AI-centered cryptocurrency projects are witnessing a surge in on-line job, with TAO main the space by a most significant margin. Per files from Phoenix Crew and LunarCrush on April 22, 2025, TAO won 5.9K engaged posts and over 1.3M total interactions, placing it as a quantity 1 mission through social job.

TOP #AI PROJECTS BY SOCIAL ACTIVITY$TAO $RENDER $FET $INJ $QUBIC $NEAR $VRA $ARC $PAAL $DIA pic.twitter.com/pK67Nag4ar

— PHOENIX – Crypto Files & Analytics (@pnxgrp) April 22, 2025

These figures existing that there could be growing hobby in utilizing AI within the blockchain, significantly for projects promoting decentralized intelligence and files effectivity.

Render and Get.ai Compete for Market Attention

Render (RNDR) and Get.ai (FET) adopted within the 2nd and third positions, respectively, indicating that they mild possess noteworthy retail and developer crimson meat up. Among them, Render mild 3,7K engaged posts with 570,7K interactions, and Get.ai had 3.4K engaged posts and 562K interactions.

After the first three platforms, Injective (INJ), Qubic, and NEAR, each and every had better than 2000 engaged posts, which exhibits they possess consistently sturdy job levels, though with significantly fewer customers. INJ obtained 3K engaged posts and 430.9K interactions on account of the expanding ecosystem of decentralized finance and the whisper of AI-pushed derivatives.

Qubic, a brand recent AI blockchain, had 2.2K alive to posts and better than 306k engagements. NEAR and VRA (Verasity) scored 2.1k posts and 495k interactions, respectively, VRA again surpassing both Qubic and NEAR.

ARC, PAAL, and DIA finished the checklist of the tip ten rankings. No matter realised comparatively low stage of engaged posts within the vary of 1.4K to 1.6K on moderate, their intensity of interaction did not slack. Decentralized Oracle DIA obtained 405K interactions, due to this investing in quality AI files sourcing.

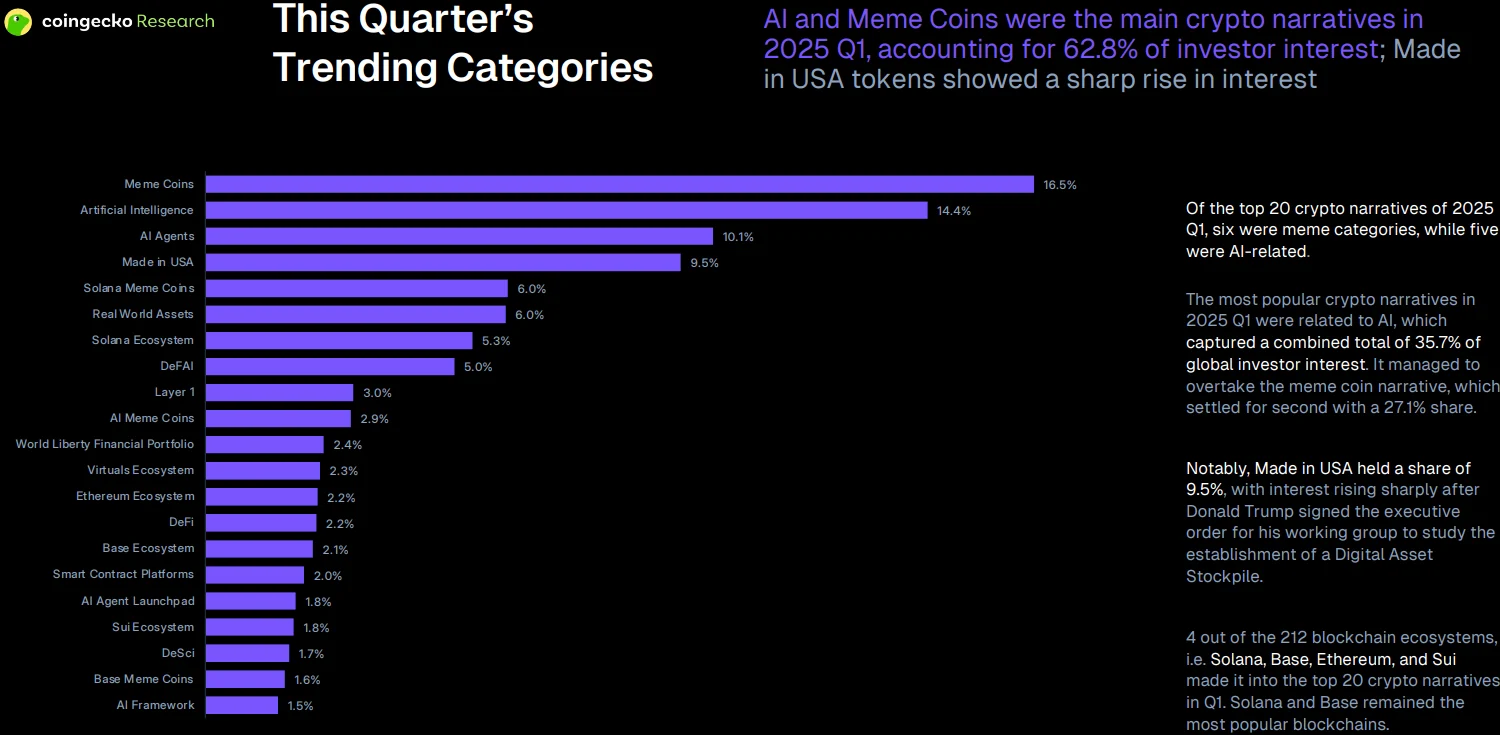

The uptick in social engagement aligns with the Q1 2025 be taught shared by CoinGecko, which pointed to AI tokens as for certain one of many very finest developments within the crypto space. AI coins took 35.7% of the merchants’ attention, while memecoins took 27.1%.

Liquidity Surge Fuels AI-Led Rally

Per macroeconomic analysts, the compose better in world liquidity is bolstering high-risk funds, including AI crypto. The World M2 money provide has been on the upward push, and folks are shifting encourage into extra speculative markets.

Julian Bittel and GMI identified that crypto markets can possess indeed bottomed, hinting at a brand recent bull breeze. AI tokens are even extra gripping now as they’re really surpassing varied total altcoin categories through price soar encourage and job.

This is totally on account of indicators of optimism in veteran finance as well as in know-how arenas, such because the recent $500 billion bet by NVIDIA on the AI backbone of the alternate. Extra crimson meat up came from U.S. President Donald Trump, who promised to starting up expediting the permits that NVIDIA required.

Bobby Ong, the co-founding father of CoinGecko, said that two major developments, AI and memecoins, persist unanswered while no recent memoir looks in 2025. In her April 17 put up, Ong identified that the recent developments glimpse take care of these of previous quarters.

Analysts imagine that barring a swap within the know-how or regulatory atmosphere, positional dominance could maybe perchance remain with AI and meme sectors within the 2nd quarter as well. Since NVIDIA is pushing the AI frontier and liquidity stays high, merchants’ behavior looks to be in a valid repetitive cycle.