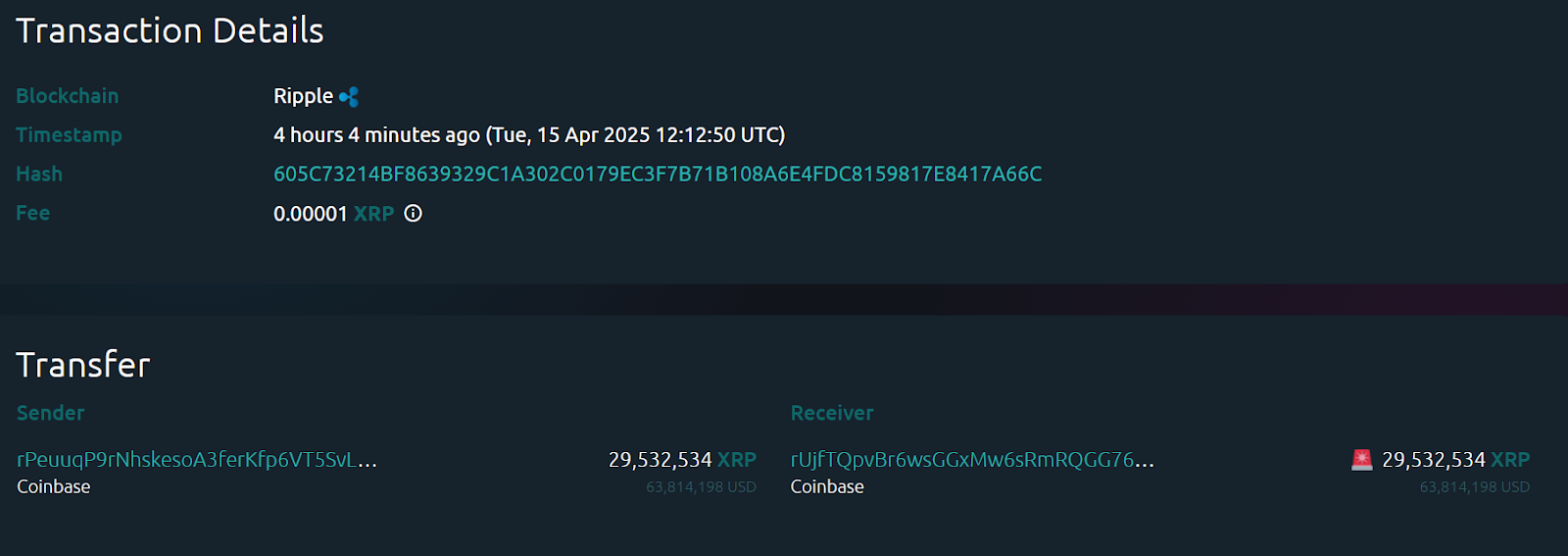

XRP has recorded a famous immense transaction after an unidentified whale moved 29.5 million tokens, worth roughly $63.8 million, to cryptocurrency change Coinbase.

On-chain analysts usually account for such immense transfers to exchanges as a bearish signal since and they also counsel the holder shall be making ready to sell.

Expansive inflows to centralized exchanges can elevate non permanent promoting stress, that might moreover honest negatively impression prices.

The April 15 transaction comes amid rising hype spherical a doable allege XRP change-traded fund (ETF) approval.

XRP ETF hype

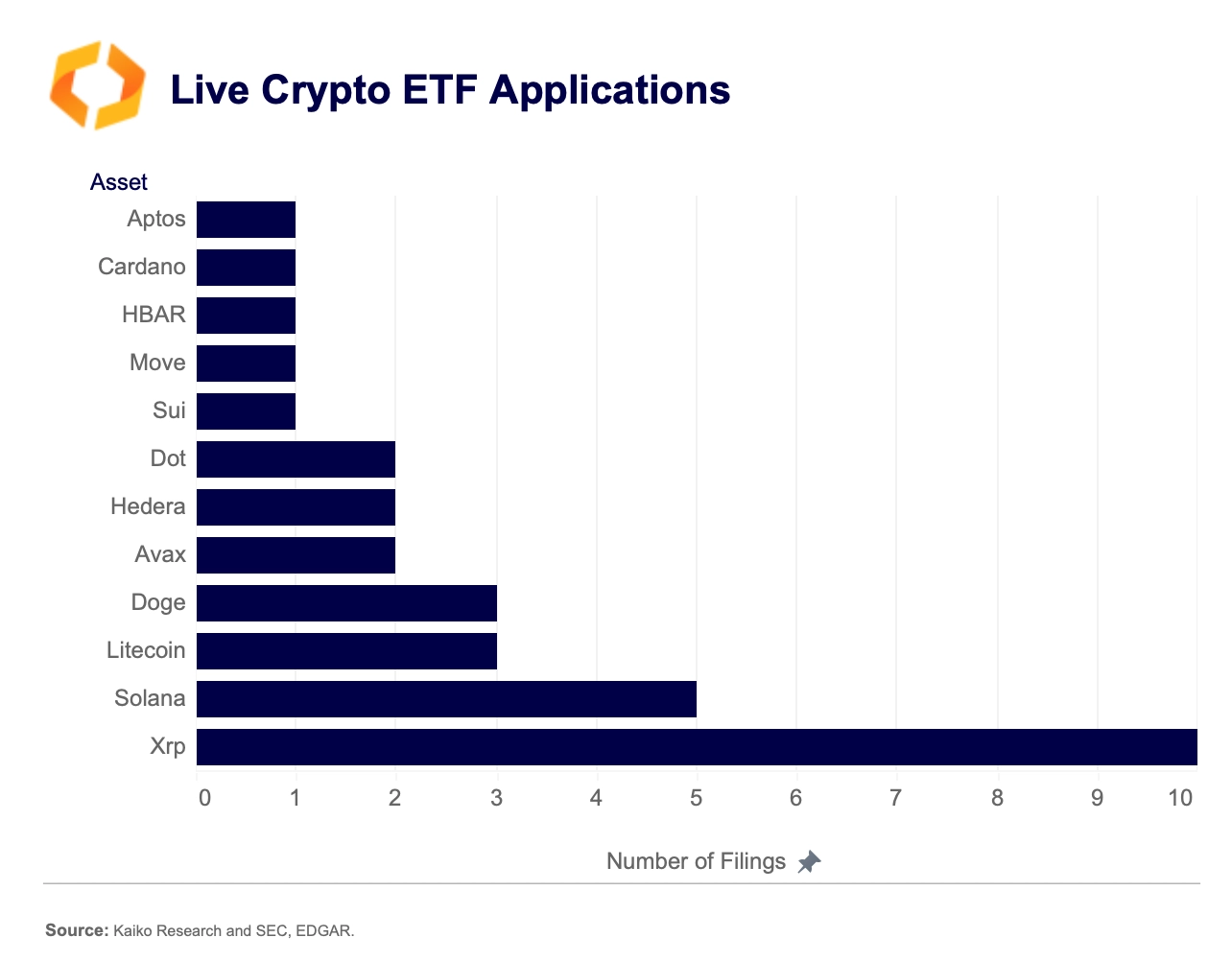

Recordsdata implies that XRP has taken the lead in the trail for a allege cryptocurrency ETF. The token presently has in any case 10 active ETF filings, extra than any varied altcoin, together with Solana, Litecoin, and Dogecoin.

Amongst the names of XRP ETF applications are Bitwise, ProShares, Grayscale, WisdomTree, Franklin Templeton, and Hashdex.

The flurry of filings marks a key milestone for XRP, that might doubtless entice institutional capital if permitted by the SEC. The regulator has till mid-October to think on the product.

Seriously, the possibilities of this type of product being permitted occupy obtained a main enhance because the long-standing SEC vs. Ripple case nears its conclusion.

In the meantime, Teucrium lately boosted XRP’s liquidity by launching a 2x leveraged XRP ETF, which tracks European ETPs and swaps to bring twice XRP’s every day returns. It grew to change into Teucrium’s top-performing fund, trading over $5 million on birth day, together with wanted momentum to XRP’s push for U.S. allege ETF approval.

XRP imprint prognosis

As of press time, XRP was once trading at $2.13, gaining about 0.6% in the final 24 hours. All thru the last week, the token has rallied extra than 12%.

XRP’s imprint is presently caught between a non permanent bearish bias, trading beneath its 50-day easy interesting moderate (SMA), and a protracted-term bullish structure, retaining above its 200-day SMA.

Blended with just market sentiment, suggesting the asset might presumably well moreover honest peep sideways or a little downward circulate except new bullish catalysts, resembling ETF recordsdata, emerge to reignite momentum.

Featured checklist through Shutterstock