On April 18, 2025, bitcoin’s worth held shut to $84,549 as merchants weighed momentum and transferring averages for course.

Bitcoin

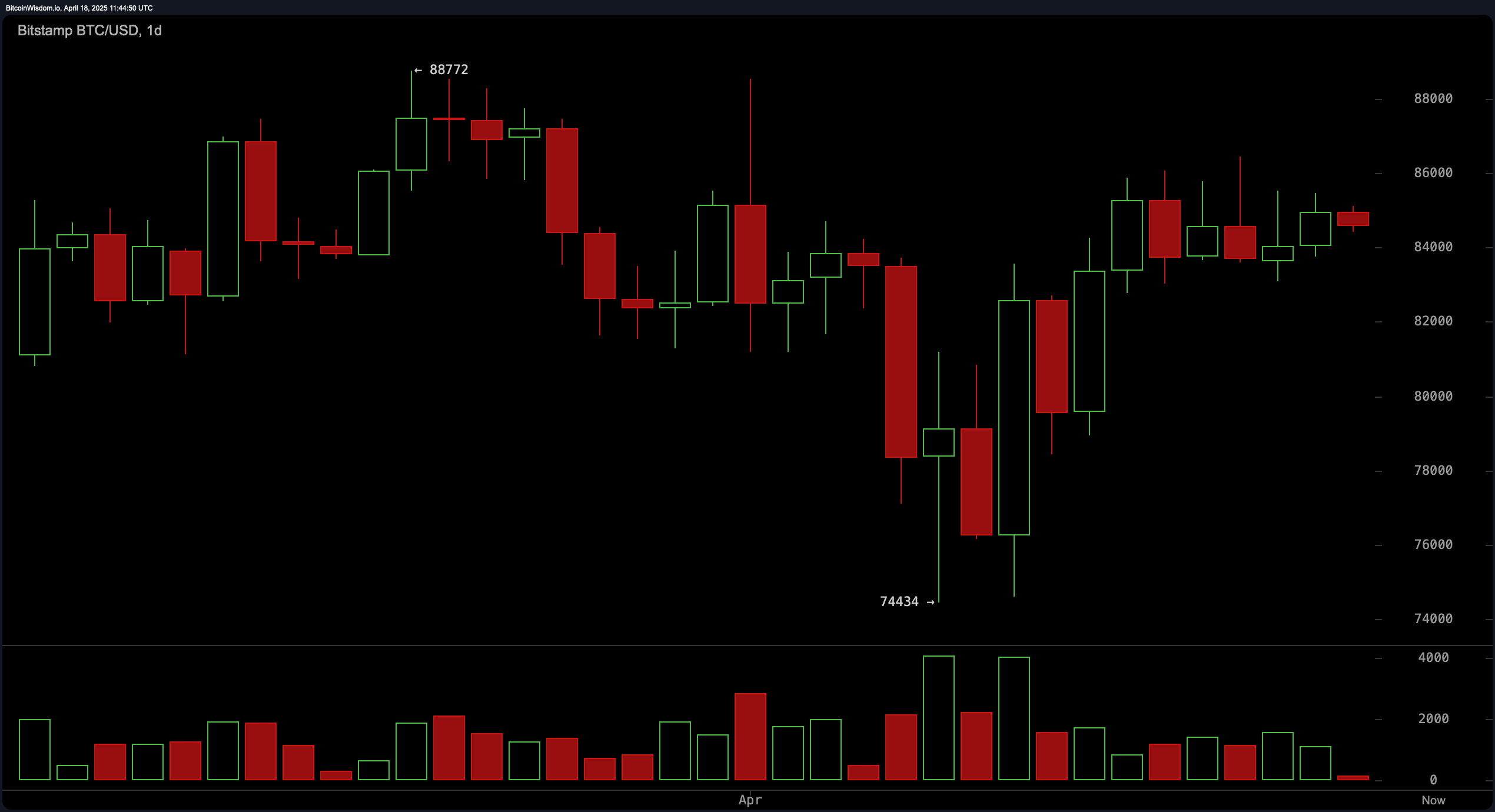

On the on a regular basis chart, bitcoin ( BTC) has traded in an outlined fluctuate since forming a lower excessive shut to $88,772 and discovering give a take to round $74,434. The rebound from that stage produced a V‑formed recovery to doubtlessly the most contemporary worth shut to $84,549, the put sideways consolidation has taken support. Key thresholds are $86,000 to the upside and $82,000 to the downside. A decisive shut above $86,000 would trace renewed upward momentum, while a break below $82,000 may per chance per chance also urged a retest of mid‑$70,000s give a take to.

On the 4‑hour chart, worth action has settled into a hall between $83,031 and $86,450, characterised by combined candlesticks and diminished volatility. A undeniable break above $86,450 accompanied by elevated quantity would validate bullish conviction, while a decisive fall below the lower boundary at $83,031 may per chance per chance also intensify selling stress. Given the capability for speedily swings, merchants have to still employ tight discontinuance orders and alter protest sizes to story for the uneven atmosphere.

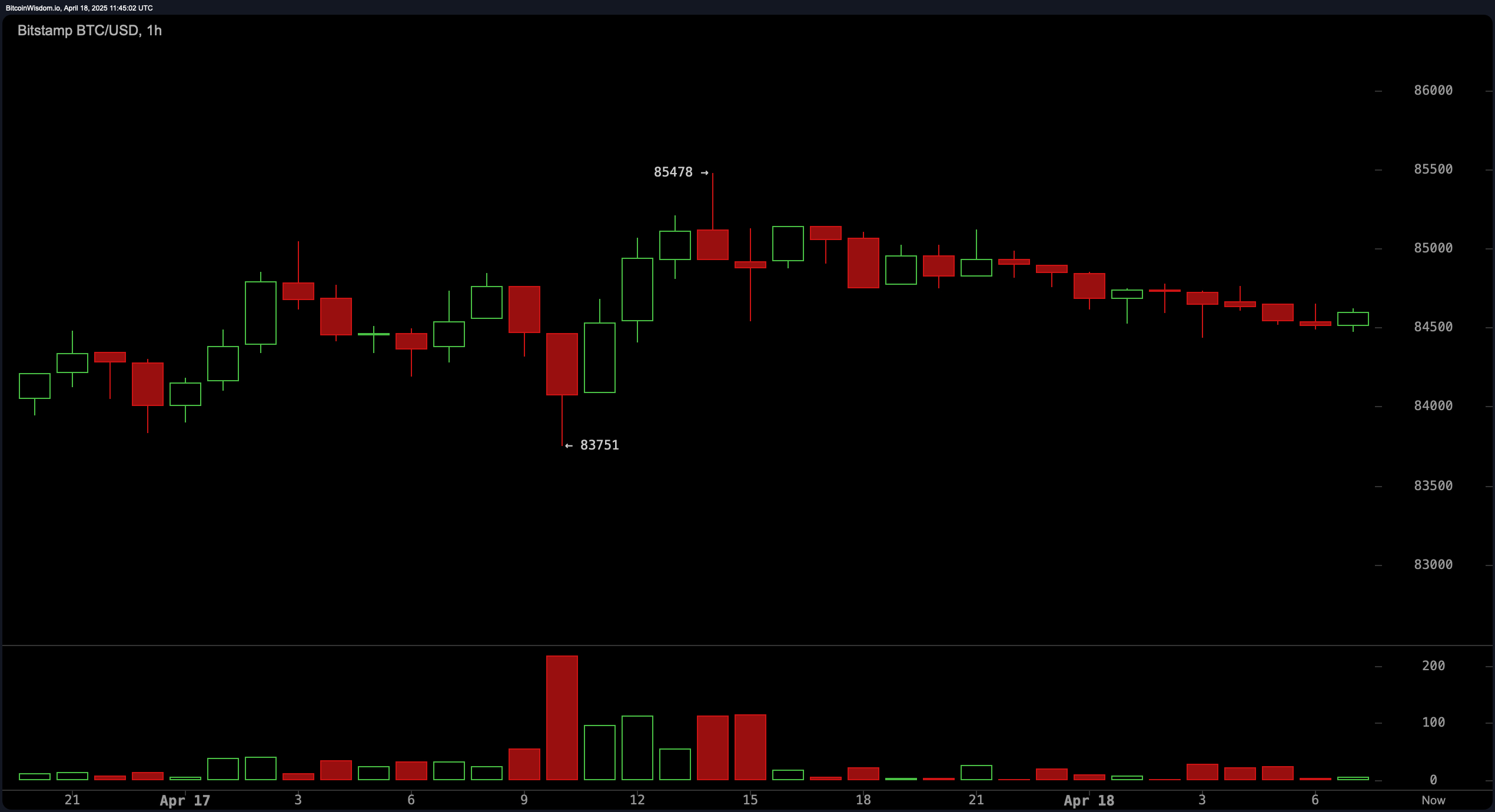

On the 1‑hour chart, bitcoin has traced a descending channel since peaking shut to $85,478, with most contemporary lows hovering round $83,751. Brief‑term momentum appears subdued, suggesting that adjust‑sure scalping is also more prudent than directional bets. Merchants may per chance per chance also unbiased glimpse for bounces within the $83,750 to $84,000 zone for doable long entries, while a breakdown below $83,750 on stronger quantity may per chance per chance also fabricate bigger moves toward the $83,000 stage and past.

Oscillators paint a mostly neutral image, with relative strength index (RSI) at 52, Stochastic at 84, commodity channel index (CCI) at 76, moderate directional index (ADX) at 13, and awesome oscillator (AO) at 1,063, all signaling equilibrium. Nonetheless, momentum (MOM) at 8,334 and transferring moderate convergence divergence (MACD) stage at –95 are flashing buy indicators, indicating that the underlying force may per chance per chance also unbiased be tipping in opt on of bulls.

Shifting averages (MAs) are skewed to the short term, with exponential transferring moderate (EMA) values of 83,694 at 10 sessions, 83,456 at 20 sessions and 83,871 at 30 sessions, alongside easy transferring moderate (SMA) values of 83,635 at 10 sessions, 82,656 at 20 sessions and 83,577 at 30 sessions, all in buy mode. On longer horizons, the 50‑length EMA at 85,332 and the 100‑length EMA at 87,458 sit down in sell territory, as attain the 100‑length SMA at 91,135 and each and each 200‑length EMAs and SMAs.

Bull Verdict:

If bitcoin can shut above $86,000 on the on a regular basis chart with a surge in quantity and support above its 20‑ and 30‑length exponential transferring averages, bullish momentum have to still raise it toward the $90,000 space.

Enjoy Verdict:

If bitcoin breaks below $82,000 give a take to and the 1‑hour channel flooring shut to $83,750 on rising quantity, a deeper pullback toward the mid‑$70,000s becomes an increasing number of possible.