Within the dynamic cryptocurrency landscape, every opened rapid station leaves liquidity pools in the good thing about, that would possibly maybe presumably also cause rapid squeezes. Therefore, traders can glimpse for cryptocurrencies with an increased volume of shorts for capability pump opportunities.

The crypto market has shifted to a dominating bullish sentiment amid a famous rally. However, some cryptocurrencies are unruffled attracting bearish rapid-sellers, that would possibly maybe presumably also rapidly turn into market makers’ targets.

Finbold gathered records from CoinGlass on February 27 to analyze the derivatives market. In particular, we learned two capability cryptocurrencies for a short squeeze next week resulting from associated liquidity pools upwards.

Actually, rapid-sellers borrow a cryptocurrency to promote available in the market. They income by re-procuring it at decrease prices once they end the station – voluntarily or no longer.

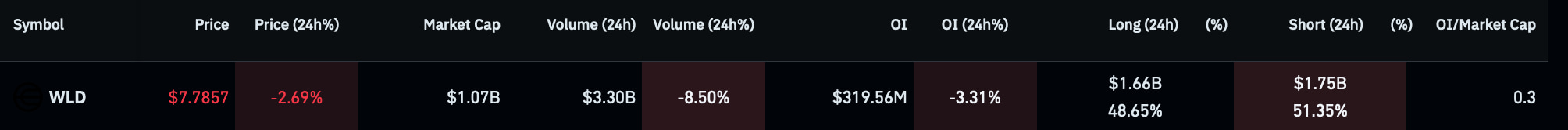

Short squeeze alert for WorldCoin (WLD)

WorldCoin (WLD) is unruffled attracting a valuable quantity of rapid-sellers despite the market’s general positive sentiment. Currently, the originate passion for WLD derivatives is at $319.56 million for $30 of its $1.07 billion capitalization.

Within the period in-between, traders opened $1.75 billion of rapid positions against the WorldCoin, for 51.35% of its 24-hour volume.

This action has left some liquidity above $9 per token. Thus, a capability rapid squeeze would possibly maybe presumably also pump the worth over 15% from the $7.78 by press time.

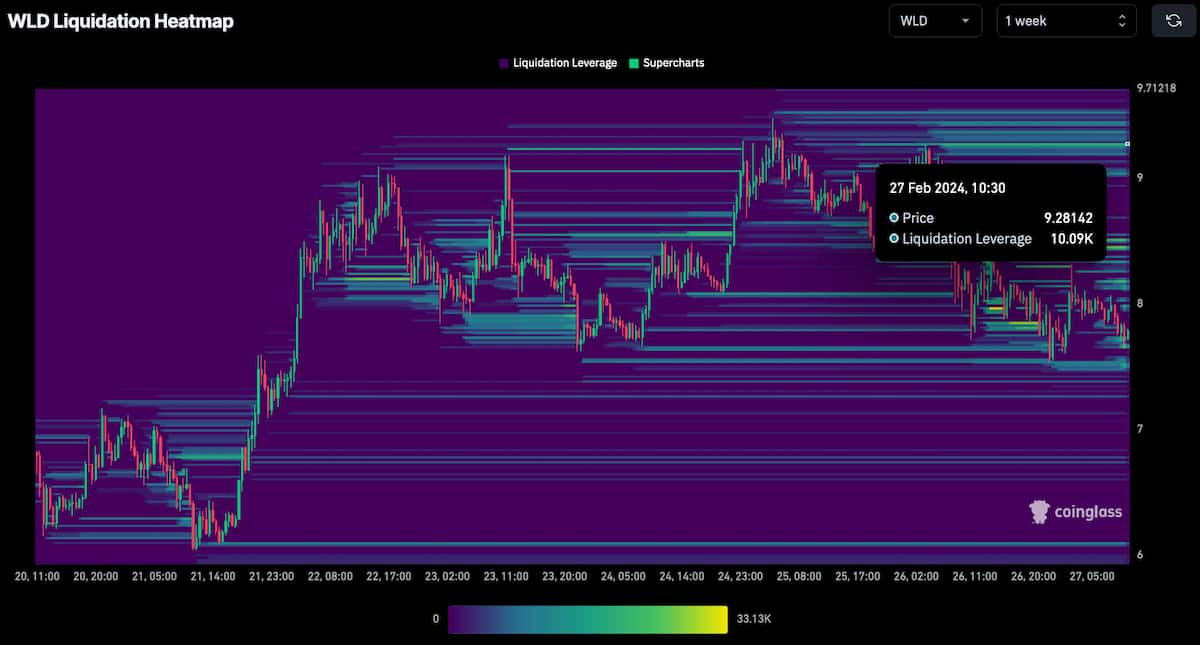

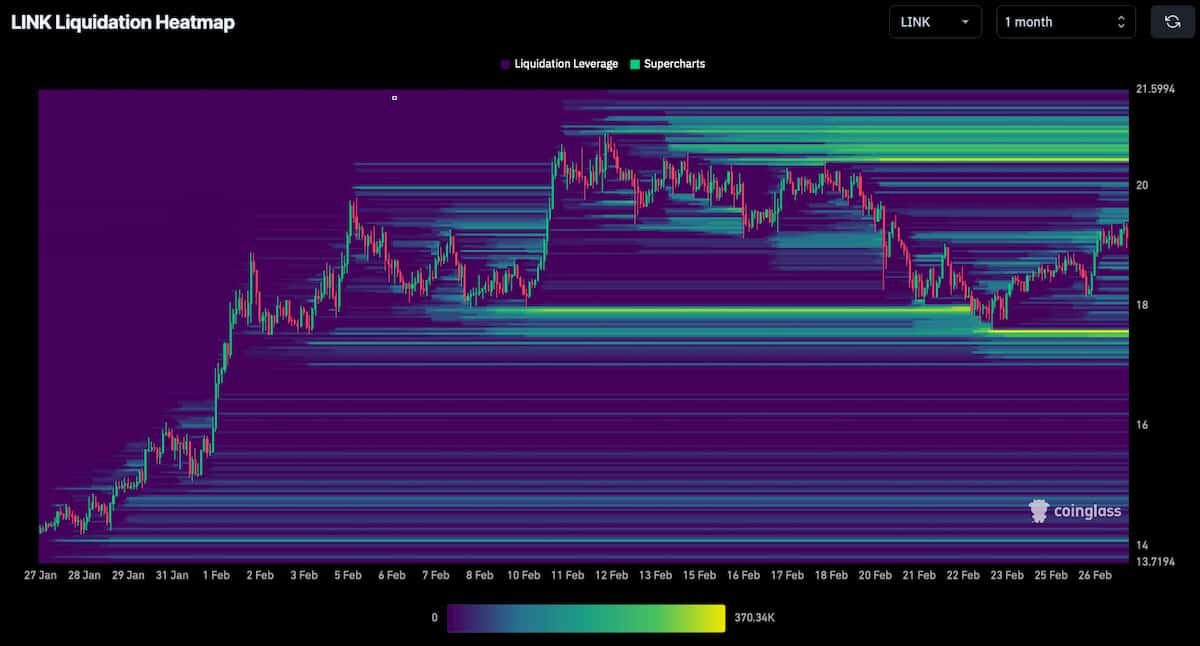

Chainlink’s (LINK) pump capability

For the time being, Chainlink (LINK) continues to existing huge liquidity pools in the worth differ between $20 to $21. These liquidations are largely evident on the month-to-month heatmap, now nearer to the present ranges at $19.

Nonetheless, traders are starting up to shift their bets, creating associated blueprint back liquidity. The ask is which of these pools market makers will goal first.

On that existing, Chainlink currently broke the $100 million TVS, in accordance with Michaël van de Poppe, who believes “slack accumulation is possible a terrific decision” on LINK.

Oracles are slowly, nonetheless in fact waking up. I mediate that $LINK is going to enact properly.

Upfront, I believe that $API3 is going to note swimsuit.

Currently down 20% from its most current height, so a slack accumulation is possible a terrific decision.

Broke $100M TVS as properly! pic.twitter.com/HS1XXZ43wO

— Michaël van de Poppe (@CryptoMichNL) February 27, 2024

Curiously, the Bitcoin (BTC) leading a bull rally would possibly maybe presumably also additionally be the extra gasoline wished to trigger these rapid squeezes. Opening shorts is unhealthy at this moment since the market can transfer quick and liquidate traders for mountainous losses.

However, sentiments can shift as quick as tag, and shoppers need to continually change cautiously and predicament the explanations for a dominating rapid station, that would possibly maybe presumably also want a classic justification.

Disclaimer: The recount on this station would possibly maybe presumably also unruffled no longer be thought about funding advice. Investing is speculative. When investing, your capital is at risk.