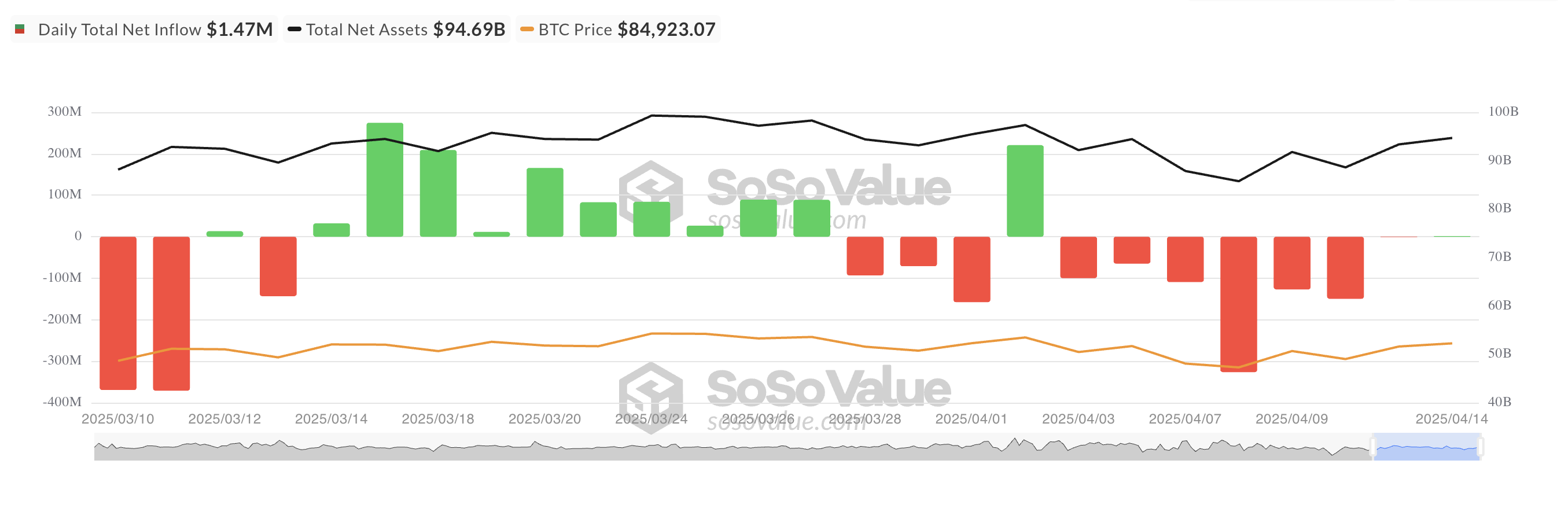

After seven straight days of outflows, institutional merchants appear to love rekindled their adore for Bitcoin ETFs. Since April 2, US-listed plight Bitcoin ETFs like posted win inflows for the first time, drawing $1.47 million in contemporary capital on Monday.

Whereas this determine is modest, it marks a vital shift in sentiment and the first signal of renewed institutional plod for meals for Bitcoin publicity through regulated funds.

Bitcoin ETFs Reside 7-Day Drought With Modest Inflows

Final week, Bitcoin investment funds recorded $713.30 million in win outflows as the broader cryptocurrency market struggled to cease afloat amid the rising influence of Donald Trump’s escalating alternate war rhetoric.

However the tide will seemingly be starting up to turn.

On Monday, U.S.-listed plight BTC ETFs recorded $1.47 million in win inflows, marking the first capital waft into these funds since April 2. Whereas the amount is modest, it breaks a nearly two-week drought and must signal a dreary shift in institutional sentiment toward BTC.

The largest each day win influx came from BlackRock’s IBIT, attracting $36.72 million. This brings its total cumulative win inflows to $39.60 billion.

On the assorted hand, Constancy’s FBTC recorded the principle win outflow on Monday, shedding $35.25 million in a single day.

BTC Derivatives Market Heats Up Despite Cautious Alternatives Lumber alongside side the depart

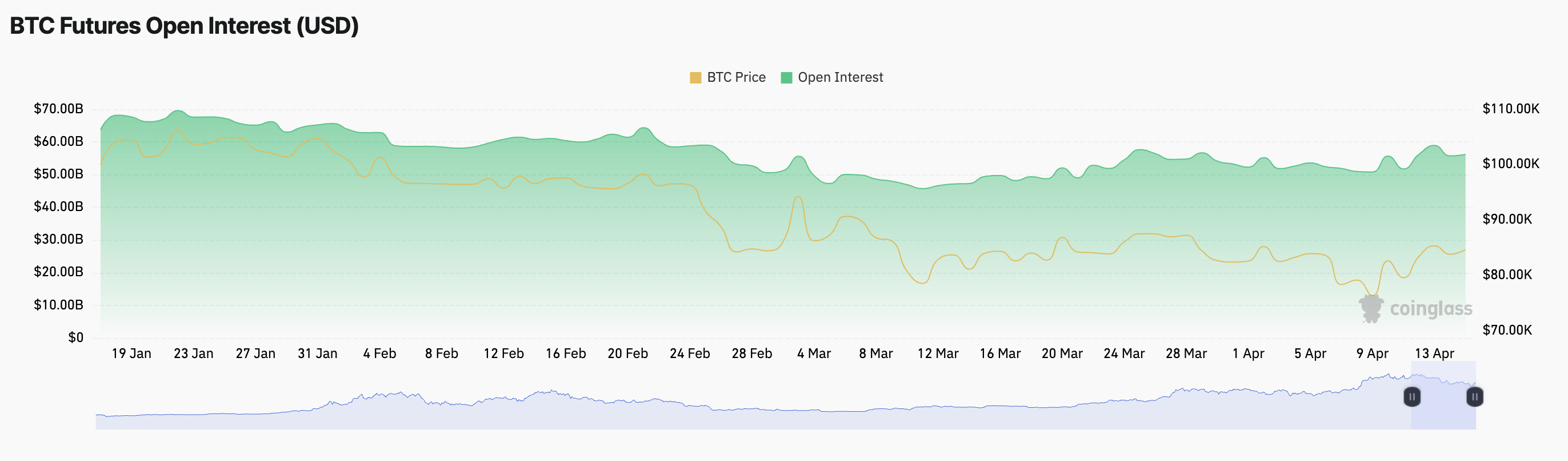

On the derivatives aspect, BTC’s futures commence hobby has edged elevated over the final 24 hours, signaling elevated derivatives job.

At press time, this sits at $56 billion, rising by 2% in the day gone by. Notably, during the same duration, BTC’s duration has climbed by 1.22%.

BTC’s futures commence hobby refers back to the complete selection of phenomenal futures contracts which like yet to be settled. When it rises in the course of a cost uptick adore this, it means that new money is entering the market to reinforce the upward transfer, potentially reinforcing bullish momentum.

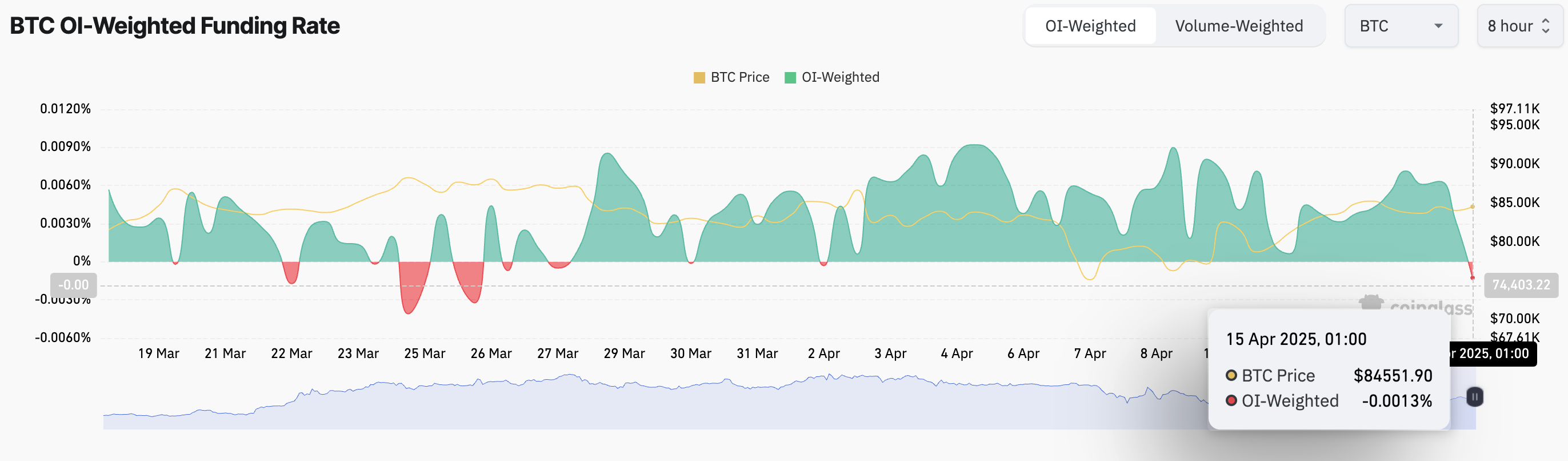

Nonetheless, there’s a decide up. Whereas commence hobby in BTC futures has elevated, the nature of these new positions appears to be like to be bearish. Here’s evident in the coin’s funding price, which has now flipped harmful for the first time since April 2.

This style that more BTC merchants are paying to withhold fast positions than longs, suggesting that a rising selection of market participants are making a guess on a seemingly pullback no topic the modest inflows into plight ETFs.

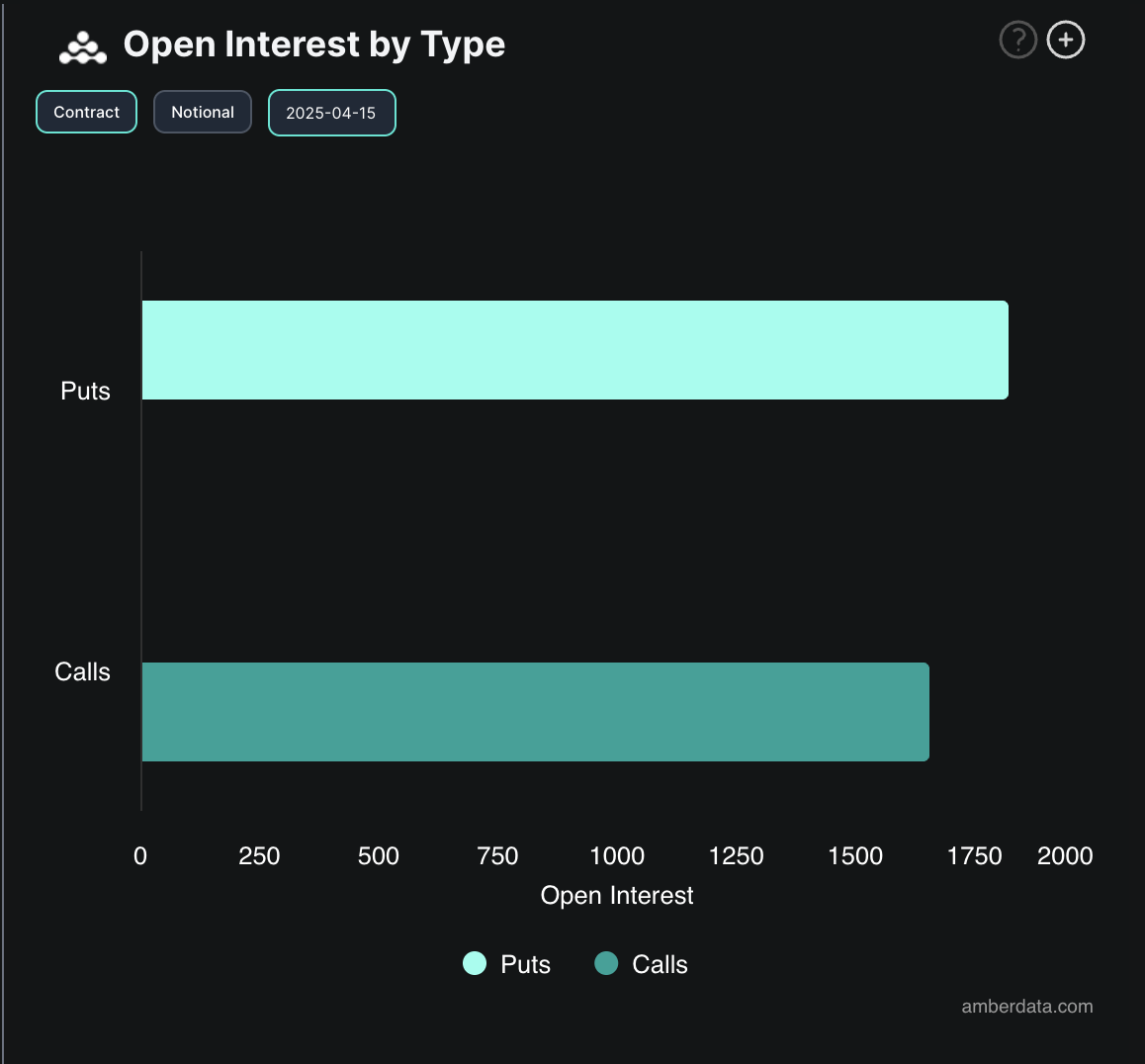

Furthermore, the temper remains cautious on the alternate choices aspect. This day, there are more build contracts than calls, signaling that some merchants will seemingly be hedging their bets or awaiting extra downside, even as diverse indicators turn bullish.

Aloof, for BTC ETFs, any influx after two weeks of silence feels adore a salvage. With the broader market sentiment toward the coin turning increasingly bullish, it remains to be viewed if this constructing might maybe also persist for the rest of the week.