Pepe Coin Mark: The cryptocurrency market returned on restoration momentum final weekend, uplifting several digital property influencing Pepe Coin. This frog-themed memecoin witnessed a large influx in the final four days because the price surged from $0.00000115 to $0.00000215, registering 84% bid. Amid this rally, the buyers breached the neckline resistance of an inverted head and shoulder sample, signaling a well-known alternate in the market dynamic.

Furthermore Read: Whales Dumping Trillions of Pepe Coin Tokens as PEPE Mark Shoots 60%

Pepe Coin Mark Eyes 30% Produce After Neckline Breach

The final correction style in PEPE coin label bottomed at $0.00000086 because the broader market witnessed renewed procuring interest aligned with rising influx in Situation Bitcoin ETF. The certain turnaround in the PEPE label has propelled the coin label by 162% inner two weeks to hit a 10-month high of $0.0000023.

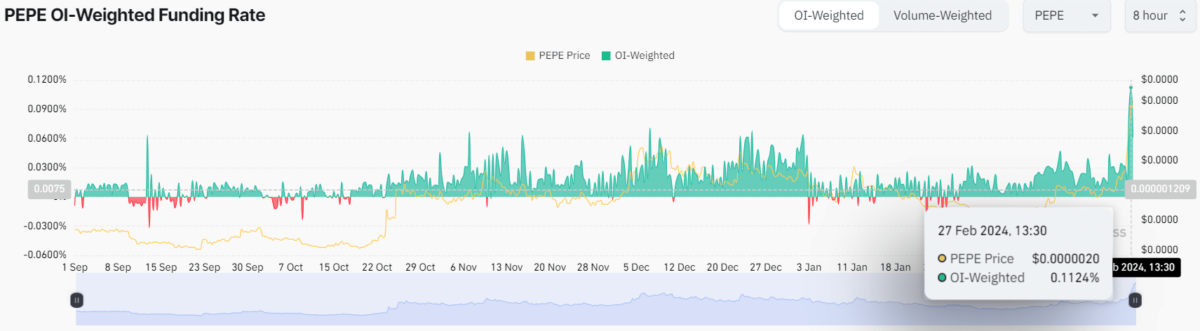

Nevertheless, a well-known fraction of this bid is got in the final two days, displayed as two elongated green candles in the day-to-day chart. Within the same length, the OI-Weighted Funding Price of PEPE experienced a well-known develop as per Coinglass, shifting from 0.0169% to 0.12%. This gargantuan upward thrust signifies a rising willingness amongst traders to pay more for holding prolonged positions in PEPE, suggesting a bullish market sentiment and an expectation of greater future costs for the asset.

An diagnosis of the day-to-day time chart exhibits the original label surge breached the neckline resistance of inverted head and shoulder patterns. This chart sample is a famed construction for style reversal as market dominance shifts from seller to buyer.

Foreign money procuring and selling at $0.00000218, the PEPE label must hiss its sustainability above the breached neckline around $0.00000163. Under the impact of this sample, this memecoin is poised to dart $0.00000288, accounting for a 30% potential create.

Furthermore Read: Pepe Mark And Glossy Meme Coin Frog Wif Hat (FWIF) Explode – Glossy All-Time High Next?

Technical Indicator

- Bollinger band: An upswing in the upper boundary of the Bollinger band indicator displays an aggressive procuring rigidity from market participants.

- Reasonable Directional Index: The ADX slope uptick at 28% signifies the buyers non-public ample momentum to lengthen the original restoration style.

Linked Articles

- Crypto Costs This day: Bitcoin Nears $56K, Ethereum Above 3,200 As PEPE Rallies 52%

- 3 Layer 1 Crypto To Aquire For March As Bitcoin Tops $57,000

- Correct-In: Obsolete Dealer Raises Bitcoin (BTC) Mark Purpose to $200K