The opponents heats up in the dapp area as developers weigh Binance Orderly Chain towards Ethereum. How assemble components like scalability and transaction costs affect their choices?

The blockchain dwelling is fiercely aggressive, particularly by manner of decentralized applications (dapps).

As of Feb. 2, in conserving with recordsdata from DappRadar, a prominent analytics platform, Binance Chain (BNB) is at the forefront with 5,215 dapps and a person execrable exceeding 5.3 million uncommon active wallets (UAW) over the final 30 days.

Ethereum (ETH), on the different hand, holds the 2nd position with 4,497 dApps, despite the truth that its person execrable of roughly 1.36 million UAWs pales in contrast to Binance Chain.

On the different hand, Ethereum’s dapps volume stands at a formidable $115 billion, more than six times Binance Chain’s $17.5 billion, highlighting Ethereum’s mountainous developer engagement.

Amid this, Xin Jiang, a dilapidated Vice President at Binance, proposed that the market may possibly well not require additional infrastructure enhancements, as dapps may possibly well emerge as the next catalysts for the crypto dwelling.

What’s going down? Let’s dive deeper into how the dapp market is performing, which chains are leading the map frontier, and which sectors are propelling the dapp market to fresh heights.

The recent deliver of dapp market

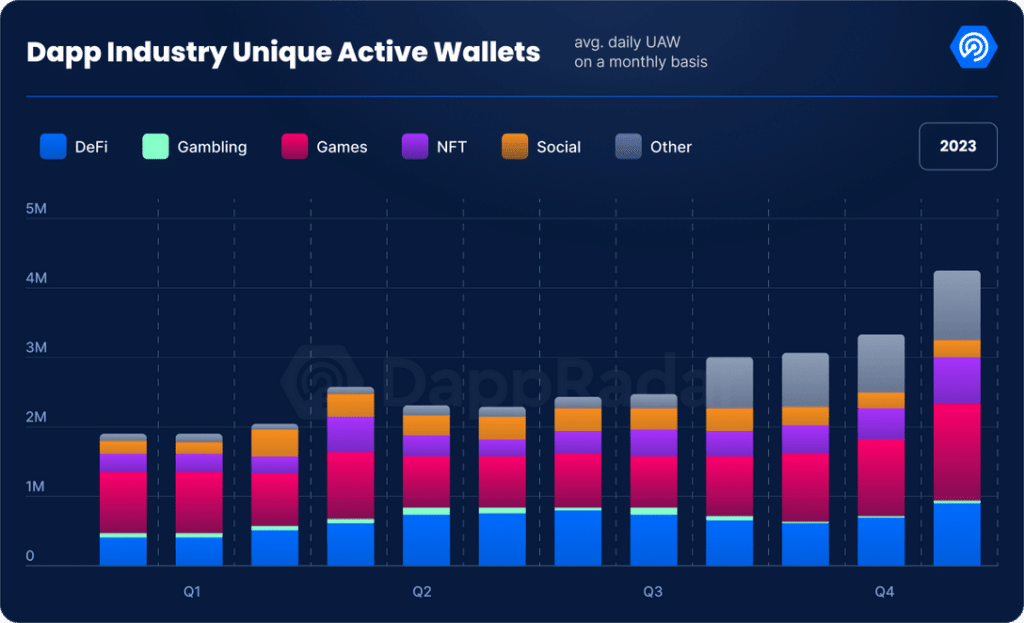

In step with a file from DappRadar, the dapp industry witnessed a formidable 124% twelve months-over-twelve months make bigger in its UAW, culminating in a day after day count of 4.2 million UAW by the end of 2023.

Fast forward to the origin of 2024, and the momentum presentations no indicators of slowing. As of Feb. 1, the dapp industry notched up a brand fresh milestone with 5.3 million day after day UAW. This represents an 18% surge from the previous month and the ideal since 2022.

Breaking down the numbers by industry segments gives insights into the diversification of dapp utilization.

Blockchain gaming continues to manual the pack with a steady 1.5 million dUAW, affirming its dominance from the previous month. This interprets to a 28% dominance over your complete dapp ecosystem,

Similarly, the decentralized finance (defi) sector remains tough, keeping steady at 1 million dUAW.

On the different hand, it’s not honest gaming and finance which may possibly well well perhaps be riding mutter. The non-fungible token (NFT) dwelling has experienced a famous growth, with a 4% uptick this month, reaching 697,959 dUAW.

Amid this, the social dapp sector has obtained headlines, boasting a formidable 868,091 dUAW. This surge, a 262% make bigger over the previous month, is basically attributed to platforms like CARV and Dmail Network, indicating a surge of ardour in social networking on decentralized platforms.

Rise of social dapps

The rising recognition of social dapps is available in the market in response to increasing worries about recordsdata privacy breaches and on-line scams on primitive platforms.

The acquisition of Twitter by tech magnate Elon Musk in 2022 triggered a wave of discontent among its person execrable. Subsequent changes, like brooding about a paywall, ended in a fall in month-to-month active users, anticipated to proceed into 2024.

Amid this, social dapps like Pal.tech obtained traction. Launched in Aug. 2023, Pal.tech quickly grew to changed into a primary participant in the social crypto scene, with over 100,000 users and $25 million in income.

However the shift to decentralized apps isn’t honest about dissatisfaction with centralized platforms. Analysts highlight that regulatory scrutiny and privacy concerns, particularly in the EU, also drive this pattern.

Dapps fluctuate from primitive platforms by warding off centralized recordsdata sequence for adverts, with some being non-income and prioritizing person privacy.

On the different hand, whereas decentralized platforms offer more freedom and anonymity, to boot they appeal to communities with gross views, raising concerns about the spread of extremist insist material.

As of Feb. 26, primarily based totally on recordsdata from DappRadar, CARV, Galxe, and Dmail Network possess emerged as the main social dapps, gauged by complete UAWs in the previous 30 days.

CARV and Dmail Network possess considered critical mutter, with volumes up by 330% and 120%, respectively. On the different hand, Galxe has experienced a mighty decline of up to 100%.

Why is Binance Chain leading the dapp lumber?

When evaluating Binance Orderly Chain (BSC) and Ethereum in dApps performance, scalability, transaction costs, and consensus mechanisms, we invent insights into their strengths and weaknesses.

BSC stands out for its low transaction costs and excessive scalability, enabling swift transaction processing at a share of the price in contrast with Ethereum.

As of Feb. 26, BSC can take care of up to Forty five.3 transactions per 2nd (TPS), a critical improvement over Ethereum’s recent throughput, which remains below 15 TPS nevertheless goals for a mighty make bigger with Ethereum 2.0.

Transaction costs on Ethereum had been a persistent ache, averaging at $0.89 as of Feb. 25. At some level of sessions of network congestion, these costs can skyrocket even additional, posing challenges for users and developers.

In incompatibility, BSC gives particularly lower transaction costs, averaging at $0.15 as of this writing, presenting a compelling advantage for those in the hunt for more price-effective blockchain interactions.

Selecting between BSC and Ethereum depends on the particular wants and priorities of dapp developers and users. Each and each platform has its commerce-offs in decentralization, security, transaction velocity, and price.

BSC excels in offering an environment pleasant and economical solution for excessive-frequency trading and applications requiring swift transaction speeds and low costs.

On the different hand, Ethereum’s energy lies in its tough decentralization and safety features, alongside with a various array of dapps and an limitless ecosystem.

The avenue forward

The success of decentralized applications depends on bettering person skills to make blockchain-primarily based mostly solutions more accessible. Simplifying interactions, refining interfaces, and incorporating acquainted aspects are foremost to attracting a wider target audience.

In this day’s security-conscious digital world, dapps need to also prioritize tough privacy and safety features. Innovations in cryptographic techniques like zero-recordsdata proofs and steady multi-occasion computation will be a need to-possess for boosting security.

Whereas finance and gaming possess dominated the dapp scene, there are alternatives for growth into fresh areas similar to social media, training, and healthcare.

Within the shatter, the just for dapps is mainstream adoption. Achieving this requires not honest technological traits nevertheless also educational initiatives to showcase the figuring out benefits of dapps in everyday lifestyles.