Bitcoin has honest lately skilled a essential rally, pulling the worth support above $90,000 after over five weeks of stagnation. As of now, Bitcoin is trading cease to $94,401, stunning apprehensive of the excessive $95,761 resistance.

This means that Bitcoin is now not yet at its saturation level, with additional upward momentum conceivable if key barriers are breached.

Bitcoin Traders Are Greedy

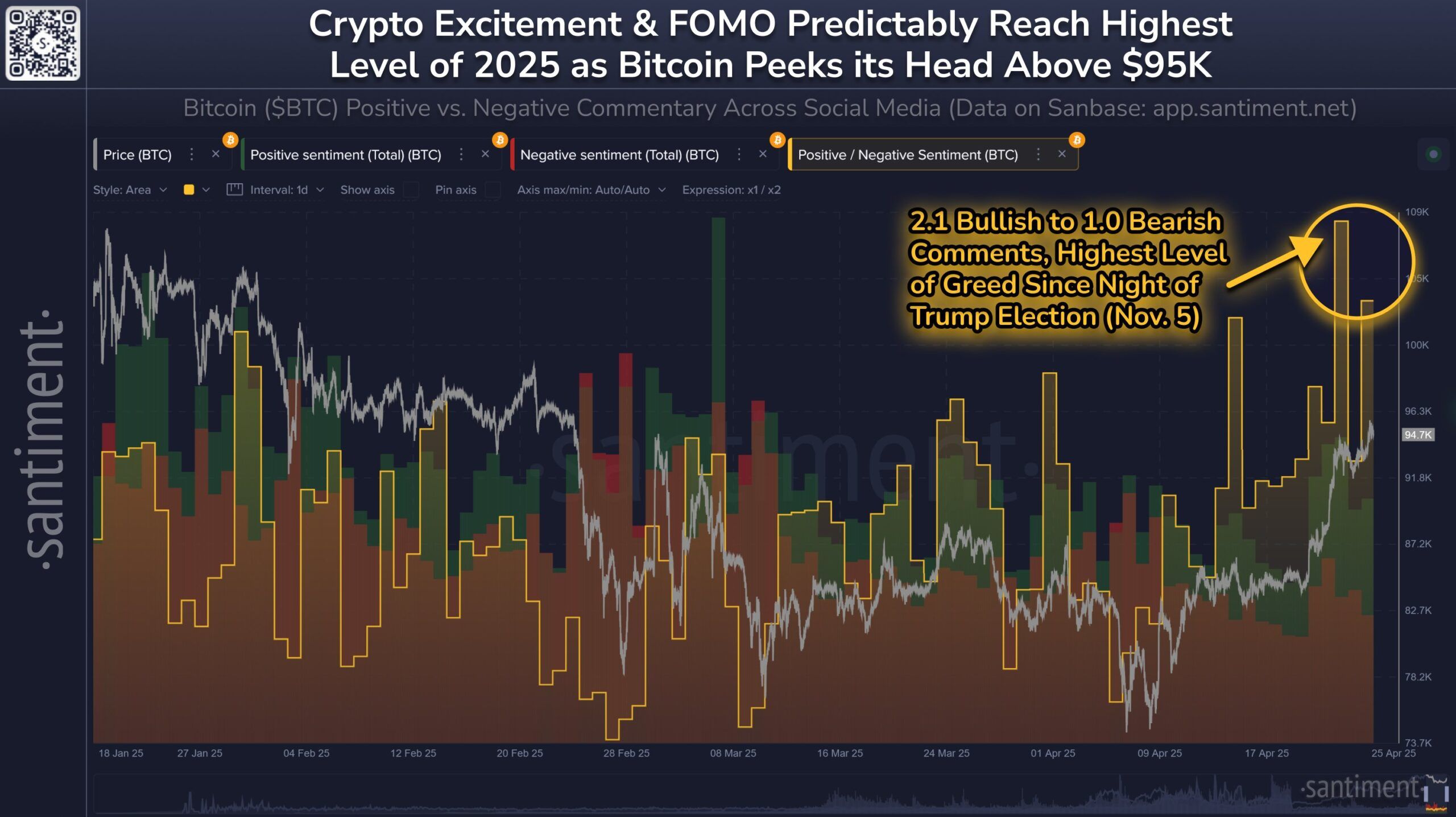

The market sentiment surrounding Bitcoin stays overwhelmingly obvious, with investors showing excessive ranges of optimism for additional designate features. Social media posts present a pointy spike in bullish sentiment, with the selection of optimistic (versus bearish) posts reaching ranges now not considered since the evening of Donald Trump’s election on November 5, 2024. This surge in positivity means that many investors are poised to capitalize on Bitcoin’s doubtless boost, additional fueling its rally.

On the opposite hand, the unparalleled level of greed out there raises questions on the sustainability of this upward movement. As investor sentiment turns into increasingly optimistic, there is a likelihood that this also can consequence in a native high if too many traders become overly grasping.

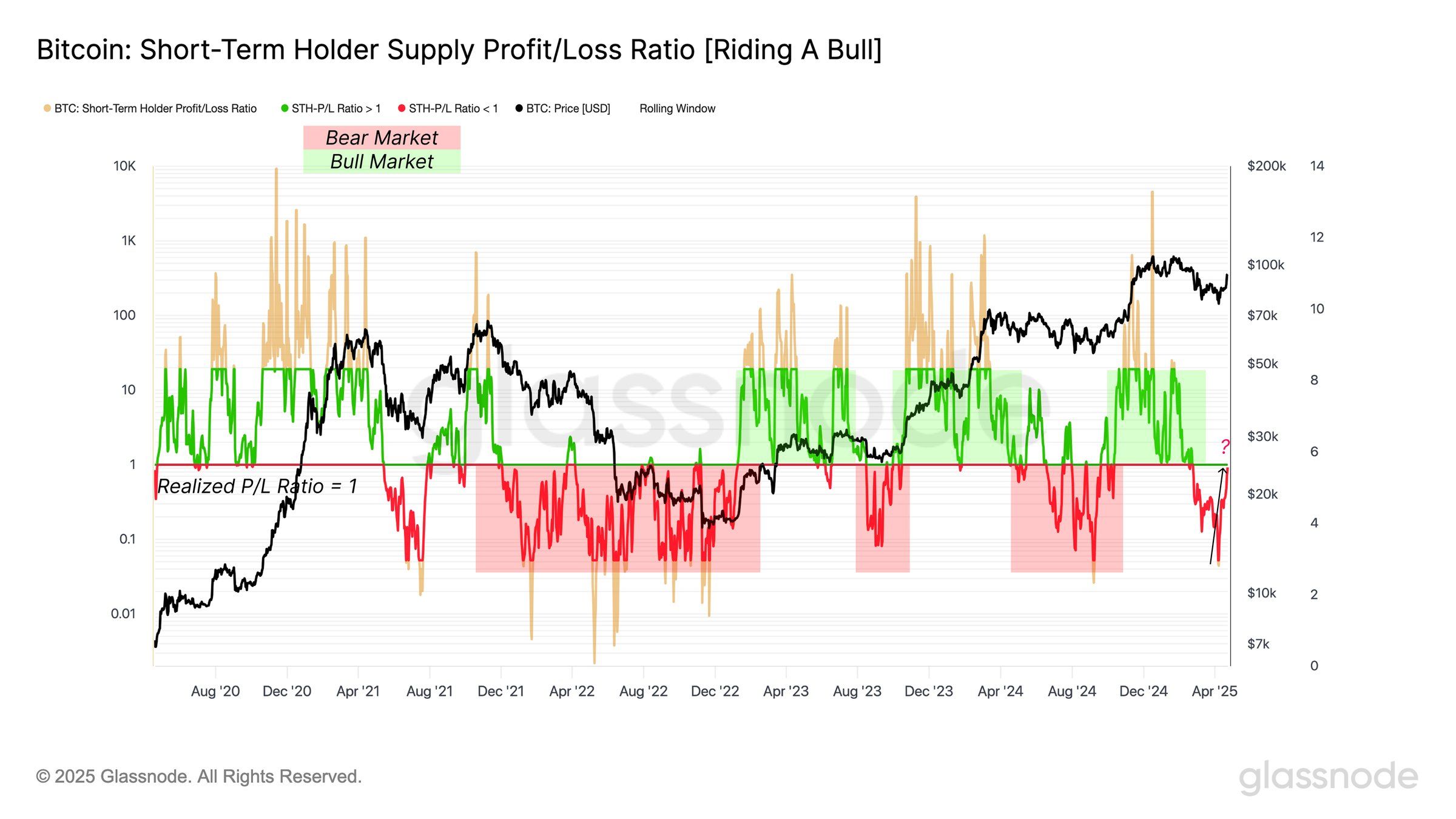

The broader macro momentum for Bitcoin is signaling a rebound, notably within the Income/Loss (P/L) ratio, which is nearing a neutral 1.0 level. This shift indicates a balance between coins in earnings and these in loss. Historically, the 1.0 threshold has acted as resistance at some level of undergo phases, however a sustained transfer above this level might perhaps perhaps perhaps also signal a stronger restoration and persisted upward momentum for Bitcoin.

While the shift in direction of a neutral P/L ratio suggests doubtless strength, it also opens up the likelihood of marketing and marketing stress as investors peer to lock in earnings. Therefore, Bitcoin’s capacity to retain momentum will depend on how investors react to designate actions and whether they suspect to promote or retain their positions.

BTC Heed Wants A Push

Bitcoin’s contemporary designate action reveals a 10% believe better within the closing seven days, trading at $94,401. The crypto king is now stunning beneath the essential $95,761 resistance level, which has been maintaining regular for some time. A rupture above this level would residing Bitcoin on course to be triumphant in unusual highs, with $100,000 as the next critical milestone.

Would perhaps collected Bitcoin breach $95,761, the rising greed at some level of the market will seemingly attend investors to retain their positions in station of promote. This might perhaps perhaps perhaps also merely seemingly feed the altcoin’s bullish momentum, pushing Bitcoin additional in direction of $100,000 as query stays sturdy amongst traders wanting to capitalize on doubtless features.

On the opposite hand, if Bitcoin fails to retain its self-discipline above $93,625, the worth might perhaps perhaps perhaps also fall in direction of the $91,521 toughen. A deeper decline to $89,800 might perhaps perhaps perhaps also build apart the bullish momentum in wretchedness, delaying any prompt restoration and lengthening the potentialities of a consolidation piece.