The establish in case you store and replace your crypto? Which is the most efficient option when it comes the total kind down to it — a crypto replace vs. a crypto wallet? Would possibly calm you utilize each an replace and a wallet, or persist with upright one for ease? Right here’s an final comparison of the professionals and cons of every in 2025.

- Crypto exchanges vs. crypto wallets: A transient comparison

- What is a crypto replace?

- What is a crypto wallet?

- Shopping and selling on a crypto replace vs. crypto wallet

- Crypto replace vs. crypto wallet: Mavens and cons

- Crypto replace vs. crypto wallet: Closing verdict

- The energy is on your hands

- Typically asked questions

Crypto exchanges vs. crypto wallets: A transient comparison

A crypto replace is the establish you aquire cryptocurrency, while a wallet is the establish you store cryptocurrency. Alternatively, each help overlapping points that blur the traces of their well-known uses.

The quiz beckons: Why now no longer explain non-custodial wallets most efficient? Because it’s likely you’ll well look, there are a option of reasons that that you just would be succesful to additionally just desire to explain an replace over a wallet and vice versa.

Right here’s a short side-by-side comparison.

| Crypto replace | Crypto wallet |

|---|---|

| Provide a seamless user trip | Handy for utilizing web3 and DeFi services and products |

| Old-usual to interchange (location, derivatives, etc.) | Retail outlets digital property (money, tokens, NFTs) |

| Basically inhibited by rules | Constrained by blockchain protocols |

| Counterparty probability | Person error probability |

| Extra points however exiguous by location | Much less points, however extra privacy and withhold watch over |

| Complete asset help for shopping and selling | Microscopic help offset by squawk storage of property |

What is a crypto replace?

A crypto replace is any platform that facilitates the procuring for, selling, shopping and selling, or swapping of cryptocurrencies. Alternatively, the felony definition of an replace might maybe additionally just differ from how most crypto users develop the many of the period of time.

Within the same intention that cryptocurrency users non-public coopted the period of time crypto from cryptography, they non-public got also done the same with the period of time replace, inflicting some confusion. To establish this into standpoint, if it is advisable aquire, promote, replace, or swap cryptocurrencies or diversified monetary merchandise, that you just would be succesful to explain diversified platforms:

- Exchanges (NYSE, CME, Binance, Bybit)

- Brokerages (eToro, Robinhood, Coinbase)

- Money Carrier Firms (MSB) (PayPal, Venmo, MoonPay)

- On-line shopping and selling/investment platforms, etc. (DriveWealth, Uphold)

Kinds of exchanges

In crypto, it’s likely you’ll well detect two forms of exchanges: centralized (CEX) and decentralized (DEX).

Centralized exchanges

A centralized replace (CEX) is a platform operated by a company the establish users replace cryptocurrencies. Among the key points of CEXs consist of:

- An uncover guide for matching trades

- Custodies users’ funds

- KYC/AML checks

- Indirectly shopping and selling on-chain

| Mavens | Cons |

|---|---|

| Typically, a higher user trip | Counterparty dangers |

| Faster trades | Takes custody of your crypto |

| Low fees | Restricts many services and products particularly areas |

How stop CEXs work?

A CEX acts as a middleman between traders and sellers. Within the occasion you region a replace, you don’t straight away engage with another user or the blockchain. As an substitute, you’re shopping and selling with the replace’s interior system, and the replace updates its hang ledger to replicate adjustments in account balances.

Within the occasion you aquire crypto on a CEX, you are procuring for an IOU until you withdraw your crypto from the replace. The replace custodies your crypto, fits trades, and on the total handles all deposits and withdrawals.

CEXs tend to present extra points than decentralized exchanges — in conjunction with margin and derivatives shopping and selling (futures, alternatives, etc.), staking, cancel packages, buyer help, NFT marketplaces, shopping and selling bots, etc.

Decentralized exchanges

A decentralized replace (DEX) is a blockchain-essentially essentially based protocol that lets users replace straight away with every diversified utilizing trim contracts without giving up custody of their property. Among the points of DEXs consist of:

- No centralized operator

- Sharp contracts cope with replace execution

- No KYC; users join their very hang wallets to interchange

- On-chain settlement

| Mavens | Cons |

|---|---|

| Non-custodial, squawk withhold watch over over your crypto | Microscopic fiat currency help |

| Privacy-conserving | Sharp contract probability |

| Take a look at-to-look shopping and selling | Degraded user trip (MEV/slippage/chain reorgs) |

How stop DEXs work?

DEXs work by allowing you to interchange straight away out of your crypto wallet. This total route of is non-custodial, that intention you never stop possession of your crypto property earlier than a replace is positioned.

Because every little thing of the uncover float on a DEX is transparent, that you just would be succesful to look in case you genuinely obtained a truthful replace. Since you stop now no longer want to KYC, you also trip a particular stage of privacy, and replace points are now no longer inhibited by your location.

What is a crypto wallet?

A cryptocurrency wallet is any machine or hardware that stores the keys to access and withhold watch over your cryptocurrency. Wallets stop now no longer genuinely store the cryptocurrencies themselves.

Crypto wallets will enable you to ship, receive, and position up your cryptocurrency property, in conjunction with money, tokens, and non-fungible tokens (NFTs). No longer like exchanges, they usually stop now no longer help evolved shopping and selling points (e.g., evolved shopping and selling interfaces, special uncover sorts, etc.). Alternatively, they can:

- Retailer your interior most keys

- Will enable you to ship and receive crypto property

- Voice your balances and transactions

- Allow you to have interaction with DApps

Kinds of crypto wallets

Because it’s likely you’ll well be conscious, there are also diversified forms of crypto wallets. These consist of hot wallets, chilly wallets, custodial wallets, and non-custodial wallets.

| Form | Storage | Examples |

|---|---|---|

| Hot wallet | On-line | MetaMask, Phantom |

| Chilly wallet | Offline | Ledger, Trezor |

| Custodial wallet | Counterparty controls keys | Wirex Wallet |

| Non-custodial wallet | You withhold watch over the keys | MetaMask, Ledger |

Hot wallet vs. chilly wallet

A hot wallet is a crypto wallet linked to the obtain, earlier for like a flash and simple access to your funds. It might maybe also be custodial, indulge in an replace wallet, the establish another person holds your keys, or non-custodial, indulge in MetaMask, the establish you withhold watch over the keys your self.

In disagreement, a cold wallet stores your interior most keys solely offline, providing stronger protection in opposition to hacks. Examples consist of hardware wallets indulge in Ledger or Trezor. Hot wallets are stout for day after day explain, while chilly wallets are higher for prolonged-period of time, earn storage.

Custodial wallet vs. non-custodial wallet

A non-custodial wallet is a form of crypto wallet the establish you care for and withhold watch over your hang interior most keys, providing you with beefy possession and responsibility over your funds — examples consist of MetaMask, Have confidence Wallet, and Ledger.

In disagreement, a custodial wallet is one the establish a third occasion (indulge in an replace or carrier provider) holds your interior most keys to your behalf, managing safety and restoration for you. Frequent examples consist of wallets on Binance or Kraken (though upright to confuse things a puny bit extra, some replace-linked wallets can individually be non-custodial, equivalent to the Coinbase Wallet).

Wallet platforms

There are also diversified wallet platforms, equivalent to hardware and machine wallets, cell wallets, desktop wallets, browser extension wallets, and browser wallets (modern web apps).

- Hardware wallet: A bodily machine that stores your interior most keys offline (indulge in Ledger or Trezor).

- Intention wallet: An app or program that runs to your machine, equivalent to MetaMask or Have confidence Wallet.

- Sharp wallet: A subset of machine wallets, trim wallets are crypto wallets constructed utilizing trim contracts.

- Cell wallets: Applications designed for smartphones or capsules.

- Desktop wallets: Crypto wallets installed on laptop systems.

- Browser extension wallets: Exist internal your web browser (Chrome or Doughty browsers) for straightforward DApp access (examples consist of MetaMask or Rabby).

- Browser wallets: These tear on your browser without requiring a earn (also called modern web app wallets) and provide a gradual-weight, app-indulge in trip (Frame or WalletConnect’s web client).

Shopping and selling on a crypto replace vs. crypto wallet

In the case of shopping and selling, crypto wallets and exchanges diverge wonderful clearly by trip.

Exchanges

The replace shopping and selling trip is on virtually on par with counterparts in former finance, particularly in case you utilize a beginner-pleasant CEX. Exchanges tend to present traders with a suite of points, in conjunction with:

- Build and derivatives shopping and selling

- Shopping and selling bots

- Reproduction and social shopping and selling

- Particular uncover sorts (restrict, discontinue-restrict, etc.)

- Extremely-hastily uncover execution

Many also non-public evolved interfaces. With the precise expertise, these is on the total a game-changer. You might maybe position extra than one shopping and selling indicators, gape uncover books live, explain drawing instruments, and edit charts to enable you replace.

Wallets

Shopping and selling with wallets is extra complex if you’re procuring for a streamlined trip, though it’s extra convenient for storage. Wallets are higher for portfolio management in region of shopping and selling. Whereas you might buy, promote, and swap property, you stop now no longer accumulate the evolved shopping and selling interface with indicators.

Alternatively, that you just would be succesful to bridge property and ship and receive crypto without desiring approval or adhering to transaction minimums or maximums. Furthermore, wallets are very just appropriate for interacting with applications across extra than one blockchain networks.

Crypto replace vs. crypto wallet: Mavens and cons

Let’s be appropriate: whether or now no longer you store your cryptocurrency in an replace or a wallet, there are many tradeoffs, and every solution has its hang strengths and weaknesses. This is able to well additionally just change into powerful extra advanced if you specialize in in regards to the many forms of exchanges and wallets. Let’s starting up with exchanges.

Exchanges

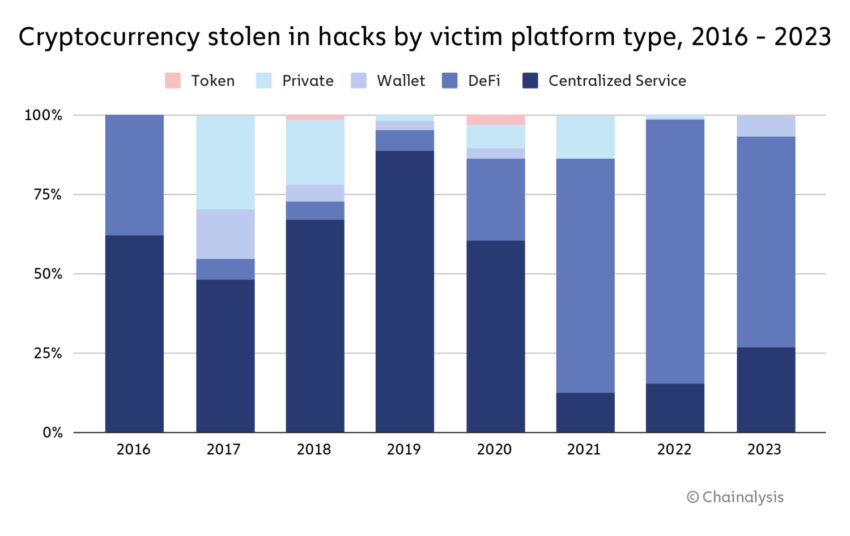

CEXs provide a higher user trip than wallets stop. They usually non-public higher interfaces, extra points, buyer help, and tutorial squawk material to help users. Alternatively, the supreme probability of utilizing a CEX is counterparty probability.

Mavens and cons

| Mavens | Cons |

|---|---|

| Higher operational safety (on the total) | Chapter probability |

| Doubtless repayment/restoration of stolen funds | Threat of hacking |

| Higher expertise to present protection to property | Segregated structure might maybe additionally just now no longer be particular financial kill protection |

Within the occasion you utilize a CEX, there might be a refined expectation that if the corporate goes beneath, your property will be seized and filed in financial kill proceedings.

One upside to utilizing a CEX is that that you just would be succesful to enable a company with higher sources and operational safety practices than your self to present protection to your crypto.

Furthermore, CEX multi-signature (multisig) wallets require extra than one interior most key holders to authorize a transaction or institute time delays for added safety.

Alternatively, CEXs are calm susceptible to hacks. The factual news is that, no longer like with self-custody, there might be a exiguous probability that the replace might maybe additionally just reimburse you in such cases. Alternatively, right here’s now no longer the norm, and exchanges are normally now no longer legally obligated to prevent so.

Wallets

Non-custodial crypto wallets medication likely the most well-known vulnerabilities connected to CEX, equivalent to bankruptcies. On the diversified hand, the supreme downside to wallets is the probability of hacks, user error, and maybe a stout discovering out gap.

Mavens and cons

| Mavens | Cons |

|---|---|

| No longer field to KYC or geo-restrictions | Require technical expertise to remain safe |

| Wallet hacks non-public diminished over the years | Hardware wallets are now no longer most attention-grabbing for frequent actions |

| Hot wallets are extra at probability of hacks | Zero probability of repayment/felony recourse when hacked |

As an illustration, the $1.5 billion Bybit hack modified into the effects of an unverified characteristic selector and raw transaction calldata. Right here’s a supreme instance of the complexities of wallet safety which capability of exchanges and custody services and products don’t on the total give their crypto to diversified exchanges to withhold safe; they non-public to explain wallets themselves.

Whereas user wallets stop give quick access to web3 applications and DApps (moreover chilly/hardware wallets), this also makes them extra susceptible (particularly hot wallets) when earlier by less technical users.

Alternatively, this characteristic is balanced by the privacy points of non-custodial wallets. On most exchanges, it’s likely you’ll well want to present up custody of your crypto and in my notion identifiable info to trip the total platform’s services and products (until you are restricted by location).

Crypto replace vs. crypto wallet: Closing verdict

The truth of utilizing an replace or wallet is now no longer within the discount of and dry. Blockchain expertise, in its most modern impart, calm has a prolonged intention to breeze, and the complexity of blockchain protocols can diminish user trip.

So, how stop you already know when and which one to explain? Right here’s a short summary:

- It is extra advantageous for some users to explain a CEX. Alternatively, if they breeze bankrupt, the odds are it’s likely you’ll well lose your funds.

- CEXs might maybe additionally just non-public higher safety, extra points, segregated property, and an total higher trip for amateur and technical users, however this doesn’t stammer safety.

- You are going to non-public to restrict the quantity of funds you enable on CEXs no topic your technical capability. Alternatively, in case you stop, that you just would be succesful to additionally just non-public user rights in some cases, though right here’s now no longer guaranteed.

- All crypto users might maybe non-public to prioritize utilizing non-custodial wallets over all diversified alternatives and might maybe non-public to also be taught to explain them.

- Hot wallets are less safe than hardware wallets. Therefore, it’s likely you’ll well non-public to restrict the quantity of capital you store in them, restrict their utilization, restrict the option of DApps you join them to, and cycle thru them recurrently.

- Chilly or hardware wallets are the gold favorite for wallet safety, however they are inconvenient for frequent on-chain transactions.

The energy is on your hands

Cryptocurrency exchanges and wallets non-public their region within the crypto world. Neither is a panacea — it all is dependent to your individual wants and talent. Both solutions need development of their most modern implementations. Whether an replace or wallet, it’s within the raze up to you to prevent the due diligence and be taught to present protection to your crypto property. The energy is on your hands.