Bitcoin (BTC) is exhibiting signs of a doable bullish vogue in Would possibly perhaps most likely moreover objective, pushed by key indicators. Specialists dangle highlighted components corresponding to miner economics, network hashrate, long-term holder accumulation, and rising global fiat liquidity, suggesting that a label magnify will be on the horizon.

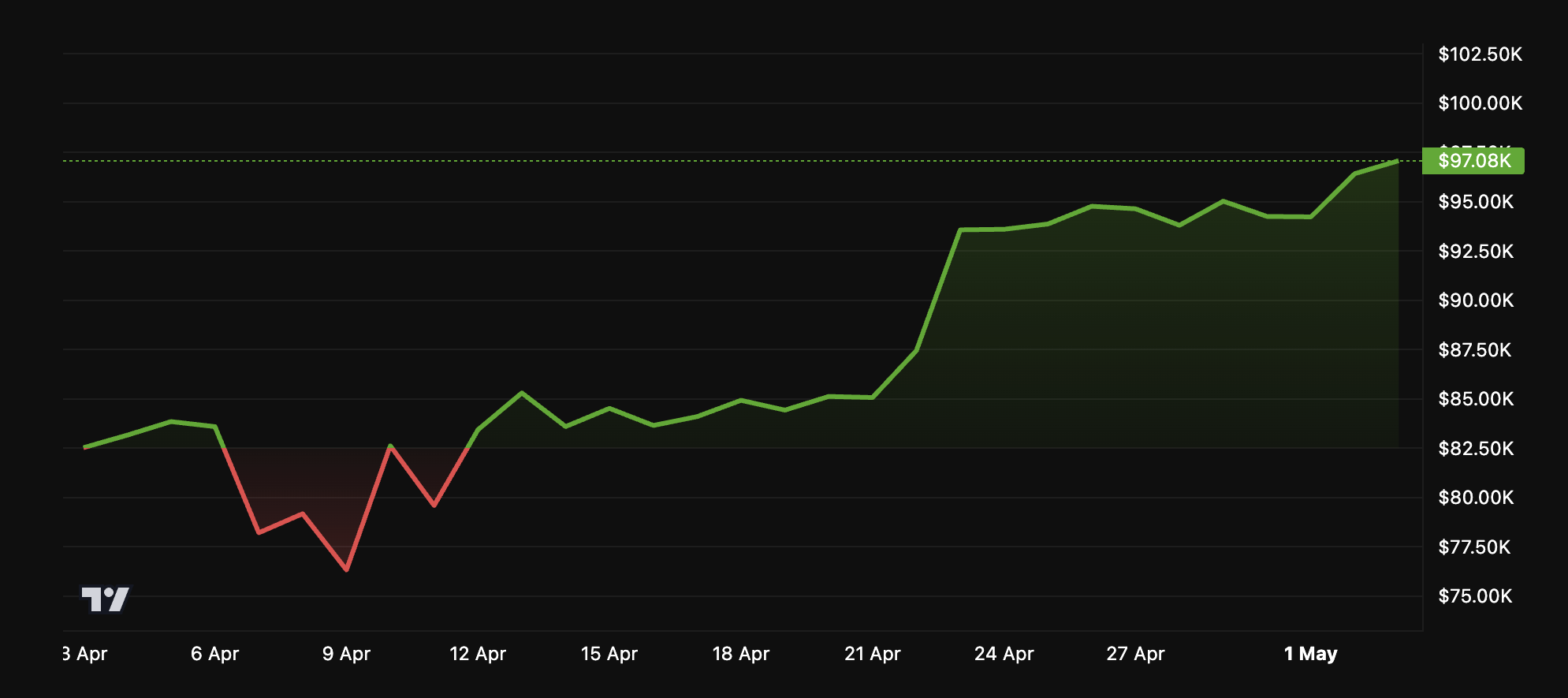

This comes as the largest cryptocurrency continues its restoration rally from early April lows, up 14.6% over the previous month.

Is a Bitcoin Bull Lumber Returning?

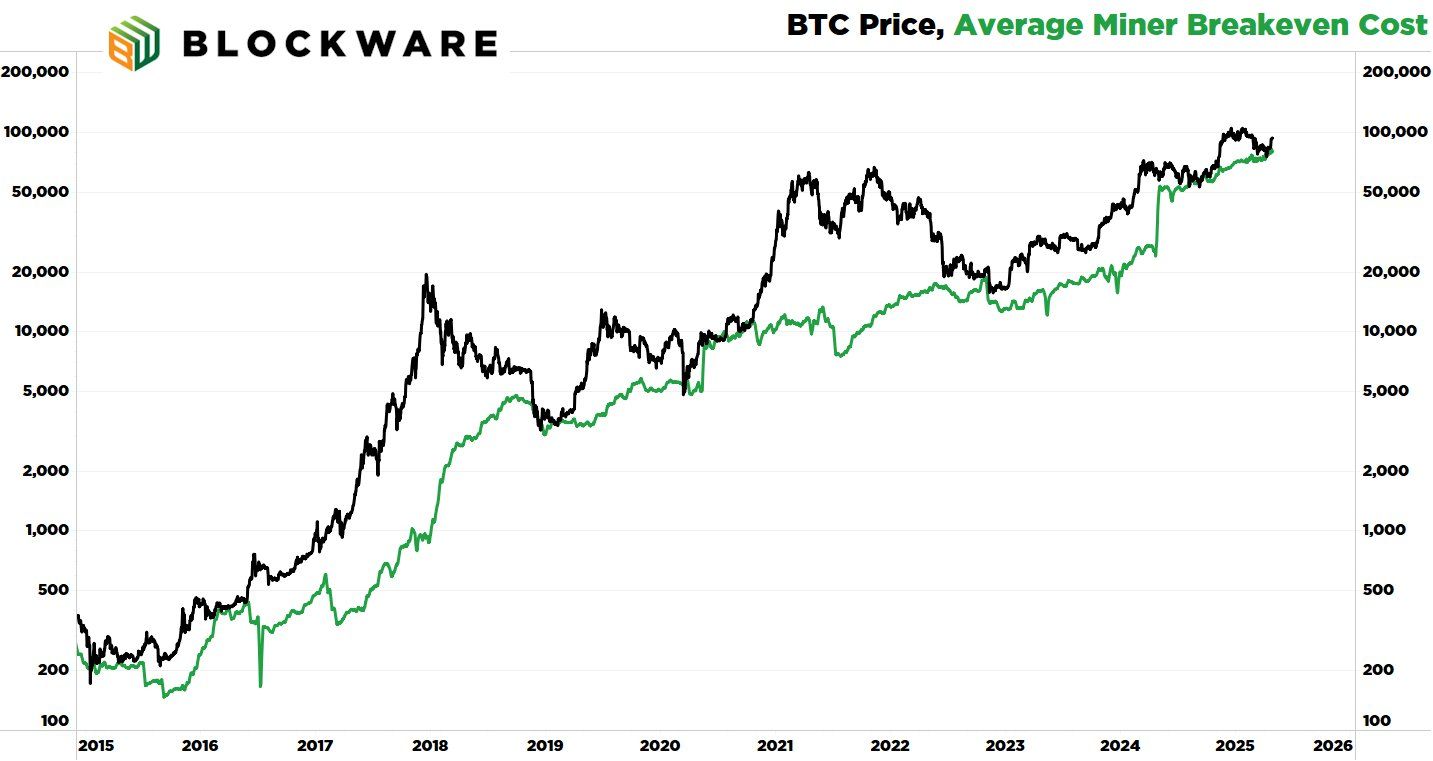

Within the most up-to-date X (formerly Twitter) post, analyst and WiM Media founder Robert Breedlove referenced Blockware Crew’s moderate miner breakeven label files to forecast that Bitcoin will be on the cusp of a bull market.

He critical that the label on the full doesn’t remain below this moderate for prolonged periods, as it represents the brink at which miners could well perhaps quit operations if unprofitable.

“In a rational economic system, belongings no longer steadily substitute below their label of production,” Breedlove remarked.

He highlighted that the index accurately identified six bottoms between 2016 and 2024. Notably, it alerts yet one more bottom, suggesting that a label magnify in Bitcoin will be approaching.

MacroMicro files further supports this. On the time of writing, the 30-day transferring moderate (MA) of the mining label-to-BTC label ratio stood at 1.05.

This indicated that miners dangle been operating at a loss on moderate over the previous month. Which skill that truth, this could well doubtlessly result in an upward label motion as miners operating at a loss slash back, tightening provide.

The Bitcoin hash payment label mannequin, which evaluates Bitcoin’s cost per the historical relationship between its label and hash payment, adds to the bullish outlook.

Analyst Giovanni commented on X that the mannequin is currently at a Bitcoin enhance level.

“The true fact the hash payment basically based totally BTC valuation is at the enhance level skill that most likely we reached some roughly native bottom,” the analyst mentioned.

Extra market alerts enhance the case for a doable rally. Breedlove pointed out that long-term holders dangle accrued roughly 150,000 BTC over the previous 30 days. This urged diminished promoting stress in the $80,000 to $100,000 differ.

As fewer folks are willing to sell Bitcoin at these phases, the label could well perhaps face upward stress as question stays strong, nevertheless the provision of accessible Bitcoin dwindles.

“At its core, the Bitcoin label is completely a feature of provide and question. After an magnify in the Bitcoin label, you commence to ask previously idle cash circulate on-chain. Inversely, after prolonged periods of sideways or antagonistic label motion, long-term holders commence gathering extra cash, environment the stage for a provide-shock and upward label stress,” he added.

Furthermore, rising global fiat liquidity is expanding the pool of capital out there to make investments in Bitcoin. That is further bolstered by substitute-traded funds (ETFs), Bitcoin treasury corporations, and convertible bonds.

These monetary autos provide simpler score entry to for contemporary liquidity to enter the Bitcoin market, bridging the gap between stale finance and cryptocurrency.

“And it’s no longer lawful USD liquidity that’s increasing – liquidity of all fiat currencies is on the upward thrust, and Bitcoin is a global asset,” Breedlove stated.

Lately, BeInCrypto also highlighted a pair of bullish components for BTC. The coin’s apparent question turned certain, implying an magnify in curiosity or attempting to get process for Bitcoin.

Furthermore, the Market Cost to Realized Cost (MVRV) ratio rebounded from the historically well-known point out of 1.74. This motion has previously proven to be a legitimate indicator of the early phases of a bull marketplace for Bitcoin.

Amidst these bullish signs, BTC’s label performance has been moderately well-known. After mercurial shedding below the 75,000 label in early April, the label has persisted to score larger.

All via the final week, BTC has viewed a 4.3% uptick. At press time, Bitcoin’s procuring and selling label stood at $97,048, representing each day gains of 2.3%.