-

Ethereum saw a latest price restoration after a dip earlier in April.

-

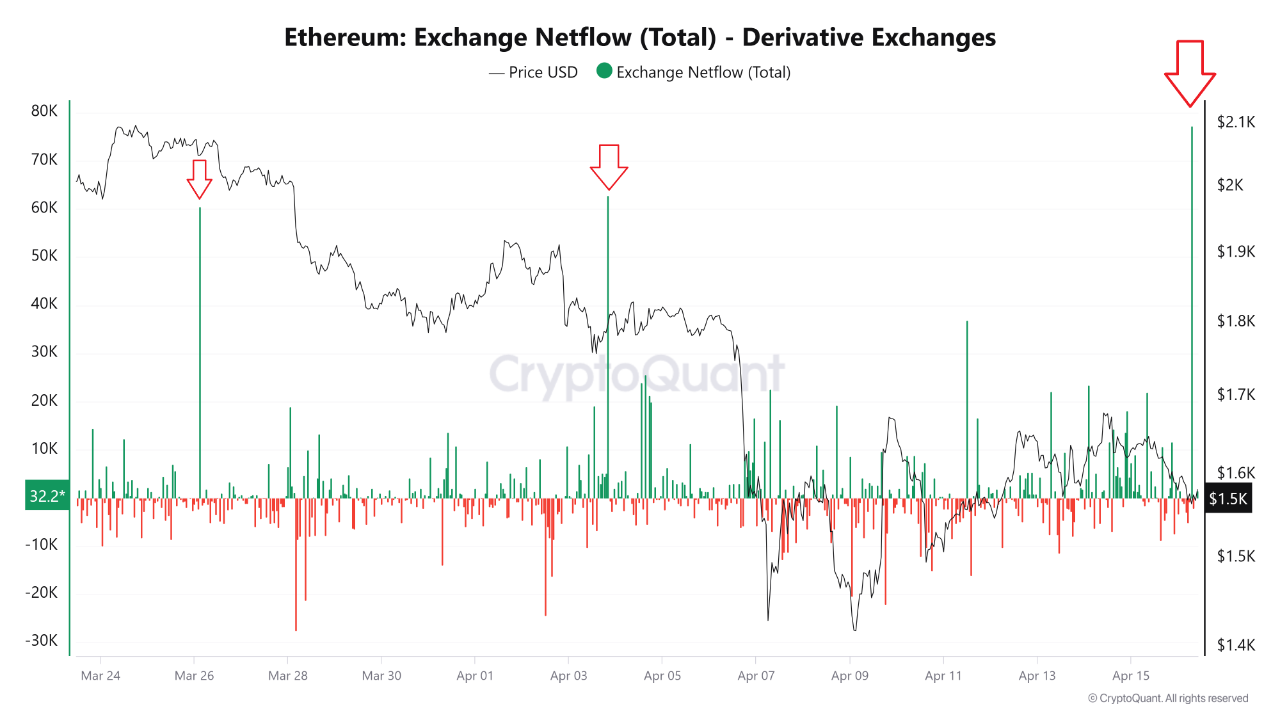

A natty influx of ETH to derivatives exchanges suggests seemingly hedging or immediate positions, traditionally preceding price drops.

-

World financial uncertainty provides to the unstable outlook for Ethereum no matter its latest positive components.

Ethereum has been making headlines again. After a piquant tumble earlier this month, the field’s second-largest cryptocurrency is exhibiting signs of restoration. On April 9 on my own, ETH jumped 8.24%. Previously 24 hours, it has climbed one other 1.5%. Nonetheless current on-chain recordsdata is raising some concerns – there’s been a natty and piquant tear of ETH into derivatives exchanges.

Might maybe well additionally this be a warning signal of one other dip?

A Rocky April for Ethereum

Ethereum started the month at $1,821.51. On April 2, the price briefly touched $1,957.94 however dropped motivate all of the vogue down to $1,794.51 by the halt of the day.

From April 5 to 8, ETH fell greater than 18.86%. Since April 9, nonetheless, the market has shown signs of restoration with a attain of seven.82%.

The second week of April has been calmer. Between April 7 and 13, Ethereum edged up by 2.83%. This became a little enchancment when put next with the outdated week.

Tranquil, all the plot in which by the last seven days, the final attain has been valid 0.1%, exhibiting that the market remains cautious.

Colossal Inflows to Derivatives: A Red Flag?

The day past, over 77,000 ETH have been moved to derivatives exchanges, per the Ethereum Alternate Netflow chart. Here is the largest day-to-day inflow considered in March and April.

On the identical day, ETH’s price dropped from $1,588.44 to $1,577.07—a 0.71% decrease. At one level, it even hit a low of $1,537.28.

Such inflows in general counsel traders are making ready for scheme back moves—both by hedging their positions or opening shorts.

This isn’t the first time we’ve considered this sample. Identical, though smaller, inflows took place on March 26 and April 3. In both cases, the market reacted with steep corrections.

From March 25 to 30, ETH dropped 13.05%. One other correction followed from April 4 to 8, with the market falling by 18.92%.

Tariff Tensions and Crypto Volatility

Ethereum’s price swings are also being formed by greater world points. The U.S. govt’s aggressive tariff policies below the Trump administration have brought on turbulence across predominant asset classes, along with cryptocurrencies. Even supposing there’s now a 90-day cease on the policy, uncertainty continues to impact investor sentiment.

Since April 1, the final crypto market has slipped by 0.38%, whereas the altcoin market is down 4.42%. Ethereum on my own has dropped by no longer no longer as much as 12.56% all around the identical duration.

Ethereum Market Outlook: What Merchants Ought to Glimpse Next

Ethereum had a solid drag in latest years, growing 90.8% in 2023 and 46.1% in 2024. Nonetheless this year has started rough. In the first quarter of 2025, ETH fell by Forty five.3%. That’s a piquant distinction to Q1 2024 and Q1 2023, when the market rose by 59.8% and 52.4%, respectively.

While Ethereum is exhibiting some non everlasting restoration, the natty inflows to derivatives exchanges are a seemingly warning signal. Combined with ongoing world financial tensions, the non everlasting outlook remains unsure.

For now, Ethereum traders may per chance presumably mute defend alert – both to market charts and world headlines.