The SEC delayed Canary Capital’s utility for a Litecoin ETF on the present time, opening public feedback over the proposal’s compliance with regulatory requirements. The price of LTC fell 5% after the announcement.

The public observation element doesn’t seem to signal the Commission’s intentions; this in most cases is a passe delaying tactic. Nonetheless, the market straight took it as a bearish signal.

Will the SEC Reject Canary’s Litecoin ETF?

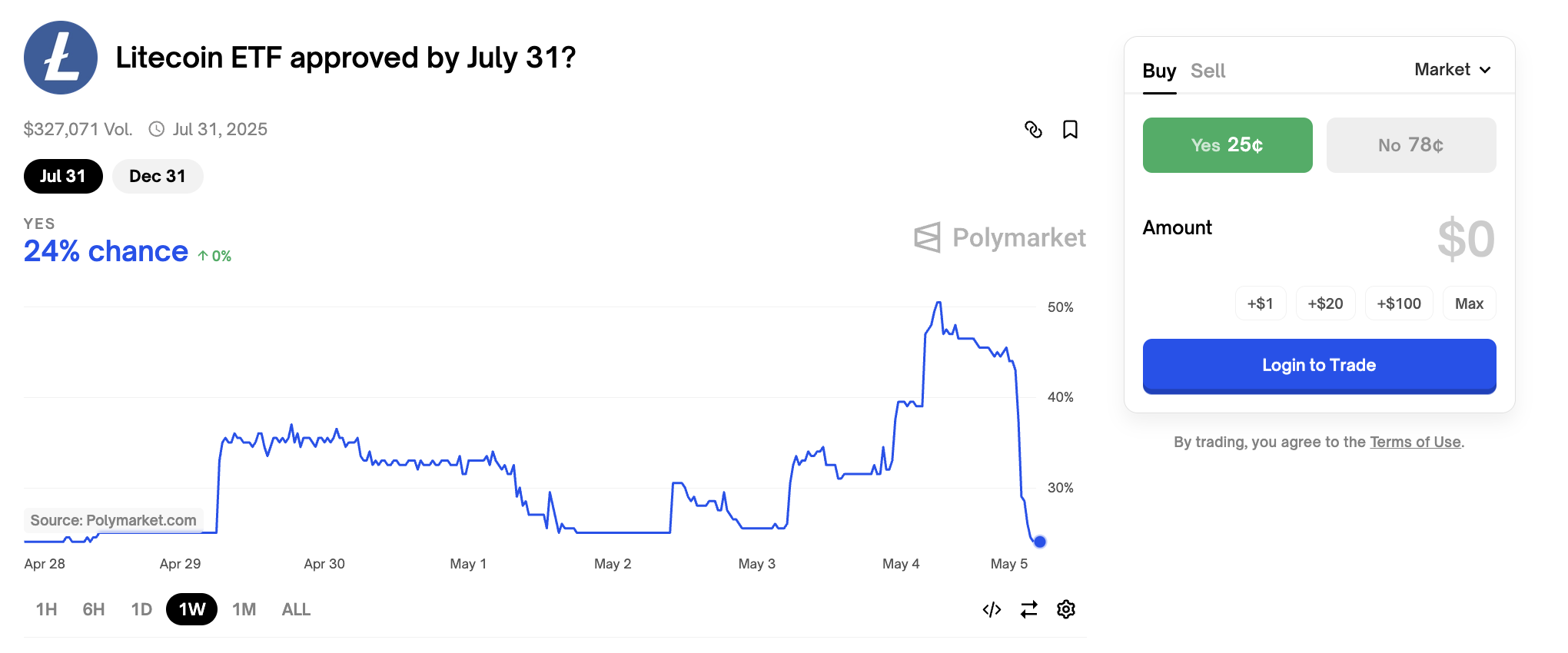

A pair of months ago, analysts proposed that the Litecoin ETF turned into once extra liable to secure SEC approval than every other altcoin ETF. Its Polymarket odds temporarily reached 85% in February, and on the present time’s SEC closing date additional spurred group hype.

On the opposite hand, the SEC as a change determined to extend this utility, together with a quiz for public feedback in its sight:

“The Commission seeks and encourages alive to folk to provide feedback on the proposed rule commerce. The Commission asks that commenters handle the sufficiency of [whether] the proposal… is designed to forestall false and manipulative acts and practices or raises any recent or recent concerns no longer beforehand contemplated by the Commission,” it read.

To make certain, it’s some distance no longer sure that this quiz constitutes a bearish construction. The SEC is fielding comparatively about a altcoin ETF proposals ethical now, and it recently delayed a number of.

It even opened public feedback for a Litecoin ETF proposal in February. In other phrases, this might maybe well also be a passe delaying tactic. Unfortunately, the market hasn’t taken it successfully.

Litecoin’s ticket fell rapid after the Commission delayed this utility, losing 5% at its lowest point. Polymarket’s odds of a Litecoin ETF approval in Q2 2025 also plummeted, however the potentialities of a 2025 approval in fashioned remained fashioned.

Primarily the most bullish expectations listed Q2 as a doable time for altcoin ETF approvals, and this bet is now making an try reasonably no longer going.

In other phrases, things in most cases is a lot worse. James Seyffart, an ETF analyst who predicted the Litecoin extend, didn’t observation on the public observation element. It appears to be like like a stretch to bid that the SEC is signaling its intent to refuse this or every other altcoin ETF proposal.

Peaceable, the market can react harshly to such dispositions within the rapid duration of time, and traders are repositioning their bets on the altcoin.