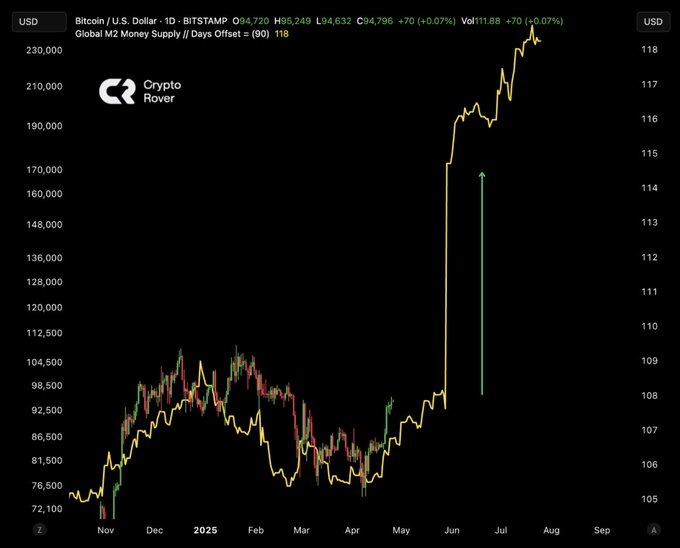

Bitcoin is nearing a severe model level of $96,000, a resistance level that has over and over challenged its upward momentum all by the consolidation portion. Nonetheless, sentiment among analysts remains firmly bullish, fueled by a without note increasing global money present.

Crypto analyst Rover acknowledged that “global liquidity is exploding” as the amount of circulating monetary capital continues to enlarge. Digital resources trip elevated build a matter to on account of rising market liquidity, which in turn boosts Bitcoin costs. The influx of capital into the market creates favorable stipulations for Bitcoin to potentially surpass the $96,000 resistance impress all by a sustained breakout.

Bitcoin Faces Key Resistance at $96,000

The old makes an attempt of Bitcoin to surpass the $96,000 resistance level attracted essential attention among customers. The market has confirmed toughen at this zone, making it disturbing for the payment to atomize by.

Related: Crypto Advertising and marketing campaign Urges Swiss Nationwide Bank to Diversify with Bitcoin Reserves

The following foremost targets for Bitcoin’s upward circulate after a likely atomize of $96,000 will be $101,000, adopted by $111,000, suggesting an ongoing bullish pattern. If Bitcoin can no longer surpass $96,000, then there exists a possibility that its model will fall.

The circulate in Bitcoin’s market sentiment depends largely on funding rates alongside rising liquidity. Funding rates turn adversarial when the majority of futures traders start immediate positions, reflecting bearish sentiment. Historically, such classes of adversarial funding have preceded Bitcoin model will increase, indicating that recent traits may per chance well even reason an upward circulate.

Institutional Hobby Strengthens Bitcoin’s Outlook

The hobby level from monetary institutions in opposition to Bitcoin has surged dramatically on account of the rising build a matter to for Bitcoin ETFs. BlackRock’s recent $240 million Bitcoin have, along side its institutional belief, signifies obvious prospects for Bitcoin. The increasing institutional toughen and rising liquidity tag that the digital asset likely of Bitcoin remains solid, which supports its favorable model pattern over the next length.

Related: Coinshares: Bitcoin All-In Mining Mark Reached $137K for Listed Miners in Q4 ’24

Bitcoin’s market payment is in an instant correlated with global monetary growth, as elevated liquidity drives build a matter to for cryptocurrencies. The cryptocurrency market implies that Bitcoin will surpass key boundaries on its path to producing mighty model appreciation.

Disclaimer: The conception presented listed right here is for informational and tutorial applications most efficient. The article doesn’t notify monetary advice or advice of any kind. Coin Edition is no longer guilty for any losses incurred since the utilization of instruct, products, or products and services talked about. Readers are told to insist caution sooner than taking any action connected to the company.