Over 50% of all cryptocurrencies ever launched since 2021 are now defunct. An even more alarming style is rising in 2025, the put the share of failed tokens launched this yr has reached the identical stage in only the foremost five months.

That share will naturally upward push with more than half of the yr left. Representatives from Binance and Dune Analytics told BeInCrypto that these failures are factual one other reminder of the need to open viable projects, backed by sturdy tokenomics and a sturdy neighborhood.

Ghost Tokens Skyrocket

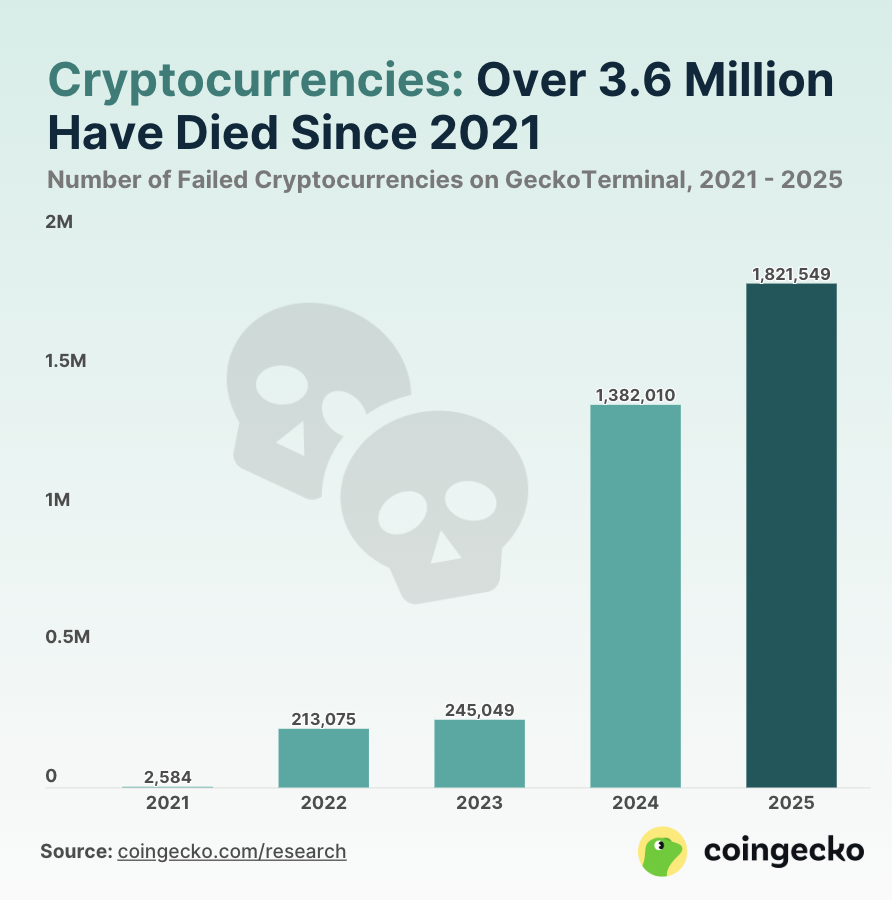

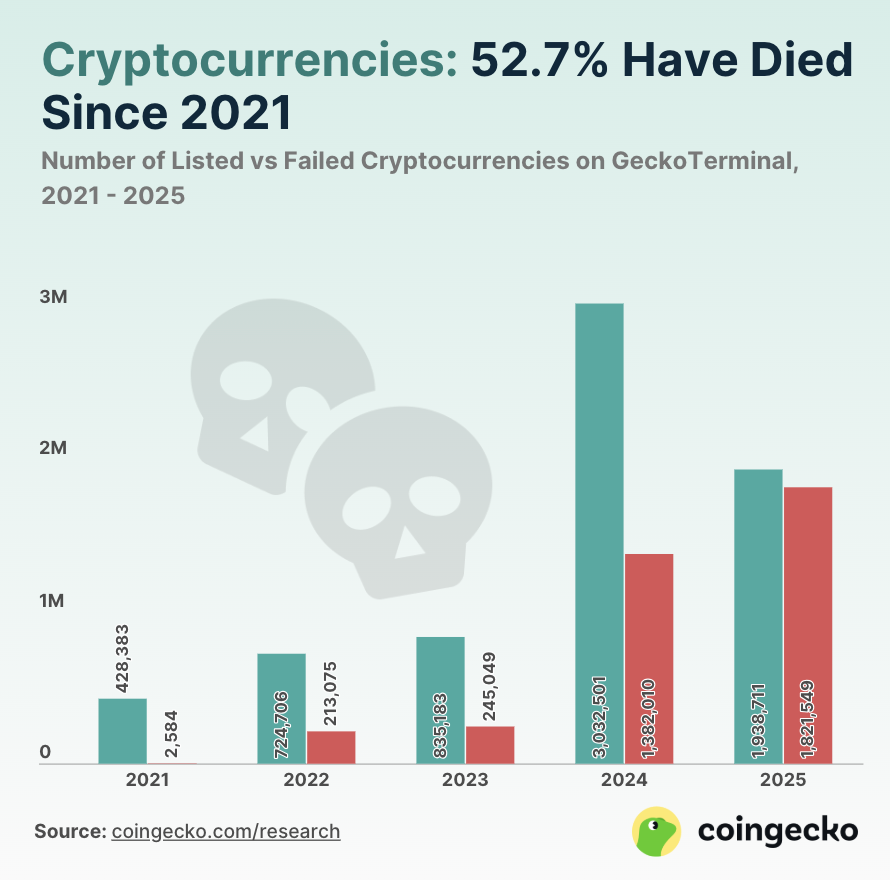

A contemporary CoinGecko document published some jaw-dropping files. Of the approximately 7 million cryptocurrencies listed on GeckoTerminal since 2021, 3.7 million dangle attributable to this fact died.

A total lot of issues are regarded as when evaluating whether a coin has reached its raze.

“A coin is classified as ‘dreary’ when it loses all utility, liquidity, and neighborhood engagement. Key indicators consist of shut to-zero trading volume, abandoned development (no GitHub commits for six+ months), and a label topple of ninety 9%+ from its all-time excessive. Groups continuously vanish without warning—social media accounts scurry dormant, domains expire,” Alsie Liu, Screech Manager at Dune Analytics, told BeInCrypto.

A huge fifty three% of listed cryptocurrencies dangle failed, with most collapses concentrated in 2024 and 2025. Notably, the over 1.82 million tokens already stopped trading in 2025 tremendously outpaced the approximately 1.38 million failures recorded at some stage in 2024.

With seven months out of the yr forward, this style of increasing failures within the contemporary yr will proceed to develop.

Why elevate out so many crypto projects fail?

Experts attribute the excessive failure rate of cryptocurrency projects, continuously termed “ghost coins,” to quite a lot of issues, at the side of broader macroeconomic stipulations affecting the crypto market.

CoinGecko particularly instructed a possible link between financial considerations relish tariffs and recession fears, noting a surge in meme coin launches after a definite election, with subsequent market volatility seemingly contributing to their decline.

On the opposite hand, no longer all responsibility can even even be positioned on a bigger financial downturn. Varied aspects can contribute to these venture failures.

“Traditional factors consist of inability to get product market fit leading to negligible interest from users or investors, or venture groups that consideration too important on short hypothesis without a lengthy-term roadmap, and typically abandonment by developers (rug pulls). Broader factors relish unfounded intentions, former person traction, novelty-driven hype, monetary shortfalls, sorrowful execution, sturdy competition, or security failures additionally contribute to venture failure,” a Binance spokesperson told BeInCrypto.

The mercurial upward push in ghost tokens additionally came with the exponential open of projects en masse, in particular since the originate up of 2024.

Analyzing the Life-Demise Ratio

Closing yr used to be novel in its dangle lawful following the proliferation of meme coins. This original fable emerged in particular after the open of Pump.fun, a Solana platform that lets in any individual to open a token at a minimal price.

In step with CoinGecko files, 3 million original tokens had been listed on CoinGecko in 2024 alone. Half of these projects died, but the assorted half survived. On the opposite hand, the disclose in 2025 looks less stable.

While the sequence of original token launches remains excessive, the sequence of failures is almost the same, with launches handiest marginally exceeding deaths by a pair of thousand.

“Ecosystems with low barriers to token advent peep the highest sequence of ghost coins. In long-established, platforms that accumulate it very easy and low-price to open original tokens peep the most abandoned coins. In some unspecified time in the future of this cycle, Solana’s meme coin surge (e.g., thru token launchpads relish Pump.fun) drove a flood of original tokens, quite a lot of which lost person traction and day-to-day exercise as soon as preliminary hype former,” Binance’s spokesperson outlined.

The greater meme market has additionally taken a particular blow to its recognition.

As of March 5, the meme coin market capitalization had sharply lowered to $54 billion, marking a 56.8% topple from its high of $125 billion on December 5, 2024. This downturn used to be accompanied by a important decrease in trading exercise, with volumes falling by 26.2% within the preceding month alone.

Certain token categories were hit more tough than others.

Song and Video Tokens Among the many Hardest-Hit Lessons

A 2024 BitKE document indicated that video and music had been outstanding categories with many failed cryptocurrency projects, reaching a 75% failure rate. This outsized share suggests that niche-focused crypto ventures continuously face challenges achieve lengthy-term viability.

“These niches face adoption and utility gaps. Song tokens combat to compete with Spotify/YouTube, while ‘hear-to-create’ devices continuously lack quiz. As more mainstream celebrities accumulate into the house without luminous important about blockchain technology, tokens dangle change into the original cash-snatch industry,” Liu outlined.

Binance’s spokesperson eminent that ethical and technical hurdles, reminiscent of music licensing and the important resources wanted for video offer, advanced the scaling of decentralized choices.

They extra outlined that many projects struggled to live sustainable without mountainous person adoption or sturdy network results.

“This highlights that a lawful belief alone is no longer ample; crypto projects need to additionally compete with entrenched Web2 platforms, navigate advanced industry challenges, and utter proper-world utility to be successful. With out aligning with person behavior and market desires, even neatly-intentioned initiatives grief fading into ghost tokens,” Binance told BeInCrypto.

No subject the discouraging sequence of failed tokens, this disclose offers foremost insights into building resilient projects that withstand snide market stipulations.

What Can We Study From Catastrophic Token Collapses?

Prospective token creators can learn important lessons from as soon as-in style projects that within the raze failed. The unfavorable outcomes skilled by these ventures, in particular in severe instances, can encourage the arrangement of original projects responsibly and preserve a long way from the same pitfalls.

Binance referred to infamous ghost coin conditions BitConnect and OneCoin.

“BitConnect, as soon as a high-10 coin, collapsed in 2018 after being exposed as a Ponzi device promising ~1% day-to-day returns. Merchants lost nearly $2 billion. OneCoin, raising ~$4 billion, below no conditions had a proper blockchain and relied on aggressive multi-stage marketing sooner than collapsing. Every conditions spotlight the hazards of projects built on hype, unrealistic promises, and shortage of verifiable technology,” Binance’s spokesperson outlined.

These examples additionally provide precious lessons for individual investors trading tokens, no subject whether the token is newly launched or more established.

Key Lessons from Ghost Tokens

While referring to, the rising sequence of ghost coins serves as a extraordinarily foremost reminder that discernible warning signs continuously precede the downfall of these cryptocurrencies.

These conditions underline the need of rigorous learn, validating underlying principles, and holding a cautious point of view, especially when funding positive aspects seem unrealistically excessive. Prioritizing grief management and sustainable lengthy-term factors can dangle to mute outweigh short speculative trading.

Binance in particular highlighted the importance of “Function Your Absorb Research” (DYOR) when evaluating crypto projects.

“Practically, this implies reviewing the whitepaper, assessing whether the venture solves a proper disclose, verifying the personnel’s credibility, inspecting tokenomics and provide distribution, and checking neighborhood and development exercise,” Binance acknowledged, at the side of that “In essence, DYOR is ready empowerment and safety. It helps investors title sturdy projects and preserve a long way from scams or ghost tokens by spotting red flags early. Given how rapid crypto markets budge, personal due diligence remains a need to-dangle for navigating the house safely and successfully.”

Indirectly, the incidence of ghost tokens highlights an foremost truth for crypto contributors: thorough learn and primary price are paramount for figuring out lasting projects.