BNB Chain delivered a standout Q1 efficiency in income and on-chain metrics, at the same time as its market cap dipped nearly 15%.

According to a new myth by Messari, BNB Chain posted staunch income efficiency in Q1 2025, with community earnings jumping 58.1% quarter-over-quarter to $70.8 million. The surge became as soon as largely pushed by a 122.6% lengthen in pockets-to-pockets transaction costs, accounting for 17.4% of total income, surpassing DeFi. The DeFi category contributed a modest 8.4% of total income, rising 7.6% QoQ, whereas stablecoin-associated actions made up 5.2% of income, rising 23.4% QoQ, nevertheless with a lowered income a part of 5.2%.

Despite the spectacular income declare, BNB’s market cap declined by 14.8% over the quarter, ending at $86.2 billion. Aloof, BNB maintained its low because the fourth-largest non-stablecoin crypto asset by market cap.

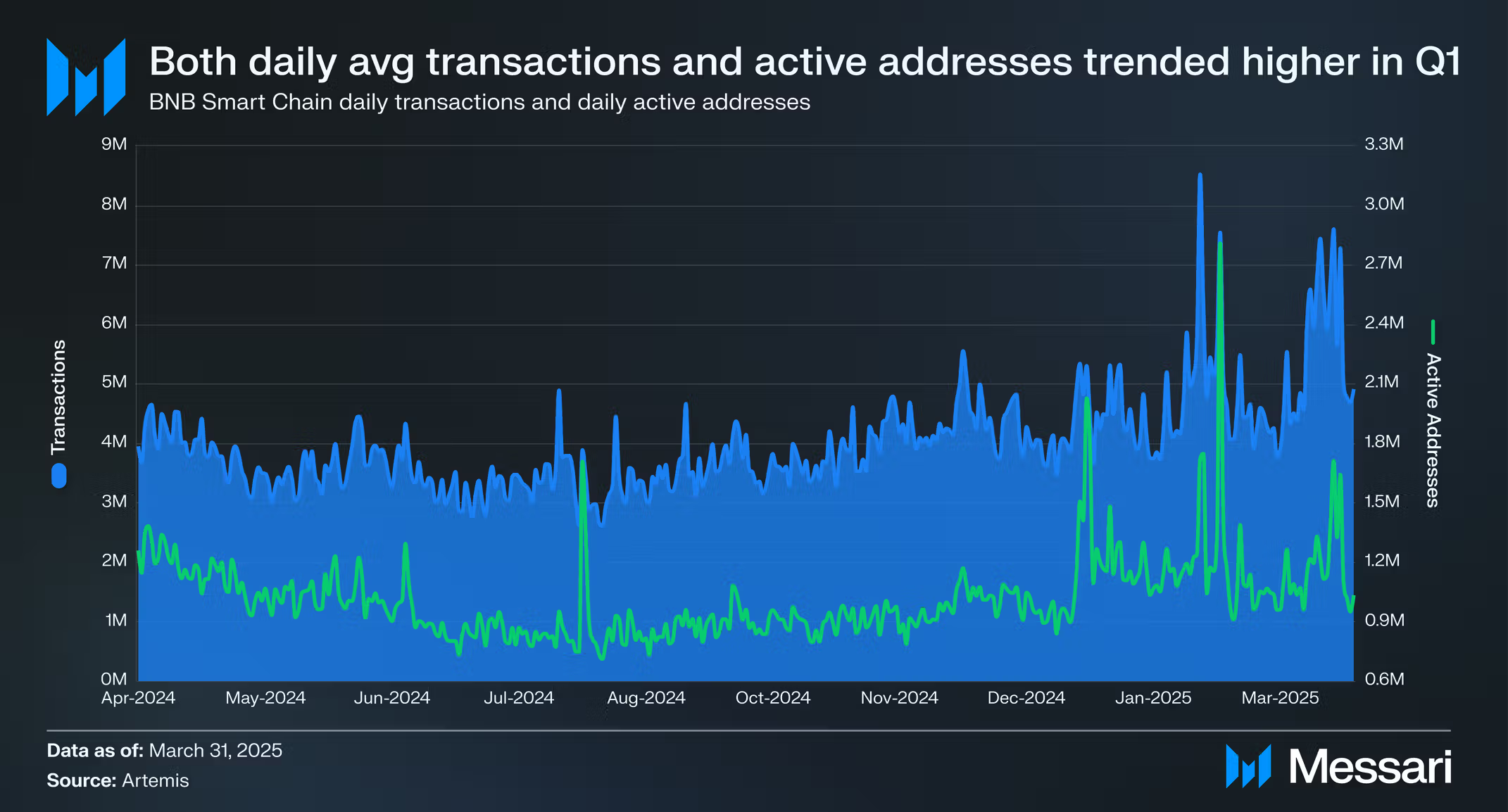

As some distance as on-chain assert is anxious, BNB Excellent Chain noticed common day-to-day transactions climb 20.9% QoQ to 4.9 million, whereas day-to-day absorbing addresses jumped 26.4% to 1.2 million. Stablecoins persisted to dominate, making up roughly 45% of all transactions at 1.2 million per day, and pockets-to-pockets transfers surged 50.9% to 835,000 day-to-day. Total rate locked in BNB Excellent Chain rose 14.7% in BNB terms.

DEX quantity surged Seventy 9.3% QoQ, averaging $2.3 billion in day-to-day trading, with PancakeSwap accounting for over 90% of the chain’s total DEX assert.

Messari additionally notorious the a hit rollout of the Pascal onerous fork, which launched key technical upgrades similar to EIP-7702 well-organized contract wallets, batch transaction toughen, and improved cryptography. Additionally, the BNB Gorgeous Will Alliance, launched in March, helped slice sandwich attacks by better than 90% through coordinated MEV protection efforts.