Bitcoin has learned enhance on the major $80K stage, prompting a bullish rebound. On the replacement hand, the 200-day fascinating sensible now acts as a main resistance, suggesting a probable consolidation share interior the $80K–$87K differ in the instant term.

Technical Diagnosis

By Shayan

The Each day Chart

Bitcoin has no longer too lengthy prior to now printed a bullish rebound after discovering sturdy enhance on the major $75K–$80K differ. This place has historically acted as a psychological and technical ground, and the bullish divergence between the RSI and price confirmed a slowdown in bearish momentum, signaling renewed purchaser ardour.

On the replacement hand, the sleek rally is approaching near a fundamental resistance stage, the 200-day fascinating sensible at $87K.

This MA serves as a dynamic resistance zone and could well cap the price in the instant term. As a result, Bitcoin is probably going to continue consolidating interior the $75K–$87K differ till a decisive breakout occurs. If bulls succeed in pushing above the 200-day MA, the next major target lies on the psychological $100K stage.

The 4-Hour Chart

On the decrease timeframe, Bitcoin learned sturdy enhance on the midline of the descending channel, prompting an impulsive surge, a capacity signal of accumulation at these ranges. The price is now attempting out the upper boundary of the channel conclude to $84K.

A confirmed breakout above this trendline and the old swing high would invalidate the bearish structure, opening the path towards the major $90K resistance zone.

Conversely, failure to interrupt above this stage would give a steal to the sleek bearish market structure, likely main to renewed downward stress in the mid-term.

On-chain Diagnosis

By Shayan

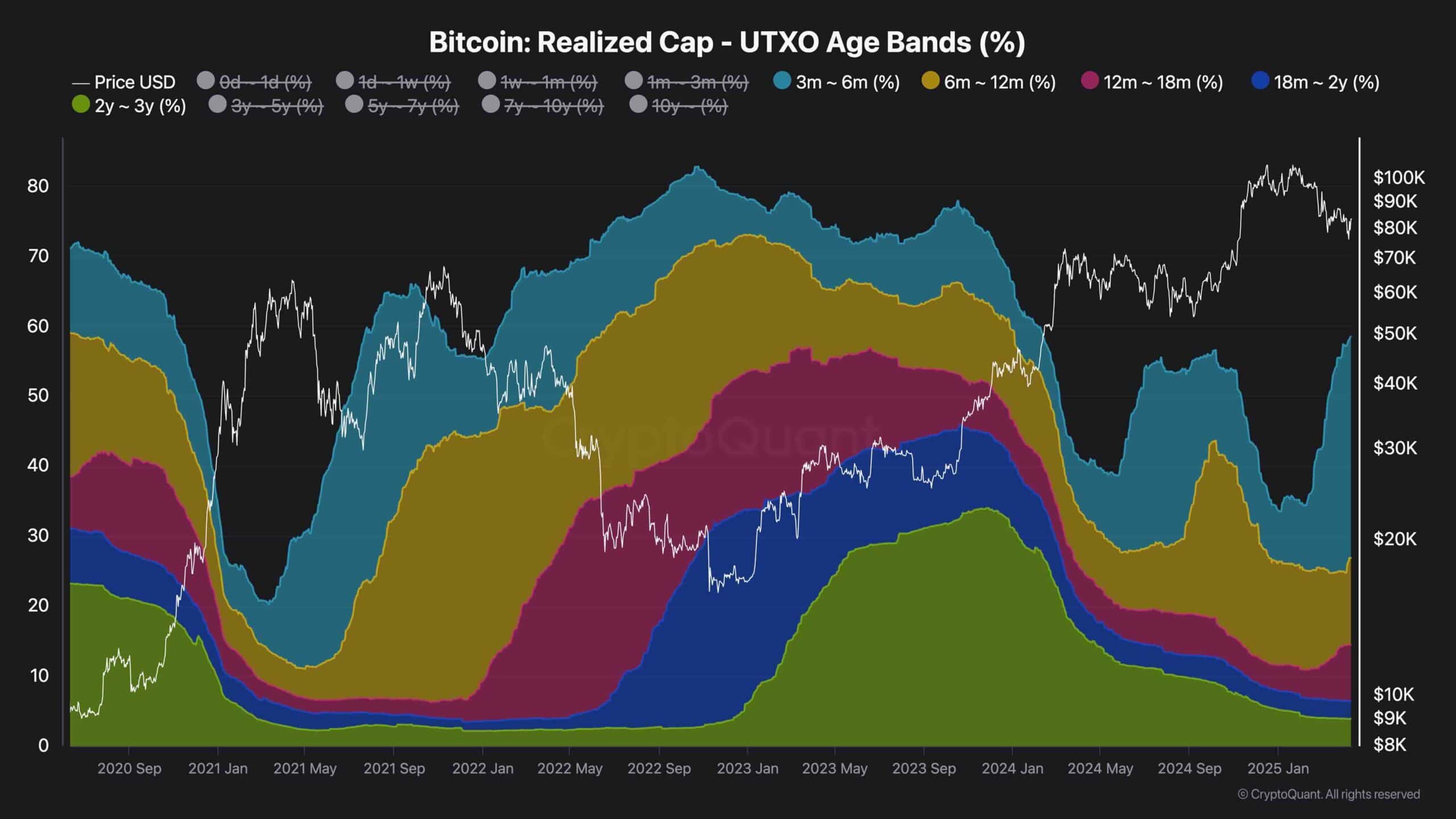

The Realized Cap UTXO Age Bands (%) is a ambitious on-chain metric that breaks down Bitcoin’s realized cap by the age of UTXOs (unspent transaction outputs), offering perception into investor behavior in accordance to conserving duration.

According to the most latest files, the proportion of coins held by the 3–6 months and 6–one year cohorts has been mountaineering step by step. This upward push carefully mirrors the accumulation patterns viewed all the contrivance throughout the prolonged correction in the summer season of 2024, reflecting rising conviction amongst holders.

This behavior components to a “hodling” growth, where merchants handle their coins no topic the continuing market correction, refraining from promoting even in the face of volatility. As more coins transfer into the hands of lengthy-term holders, the accessible circulating present shrinks, growing Bitcoin’s scarcity.

Historically, such present constraints, when met with renewed search files from, had been catalysts for sturdy ticket rallies. These dynamics in most cases space the stage for ticket discovery and sleek all-time highs.

Therefore, the sleek on-chain structure means that the continuing drawdown is less likely to be the beginning of a undergo market and more likely a wholesome correction interior a broader bullish cycle.