is the Market Reacting?

To this level, the market appears to be like to be to be welcoming the upgrade. Ethereum’s technical setup has improved since Pectra went live, with the transferring averages tightening and the associated rate starting up set to climb above resistance zones. Whereas ETH has no longer yet exploded upward, the foundation for a bullish breakout is solidifying.

This consolidation section might act as a launchpad if key resistance levels—significantly around $1,880–$1,920—are broken with convincing volume. The next main psychological resistance lies at $2,000, a diploma that will likely be examined if bullish sentiment continues and community job will increase on legend of Pectra’s enhancements.

Ethereum Imprint Prediction: What’s Next?

If Ethereum mark holds toughen above $1,800, the non everlasting outlook stays bullish. A decisive stop above $1,880 on the everyday chart might validate a push toward $2,000 and beyond. On the flip side, a rejection at recent levels might send ETH mark encourage to the $1,740–$1,760 toughen fluctuate, but this kind of plunge would likely be non everlasting given the bettering fundamentals.

Closing Tips

With Ethereum’s Pectra upgrade now live and the charts exhibiting renewed strength, ETH is coming into a brand new section of doable negate. Whereas the breakout hasn’t fully ignited yet, the mix of technical setup, market structure, and fundamental innovation makes Ethereum one amongst doubtlessly the most promising assets to seem in the arriving weeks.