Bitget (BGB), Cronos (CRO), and 1INCH are three of the pause change tokens to stare in April 2025. BGB is down 4% this week after a huge rally in tiresome 2024, whereas CRO has dropped just about 10% amid broader market weak point tied to the tariff battle.

1INCH has additionally fallen over 5%, impacted by Ethereum’s persevered decline. Regardless of the pullbacks, each and every token has key catalysts forward that could force a reversal—or deepen the correction.

Bitget (BGB)

BGB token has drawn main attention in present months, rallying 434% between December 1 and December 27, 2024.

Then but again, after reaching that peak, momentum started to chill, and the token is now down 12% over the final seven days. This pullback comes as traders reassess the token’s advance-term doable following its explosive speed.

Regardless of that correction, Bitget Token is quiet one of many finest change tokens on the market, with a market cap of $4.8 billion.

In Q1 2025, Bitget burned 30 million BGB tokens, following a considerable bigger 800 million burn in tiresome 2024—reducing total provide by 40% in a hump aimed toward boosting prolonged-term label via deflation. BGB has additionally expanded its utility, now supporting multi-chain gas charges and staunch-world payments, pushing its use situations previous the Bitget ecosystem.

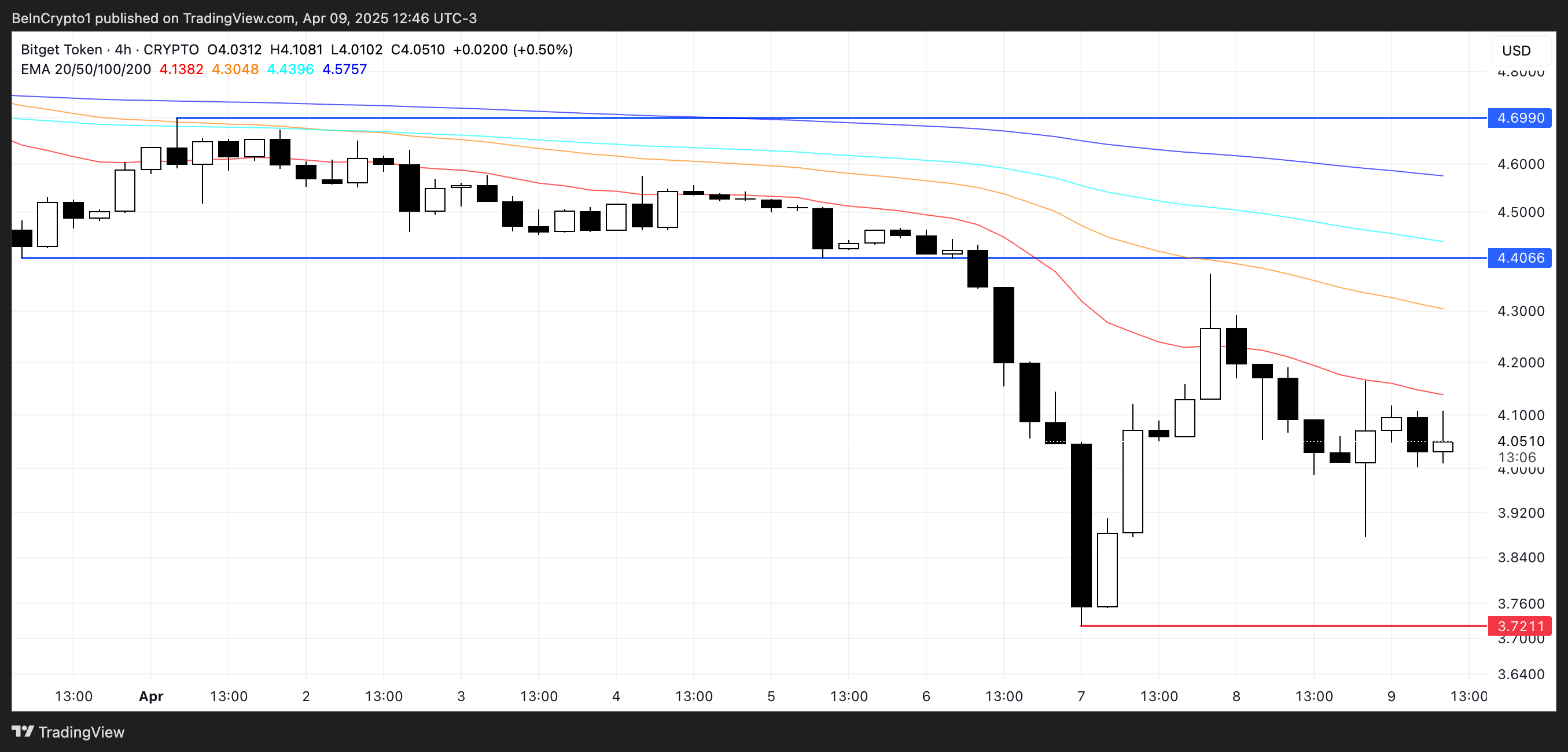

If the present correction reverses, Bitget Token could presumably test resistance at $4.40, with a doable push to $4.69 if broken.

Conversely, if the selloff deepens, crimson meat up spherical $3.72 could presumably just be examined, and a ruin below that could imprint the token’s first tumble beneath $3.70 since December 2024.

Cronos (CRO)

CRO, Crypto.com’s native token, is down just about 22% over the final seven days, making it one of many worst performers among main change tokens this week.

The decline comes as broader crypto markets react sharply to the escalating tariff battle, which has precipitated a wave of threat-off sentiment throughout each and every primitive and digital sources.

Crypto.com had ambitious plans for 2025, including talk of a doable CRO ETF, nonetheless with market prerequisites deteriorating, the viability of these milestones stays hazardous.

Technically, Cronos’ EMA lines salvage fashioned two death crosses in present days—a stable bearish signal. If the downtrend persists, CRO could presumably fall to test crimson meat up at $0.077, and if that stage breaks, tumble further to $0.073.

Then but again, if market sentiment rebounds—especially if boosted by Crypto.com’s partnership with Trump Media—CRO could presumably recover sharply, making it one of many most connected change tokens on the market.

Key upside targets include $0.085, followed by $0.097, $0.108, and almost definitely $0.12 if bullish momentum strengthens.

1INCH

1INCH stays one of many finest DEX aggregators within the crypto position, at the same time because it operates at a considerable smaller scale compared with rivals care for Jupiter, which sees roughly five times more procuring and selling quantity.

It additionally faces rising competition from newer gamers care for CoWSwap, striking strain on its dominance within the sector.

Regardless of its stable fundamentals and popularity, 1INCH has considered its token label tumble more than 17% over the final seven days, bringing its market cap down to $221 million.

The continuing downturn within the Ethereum ecosystem, with ETH now procuring and selling below $1,500 and at threat of dropping toward $1,000, has had a serious affect on aggregators care for 1INCH.

If the correction deepens, 1INCH could presumably test crimson meat up advance $0.148.

Then but again, a rebound in Ethereum exercise could presumably hasty reverse the pattern, almost definitely pushing 1INCH to retest resistance at $0.177 and, if broken, rally toward $0.198 and even $0.22.