- Over $380 million in Ethereum has flowed out of exchanges in the past week.

- Huge ETH holders possess elevated their positions, reversing a prolonged-term downtrend in pockets concentration.

- On-chain recordsdata suggests increasing investor self perception despite subdued procuring and selling volumes and ongoing market caution.

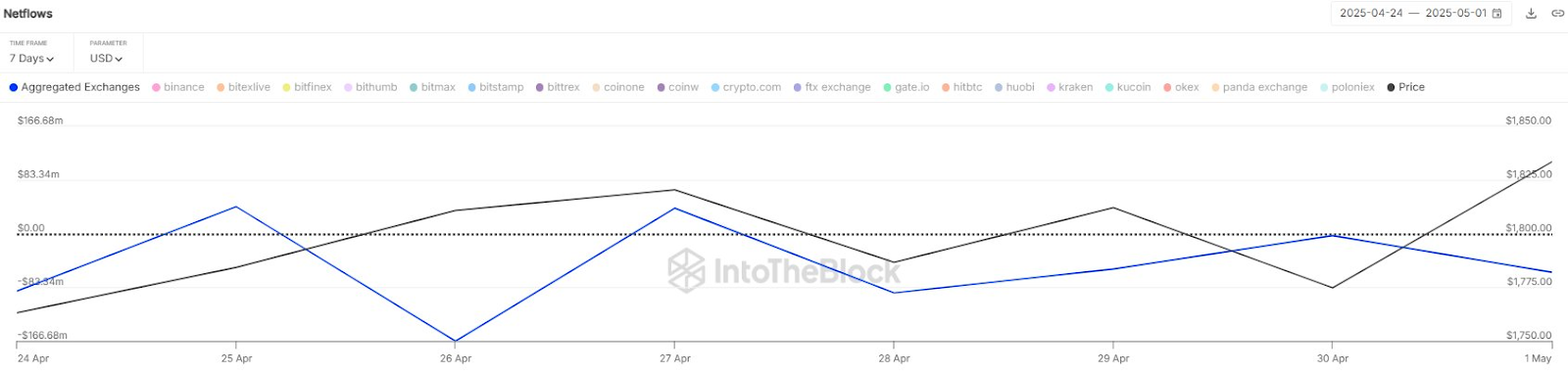

Ethereum (ETH) continues to scramble along with the high-tail out of centralized exchanges at a critical rate. Over the past seven days by myself, salvage outflows surpassed $380 million, based fully mostly on blockchain analytics company IntoTheBlock.

This reduction in alternate-held ETH displays increasing investor accumulation into self-custody and could well expose a tightening provide legend that has historically preceded sign rallies.

ETH Accumulation Persists Despite Note Volatility

Data shows Ethereum’s salvage flows from exchanges were consistently adversarial between April 24 and Would possibly presumably possibly even neutral 1, with an especially huge outflow recorded on April 26. This behavior means that merchants took help of temporary sign dips to buy and withdraw ETH into self-custody.

Despite sign fluctuations throughout the week, ETH ended the duration on a sure veil, mountain climbing help above $1,840. Analysts account for sustained alternate outflows as a bullish signal as diminished provide on exchanges lowers the likelihood of promote stress and could possess to peaceful abolish the instances for a breakout if ask will increase.

Associated: Ethereum (ETH) Note Prediction Would possibly presumably possibly even neutral 2025: Will ETH Spoil $2,100 or Face Rejection?

On-Chain Data Reveals Whale Accumulation, Regular Explain

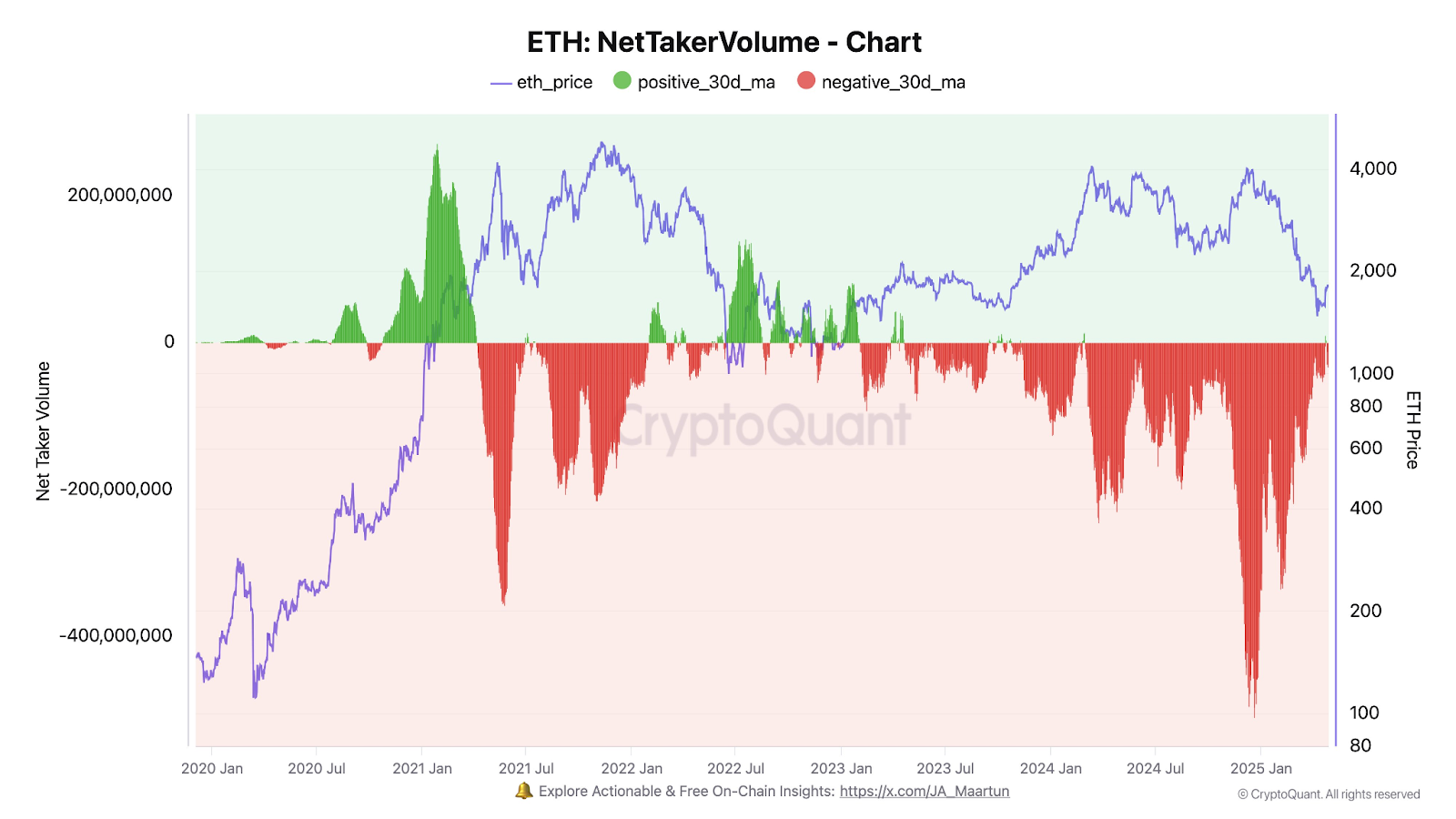

This outflow fashion supports the broader legend that Ethereum will be establishing for a critical rebound after hugely underperforming Bitcoin this cycle. Most as much as date recordsdata from CryptoQuant shows that the distribution of Ethereum provide by pockets dimension indicates that the finest holders are both placing forward their positions or persevering with to procure.

CryptoQuant analyst Darkost highlighted that wallets maintaining larger than 100,000 ETH possess grown by approximately 3% since August 2024. He sees this as a signal of “natty cash” positioning. He illustrious that since 2020, the proportion of ETH held by huge wallets had regularly diminished, but that fashion now looks to be reversing.

Extra Bullish On-Chain Data Pointing to a Likely Rally for Ethereum

Darkost moreover illustrious that the collection of spirited addresses has remained trusty despite ETH’s sign decline. He seen with out a doubt in depth promoting stress in the derivatives market, though this is also easing. Severely, Obtain Taker Volume changed into sure on April 23 and 24, which could well signal the starting of a bottoming route of if the fashion continues.

Darkost stressed that these metrics trip counter to the “Ethereum is tedious” legend. Surely, despite ETH currently procuring and selling about 62% below its 2021 all-time high, on-chain recordsdata parts to enduring energy and strategic accumulation.

Associated: ETH Note Outlook: Can Bulls Shield $1,750 or Will Would possibly presumably possibly even neutral Launch With a Breakdown?

The superb solution to Scheme ETH

Darkost concluded that while some encouraging prolonged-term indicators exist, on-chain recordsdata peaceful displays a lingering sense of pessimism round ETH. He moreover illustrious that begin hobby has dropped considerably and that procuring and selling volumes remain subdued, both of which underscore the cautious market sentiment.

In his explore, essentially the most prudent design handsome now will be to seem forward to a transparent invalidation of the bearish fashion or, at most, to engage in a gradual dollar-sign averaging (DCA) plot.

Disclaimer: The suggestions presented on this text is for informational and academic functions only. The article does now not portray financial advice or advice of any form. Coin Edition is now not to blame for any losses incurred as a outcomes of the utilization of mumble, merchandise, or products and companies mentioned. Readers are told to exercise caution earlier than taking any movement linked to the corporate.