Bitcoin is gearing up to outshine gold as Fidelity’s newest prognosis highlights a pivotal shift in efficiency momentum, signaling a unusual generation for digital store-of-payment dominance.

Fidelity Signals Bitcoin Might well Rapidly Grasp the Baton From Gold

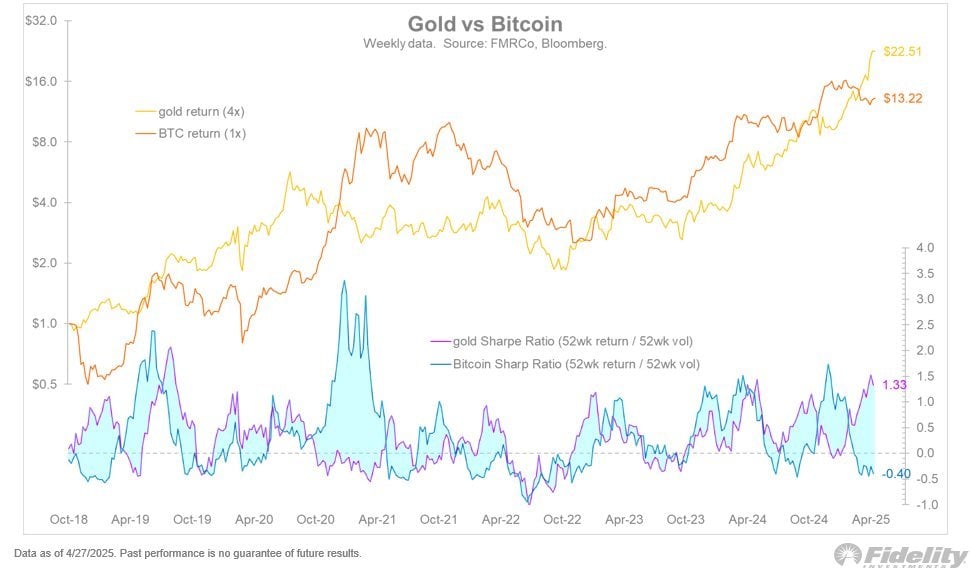

Fidelity Investments’ director of world macro, Jurrien Timmer, provided a comprehensive steal on the dynamic between bitcoin and gold on April 27 thru a sequence of posts on social media platform X. Citing knowledge from Fidelity Administration & Compare Company (FMR Co) and Bloomberg, Timmer analyzed the transferring Sharpe Ratios of the two resources—a hallmark that measures return adjusted for threat—and pointed to a doable turning level of their relative efficiency.

“Ironically, gold and bitcoin are negatively correlated to every assorted. As the chart beneath shows, both resources had been taking turns lately, as measured by their Sharpe Ratios,” he opined, adding:

From the appears to be like to be like of it, it will most likely presumably presumably be bitcoin’s flip to steal the lead, on condition that its Sharpe Ratio is -0.40 whereas gold’s is 1.33. So presumably we’re due for a baton-lunge from gold to bitcoin.

The chart shared alongside the commentary shows that gold has no longer too lengthy ago delivered a return of $22.51 in comparison to bitcoin’s $13.22, with gold’s efficiency scaled by a 4x multiplier to mirror its lower volatility versus bitcoin’s unscaled 1x return.

The Fidelity director of world macro no longer too lengthy ago impressed investors to dangle in thoughts both resources as piece of a unified approach as adverse to oppositional choices. “Why determine between gold and bitcoin for these that can presumably well admire both? I inquire them as assorted gamers on the identical employees.” He suggested a starting portfolio mix of four parts gold to 1 piece bitcoin, noting the volatility differential: “Gold’s volatility is one quarter of bitcoin’s, even when they’ve identical Sharpe Ratios.” He further explained how he views valuation thru a normalized lens:

If we overview the historic impress of bitcoin to gold on a 1:1 basis we inquire that bitcoin has dominated. Nonetheless if we overview bitcoin to gold on a 1:4 basis, we inquire that the two resources are extra alike.

Besides as to efficiency metrics, Timmer commented on the psychological and behavioral choices of investing in bitcoin. He described its volatility and unpredictability as significant traits: “Bitcoin is a limited bit assorted than gold, since it has this Dr Jekyll & Mr. Hyde personality.” Based on Timmer, bitcoin flourishes when both money supply (M2) and equities are increasing—leveraging its dual charm as a speculative asset and a store of payment. Gold, on the assorted hand, he remarked, is “factual one ingredient,” providing extra balance. Timmer acknowledged the legitimacy of bitcoin in at the present time’s monetary panorama, describing it as “a contemporary day invention that is intending to be exhausting money in a easy money generation.”