In 2025, international economies are faltering. As markets — along side crypto — react to Trump’s tariffs, there’s one quiz on the minds of many investors. Will Bitcoin receive going up from these stages, or are we coming into a deeper correction? With one other doable crypto bull bustle on the brink and rising curiosity from institutional investors, now’s the time to slit reduction the noise and gain out about market traits. Right here’s what to understand.

- How high will Bitcoin scamper?

- What does all this imply for you?

- Bitcoin’s historical label peaks

- Key components that will shape Bitcoin’s label subsequent

- On-chain diagnosis and market sentiment

- Tracking the expert label predictions

- What might perhaps perhaps live Bitcoin from reaching recent highs?

- So, will Bitcoin receive going up?

- Continually asked questions

How high will Bitcoin scamper?

All individuals’s asking the a similar disclose perfect now: how high will Bitcoin scamper from here? You’ve perhaps seen intrepid predictions floating around — some pronouncing Bitcoin might perhaps perhaps hit $100K, others throwing around numbers like $250,000, or remarkable extra. However what’s exact, and what’s right hype? The fact is, there’s a little of each and every.

Some effectively-identified voices in the space — like Tom Lee from Fundstrat — are substantial bullish. He thinks BTC might perhaps perhaps reach $250,000 by the stop of this cycle, pushed by stronger seek information from of from institutional investors in crypto and cleaner legislation.

Even Robert Kiyosaki (yes, the Rich Dad Wretched Dad man) is on the a similar narrate, having a bet on Bitcoin to head that high, in particular if governments initiate stacking it as a reserve asset.

On the flip aspect, platforms like Polymarket are a little bit extra measured, projecting Bitcoin to land somewhere around $120K–$138K by the stop of 2025.

For positive, there are some frightened or somewhat downright pessimistic takes flying around too. Some analysts warn that Bitcoin’s label might perhaps perhaps mild dip, in particular if international uncertainty sticks around. Mike McGlone from Bloomberg is one among them. He even flagged a that probabilities are you’ll perhaps additionally absorb fall to $10K if issues unravel; even though that’s positively the worst-case extra or much less talk.

What does all this imply for you?

Typically, there’s no single respond. However the combo of rising adoption, doable provide shocks, and remarkable seek information from of suggests that the upside doable is mild in play — although it’s not a straight line to the high.

To in actual fact gain a tackle on where Bitcoin might perhaps perhaps scamper subsequent, it helps to search reduction. History has a droll formulation of repeating itself, in particular in crypto. Let’s now look what which formulation.

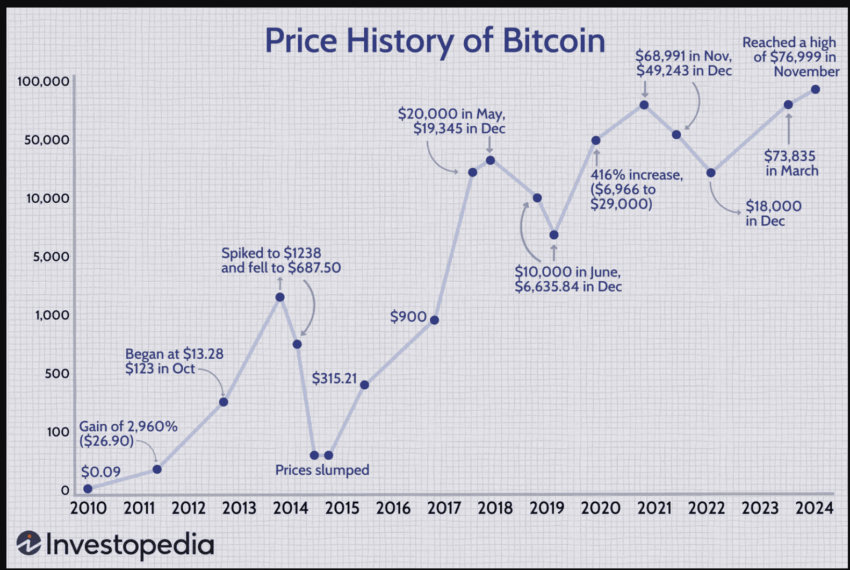

Bitcoin’s historical label peaks

The OG cryptocurrency has experienced well-known label surges over the years. Right here’s a concise overview of these peaks:

2013: The predominant distinguished surge

In November 2013, Bitcoin reached a label of $1,242. This surge modified into pushed by increased media consideration and rising curiosity from early adopters.

2017: Breaking the $20,000 level

December 2017 saw Bitcoin flee to honest about $20,000. This remarkable upward thrust modified into pushed by mainstream adoption and heightened investor enthusiasm.

2021: Reaching recent heights

By April 2021, Bitcoin peaked at $64,895. This scamper modified into pushed by institutional investments and original recognition as a digital asset. Develop present that one other height — nearly $69,000 — followed a few months later.

2024: Surpassing the $100,000 milestone

In November 2024, Bitcoin surpassed the $100,000 heed for the predominant time. Nevertheless, it didn’t receive surging, as a substitute facing huge label-connected resistance.

These historical peaks expose Bitcoin’s volatility however most particularly its doable for substantial recount. Examining these traits can offers insights into the components that force label actions and reduction us formulate informed Bitcoin label predictions.

Key components that will shape Bitcoin’s label subsequent

So now that we’ve looked at how Bitcoin has finished in the previous, what’s subsequent? What in actual fact moves the needle by formulation of Bitcoin’s label?

Bitcoin halving and the availability shock invent

One in all one of the best forces gradual every distinguished crypto bull bustle is the Bitcoin halving. This occasion cuts the replacement of recent BTC coming into circulation in half of, and occurs every four years.

It matters honest on yarn of of provide and seek information from of. When fewer coins are being created, however folk mild resolve on in (in particular with extra institutional investors in crypto), the associated rate in total spikes. Historically, label rallies absorb followed every halving, and with the latest one gradual us, the stage might perhaps perhaps additionally already be space.

Institutional adoption is (mild) a colossal deal

Whilst you mediate it’s right retail investors trying to gain in — mediate again. Tall names like BlackRock, Fidelity, and even sovereign wealth funds absorb dipped their toes into Bitcoin through ETFs, custody companies and products, and jam allocations. This isn’t right about hype. tI’s capital, credibility, and prolonged-time duration conviction.

The extra these gamers gain, the tighter the availability becomes for all individuals else. That’s why many mediate the following leg up available in the market shall be pushed by colossal money — not right retail FOMO.

Macroeconomic components are playing a bigger role

Then there’s the bigger direct. We’re talking curiosity rates, inflation, fiat devaluation; your complete macro mess. When ragged resources look shaky, Bitcoin starts to search like a hedge. In times of uncertainty, many look it as “digital gold” — a store of rate that sits open air the ragged arrangement.

Right throughout the 2021–2022 inflation spike, Bitcoin modified into seen as a hedge and climbed snappy. However as central banks hiked curiosity rates, threat resources took a success, along side crypto.

On-chain diagnosis and market sentiment

Making sense of Bitcoin’s label dynamics requires greater than right tracking market information. It also entails analyzing on-chain information, which is able to present an extraordinarily remarkable insights into investor habits and market sentiment. Let’s absorb a study a few key metrics:

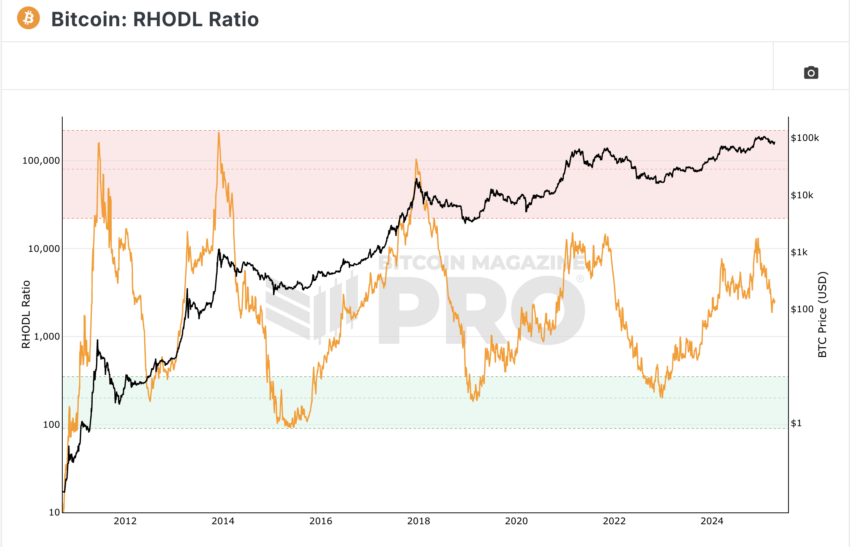

1. HODL ratio and prolonged-time duration holder habits

The HODL ratio reflects the proportion of Bitcoin held prolonged-time duration versus non permanent. Historically, a high HODL ratio indicates remarkable conviction amongst investors, in total preceding label surges. For instance, in early 2020, a rising HODL ratio corresponded with Bitcoin’s ascent from around $7,000 to over $60,000 by April 2021.

2. Whale accumulation patterns

Natty holders, or “whales,” very much impact Bitcoin’s label. Most contemporary information exhibits that whales absorb accumulated over 100,000 BTC since early March 2025, signaling self perception in Bitcoin’s prolonged-time duration rate. Such accumulation in total precedes bullish market traits.

3. Switch reserve stages

Monitoring Bitcoin reserves on exchanges offers perception into doable selling tension. A lower in trade reserves suggests that investors are transferring their holdings to icy storage, indicating a bullish sentiment. Conversely, increasing reserves might perhaps perhaps additionally signal doable sell-offs.

4. Market sentiment indicators

Instruments like the Anguish & Greed Index gauge investor sentiment. Vulgar fright can present a trying to gain replacement, whereas crude greed might perhaps perhaps additionally signal a market correction. In March 2025, the index reached a “greed” level of 75, aligning with Bitcoin’s label nearing $100,000.

These on-chain metrics provide precious insights into market dynamics, complementing ragged technical and elementary analyses.

Tracking the expert label predictions

So, will Bitcoin receive going up? Diversified experts absorb weighed in with their forecasts:

- PlanB’s Stock-to-Float mannequin: This mannequin, which assesses Bitcoin’s shortage by evaluating its circulating provide to the tempo of recent provide, suggests that Bitcoin might perhaps perhaps reach $288,000 by 2025, pushed by its restricted provide and increasing adoption.

- Tim Draper: The venture capitalist predicts Bitcoin will hit $250,000 by 2025, citing increased adoption by outlets, institutional investors, and governments.

- Cathie Wood of ARK Invest: Forecasts Bitcoin reaching $500,000 or extra by 2025, pushed by institutional adoption and the asset’s role as a hedge in opposition to inflation.

- Anthony Scaramucci: The founder of SkyBridge Capital predicts Bitcoin might perhaps perhaps reach $200,000 in 2025, led by increased institutional adoption.

- H.C. Wainwright Analysts: They project Bitcoin’s label might perhaps perhaps surge to $225,000 by the stop of 2025, citing historical label cycles and favorable regulatory expectations.

What might perhaps perhaps live Bitcoin from reaching recent highs?

While label targets sound moving — $100K, $250K, even $500K — the path up isn’t frequently neat. For every bullish cycle, there are headwinds that might perhaps perhaps derail the momentum.

Right here’s what might perhaps perhaps sluggish Bitcoin down, or a minimal of invent the avenue to a recent BTC all-time high extra bumpy:

Regulatory uncertainty

Governments mild haven’t fully figured out receive an eye on crypto. At any time when there’s talk of banning self-custody, taxing unrealized positive aspects, or limiting stablecoins, the market reacts.

- In early 2022, regulatory fright in the U.S. shaved honest about 25% off Bitcoin’s label in precisely two weeks.

- Any recent restrictive insurance policies might perhaps perhaps spook each and every retail and institutional investors in crypto, stalling momentum.

Macroeconomic instability

While we’ve mentioned that BTC can a little bit act as a hedge, it’s not somewhat there yet.

- If central banks elevate curiosity rates again or liquidity dries up, threat resources (along side crypto) tend to sell off.

- Right through 2022–2023, Bitcoin fell from $69K to $16K as rate hikes and recession fears shook investor self perception.

Overheated market and greed cycles

Typically it’s not the guidelines — it’s us. The crypto bull bustle hype cycle can push valuations into unsustainable territory.

- Accept as true with in solutions the Anguish & Greed Index? When it crosses into “crude greed” (above 80), native tops in total apply.

- In unimaginative 2021, the index hit 95 right sooner than Bitcoin dropped by over 40% in three months.

Inner shocks or security concerns

While Bitcoin’s core network is secure, the broader crypto ecosystem isn’t bulletproof.

- Switch hacks, like the FTX collapse in 2022, wiped out billions and tanked market self perception.

- Protocol bugs, mining assaults, or pockets exploits might perhaps perhaps invent fear, although BTC itself stays secure.

So, will Bitcoin receive going up?

With remarkable market traits, rising institutional adoption, and put up-halving momentum, the prolonged-time duration outlook mild leans bullish. While non permanent dips might perhaps perhaps additionally check your nerves, history, on-chain information, and provide dynamics counsel that BTC isn’t finished yet. All signs present that Bitcoin will receive going up. Nevertheless, in crypto nothing is assured, and we can surely quiz a replacement of twists and turns along the formulation.