The launch of the first Solana futures alternate-traded funds (ETFs) marks a valuable milestone for institutional crypto adoption within the U.S. With these contemporary monetary products, investors develop regulated publicity to Solana (SOL), doubtlessly driving build a question to and liquidity. But can this institutional push propel SOL’s tag toward the $500 impress?

Solana Futures ETFs: A Game-Changer for Institutional Traders

On March 20, 2025, Volatility Shares LLC equipped two groundbreaking Solana futures ETFs:

- Volatility Shares Solana ETF (SOLZ): Offers usual publicity to Solana futures.

- Volatility Shares 2X Solana ETF (SOLT): Gives leveraged publicity, amplifying Solana’s tag movements by twofold.

These ETFs describe the first U.S.-basically based funds monitoring Solana futures, signaling rising institutional hobby within the asset.

Regulatory Approval and Market Timing

The swift approval of Solana futures ETFs by U.S. regulators underscores a shifting stance toward digital belongings. Consultants counsel that this switch may maybe perchance maybe even elope the direction toward a space Solana ETF, same to the trajectory of Bitcoin and Ethereum.

Justin Young, CEO of Volatility Shares, emphasised that this approval reflects a broader recognition of the importance of crypto in sustaining the U.S.’s management in monetary markets.

Will Institutional Question Push SOL Mark to Unique Highs?

With the launch of those ETFs, expectations are high for elevated institutional adoption. Analysts predict that the inflow of institutional funds may maybe perchance maybe even very a lot boost Solana’s market capitalization, narrowing the gap with Ethereum. On the other hand, some remain cautious, noting that futures-basically based ETFs normally entice less capital when put next to space ETFs.

Market Reactions and Mark Projections

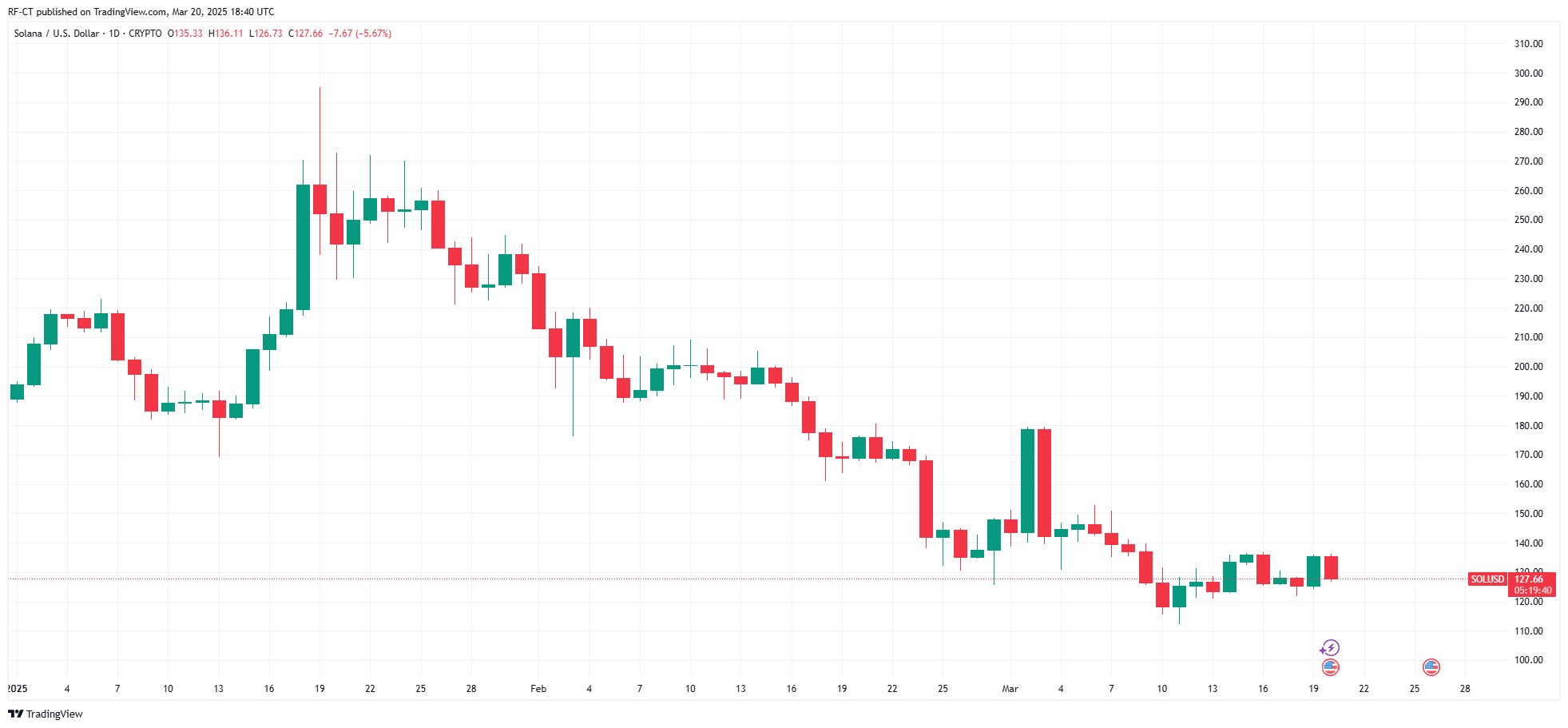

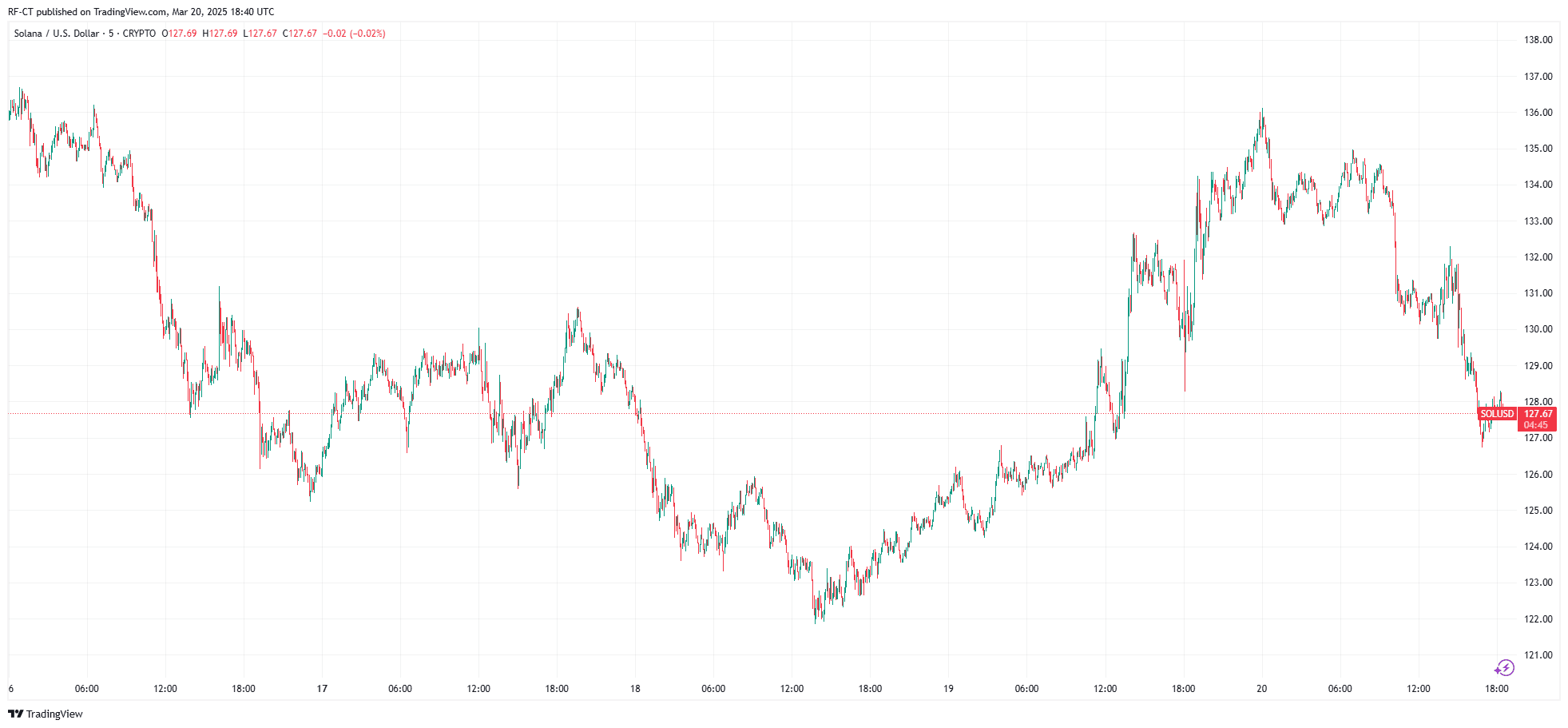

Previous to the ETF debut, Solana’s tag surged 12%, reaching $136 as traders positioned themselves for doable institutional inflows. Quick-term resistance phases are house round $140, whereas key enhance sits at $127.

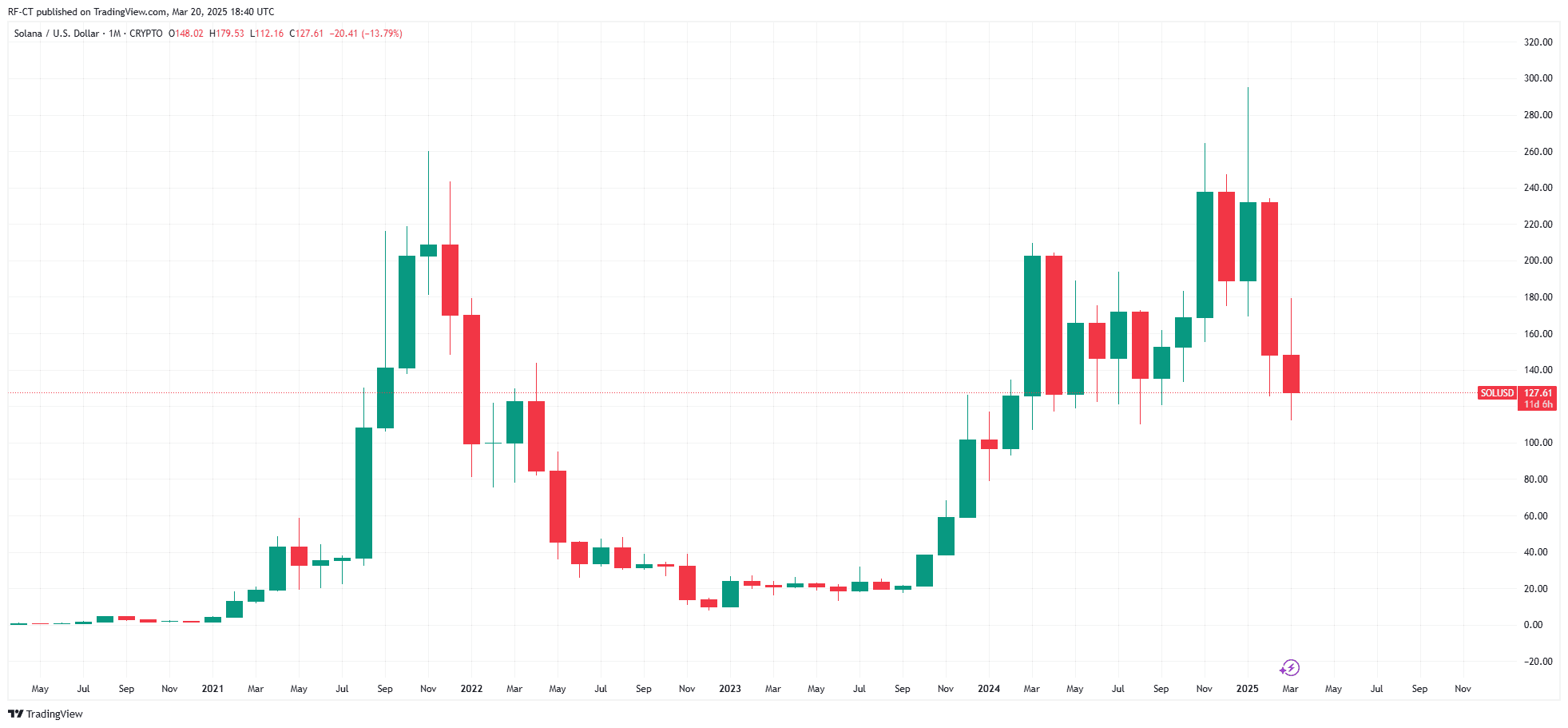

While the instantaneous impact on Solana’s tag stays unsure, some analysts speculate that sustained institutional build a question to, mixed with broader crypto market utter, may maybe perchance maybe even propel the SOL tag toward the $500 target within the prolonged elope.

Solana Mark Prediction: Can SOL Mark Attain $500?

The launch of Solana futures ETFs marks a turning point in institutional adoption of the asset. While initial inflows can be moderate, this model sets the stage for doable future space ETFs, extra growing accessibility and build a question to for Solana. Whether SOL can reach $500 will depend on persisted institutional hobby, broader market stipulations, and upcoming regulatory choices.

Solana Futures ETF vs Solana ETF

Possibly the main distinction between a Solana ETF and a Solana Futures ETF lies within the underlying belongings they track and how they give publicity to Solana (SOL).

Solana ETF (Enlighten ETF)

- A Solana ETF (Enlighten ETF) would defend proper SOL tokens as its underlying asset.

- Traders procuring shares of the ETF would in a roundabout scheme gain proper Solana, making it same to procuring and holding SOL on a crypto alternate.

- A space Solana ETF would straight away impact the tag of SOL, as fund managers would need to aquire and retailer SOL tokens to verify investor build a question to.

- As of now, no space Solana ETF has been well-liked by regulators.

Solana Futures ETF

- A Solana Futures ETF does not defend proper SOL tokens. As a change, it invests in futures contracts that track Solana’s tag.

- Futures contracts are agreements to aquire or promote Solana at a predetermined tag on a explicit future date.

- These ETFs enable investors to make investments on Solana’s tag movements with out straight away proudly owning SOL.

- Futures-basically based ETFs are regularly less correlated with the correct tag of SOL resulting from components love roll charges (charges incurred when rolling over expiring contracts).

Key Variations

| Feature | Solana ETF (Enlighten) | Solana Futures ETF |

|---|---|---|

| Underlying Asset | Holds proper SOL tokens | Holds futures contracts on Solana |

| Market Affect | Without extend affects SOL tag | Indirect impact, in step with futures costs |

| Investor Publicity | Allege ownership of Solana | Publicity to tag movements by scheme of derivatives |

| Regulatory Space | Now not yet well-liked | Permitted and procuring and selling within the U.S. |

| Mark Correlation | Closely follows SOL’s tag | Would possibly deviate resulting from futures market stipulations |

Which is Better?

- A Solana Enlighten ETF would provide a extra divulge and acquire manner to make investments in Solana, because it tracks the correct tag of SOL.

- A Solana Futures ETF affords publicity to tag movements however comes with extra dangers, comparable to futures market volatility and contract roll charges.

Currently, handiest Solana Futures ETFs had been launched within the U.S., whereas a Enlighten Solana ETF is collected searching forward to regulatory approval.