The U.S. would possibly maybe well maybe accomplish $200 billion value of Bitcoin and build an estimated $354 billion in the job, per Andrew Hohns, CEO of Newmarket Capital.

At some level of the Bitcoin For The United States tournament, Hohns presented a strategy that makes exhaust of Bitcoin in bond issuance to cut authorities borrowing costs. The plan can also accumulate pleasure from Bitcoin’s long-term increase.

A Groundbreaking Bond Construction

Hohns’ proposal comprises issuing $2 trillion in bonds, the set 10% of it, around $200 billion, would possibly maybe well maybe be invested straight into Bitcoin. The final 90 percent would possibly maybe well maybe be ragged for presidency operations.

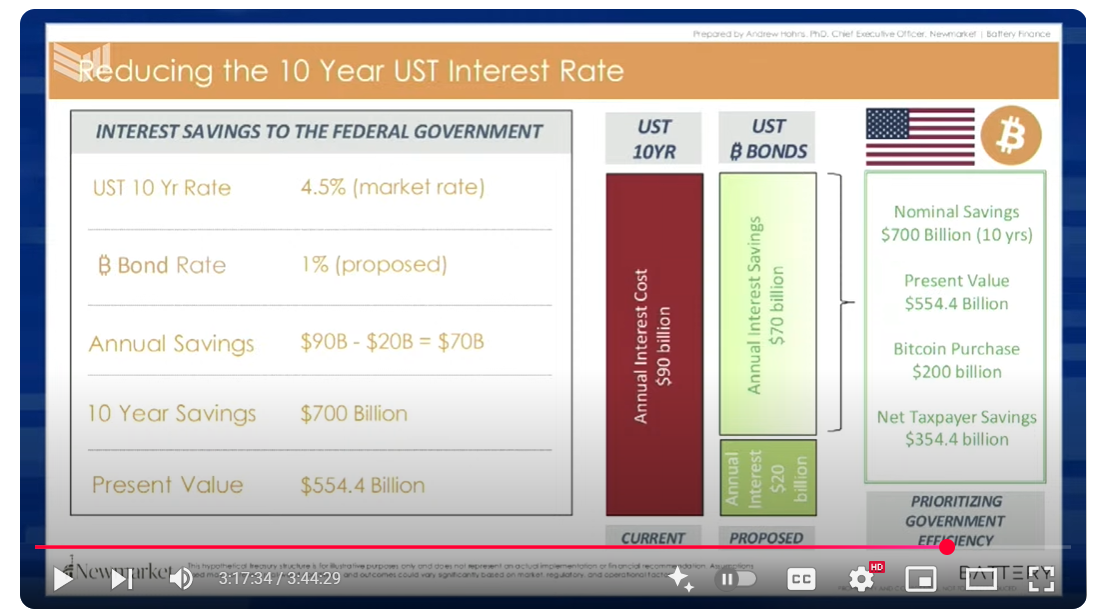

Severely, the plan comprises issuing the bonds at a 1% hobby rate, enormously lower than essentially the most original U.S. 10-year Treasury rate of 4.5%. This would possibly maybe maybe lead to annual savings of 3.5%, or $70 billion, on the $2 trillion total. Over 10 years, this amounts to $700 billion in savings.

After brooding about the $200 billion price of acquiring Bitcoin, the obtain savings on hobby would possibly maybe well maybe be roughly $554 billion in level to price phrases. Thus, the authorities would possibly maybe well maybe accomplish $200 billion in Bitcoin and build $354 billion on hobby payments.

Bond investors would safe an annual return of 4.5%, whereas also taking good thing about a part of any Bitcoin gains. Particularly, each and every the U.S. authorities and investors would narrow up any appreciation in Bitcoin. Moreover, Hohns proposed that gains from the Bit Bonds be exempt from earnings and capital gains taxes, offering a doable tax advantage for American households.

Bitcoin’s Role in Reducing National Debt

The plan objectives no longer most intriguing to cut borrowing costs but also to leverage Bitcoin’s doable for substantial appreciation to support bother up the U.S. national debt. If Bitcoin continues its ancient increase rate of 37% every year, the authorities’s Bitcoin holdings would possibly maybe well maybe surpass $1.7 trillion by 2035 and potentially exceed $50 trillion by 2045. This would possibly maybe maybe well maybe play a truly major position in cutting again the national debt over time.

In addition, the strategy aligns with Treasury Secretary Bessent’s aim of diversifying debt maturities to cut refinancing risks. Hohns emphasizes that this proposal provides a “receive-receive-receive” scenario, benefiting taxpayers, investors, and policymakers alike.

Knowledgeable Toughen for Bitcoin-Basically essentially essentially based Debt Management

The thought that of the utilization of Bitcoin to tackle national debt has gained traction from other financial consultants, equivalent to Matthew Sigel, Head of Digital Asset Analysis at VanEck.

Sigel has proposed a same device to support bother up the U.S. authorities’s $14 trillion debt. His model comprises the utilization of the bond proceeds to aquire Bitcoin, with investors receiving all Bitcoin gains as a lot as a 4.5% annual return. Any extra gains would possibly maybe well maybe be cut up between investors and the authorities, making a shared incentive.

This thought also resonates with Senator Cynthia Lummis, who has advocated for the U.S. authorities to function Bitcoin as a technique to cut national debt. Lummis proposed that the U.S. accomplish 200k BTC tokens every year over five years to reach 1 million items. She believes this would possibly maybe most likely well maybe cut the national debt by as worthy as 50% over the next two many years.