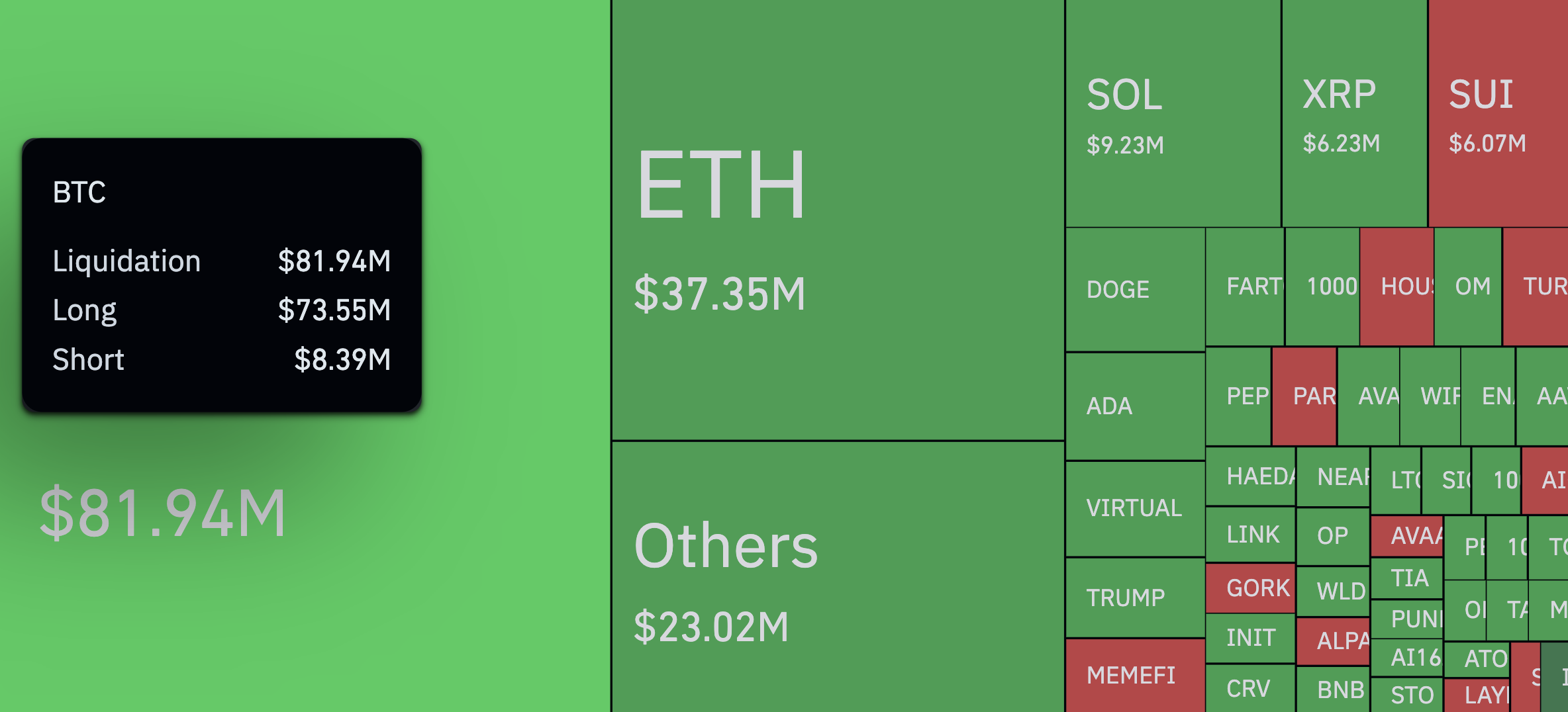

Within the closing 24 hours, Bitcoin (BTC) traders confronted $81.94 million in total liquidations, with $73.55 million of it coming from lengthy positions. Shorts? Honest $8.39 million. That is a 9-to-1 imbalance — a 900% spike favoring one aspect — welcome to one of Bitcoin’s most vulgar lopsided liquidation events nowadays.

It took place as fragment of a bigger fashion of liquidations within the crypto enviornment; in total, $209.97 million in positions had been cleared out in exactly one day, hitting over 74,000 traders. Honest as with Bitcoin, the longs took the brunt of the atomize — $167.03 million versus $42.94 million in shorts.

Ethereum (ETH) used to be now no longer spared both, with liquidations totaling $37.35 million. Solana (SOL) and XRP followed, with $9.23 million and $6.23 million, respectively. While these figures are now no longer out of the usual-or-backyard on their very have, leaning in direction of lengthy liquidations all the diagram through nearly each and each major token paints a affirm image: the market used to be overly bullish, and bulls obtained caught in a trap.

The 12-hour window showed the identical story — $80.55 million in lengthy liquidations versus $26.84 million in shorts — pointing to a cascade build that seemingly started with mild downside and quickly accelerated as stay losses and margin calls kicked in.

It is appealing that this all took place with out any gargantuan value drops. Bitcoin and the different high cryptocurrencies dipped, however now no longer by ample to point to this stage of washout. That is how powerful this market normally is — it’s some distance never correct the hunch itself, however the positioning within the help of it that can certainly fetch some atomize.

In step with CoinGlass, the largest liquidation used to be from HTX’s ETH/USDT pair at $2.36 million. It is powerful to affirm for now whether or now no longer this used to be correct a reset of some form or a signal that the market is in unsuitable shape.