Ethereum has slipped under the $1,600 mark, but on-chain and technical alerts hint that the market will most likely be coming into a key accumulation fragment.

In accordance to an Apr.17 prognosis by CryptoQuant contributor abramchart, Ethereum (ETH) is purchasing and selling shut to its realized mark level, historically a zone that has preceded predominant rebounds. The realized mark, at the 2nd around $1,585, has served as a legitimate signal of deep-mark accumulation.

Every most predominant bull scramble in ETH’s history has started when the mark fell to or under this level. Ethereum is drawing strategy the decrease band of the realized mark mannequin, indicating market cooling and potentially priming lengthy-timeframe holders for re-entry.

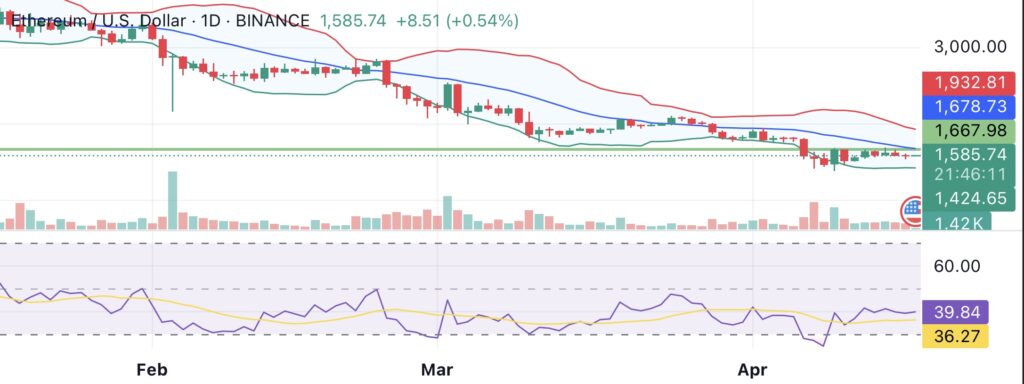

Serene, technical indicators remain blended. ETH has slipped under its 20-day transferring realistic and remains well under the 200-day, indicating a tough downtrend. The relative energy index hovers acceptable below 40, reflecting former momentum but no longer but fully oversold. Day-to-day Bollinger Bands remain compressed, reflecting decrease volatility, but a decisive gallop in either direction will most likely be drawing near near.

Have to quiet the downtrend persist, ETH would possibly possibly well gain reinforce within the $1,450–$1,550 differ, a zone that has historically served as a bottoming say. Prompt resistance lies around $1,670 and a stronger overhead strain will most likely be experienced within the $1,930 say.

On the basics front, Ethereum’s mark snatch on layer 1 has weakened significantly for the reason that Dencun upgrade, as great by an Apr. 16 Binance Evaluation article. Whereas scalability has increased practically 16-fold due to the the introduction of blobs, the trade lowered L1 price revenues.

With users migrating to more cost effective layer 2s, ETH’s role as “ultrasound cash” has diminished, hurting its allure relative to faster, decrease-price rivals delight in Solana (SOL) and BNB Chain (BNB).

Santiment’s Apr. 16 prognosis published that Ethereum charges be pleased dropped to 5-year lows, averaging acceptable $0.168 per transaction. This presentations falling utilization and congestion, but from a contrarian point of view, would possibly possibly well hint at a doable rebound.

Historically, low charges below $1 on the entire precede mark rebounds. As Santiment notes, “The extra the retail crew leans a ways from an asset (especially one with quiet thriving improvement), the upper the likelihood of an eventual surprise rebound with small resistance.”

Great of the pullback will most likely be tied to broader macro uncertainty. Santiment noticed that merchants are highly sensitive to tariff and financial files, on the entire delaying ETH assignment unless larger clarity returns to the world image.