Mantra (OM) is up more than 10% within the previous seven days, taking build of residing because the 2nd-largest Precise World Asset (RWA) token by market cap. With a market cap of round $6.8 billion, OM is gaining momentum and attracting consideration within the RWA space.

Technical indicators are flashing combined signals, with OM’s RSI cooling off from overbought ranges and Ichimoku Cloud constructions remaining bullish. As OM trades reach key resistance and toughen zones, traders are watching carefully to think if it will lengthen its rally and problem new all-time highs.

Mantra RSI Is Again To Neutral After Reaching Overbought Ranges

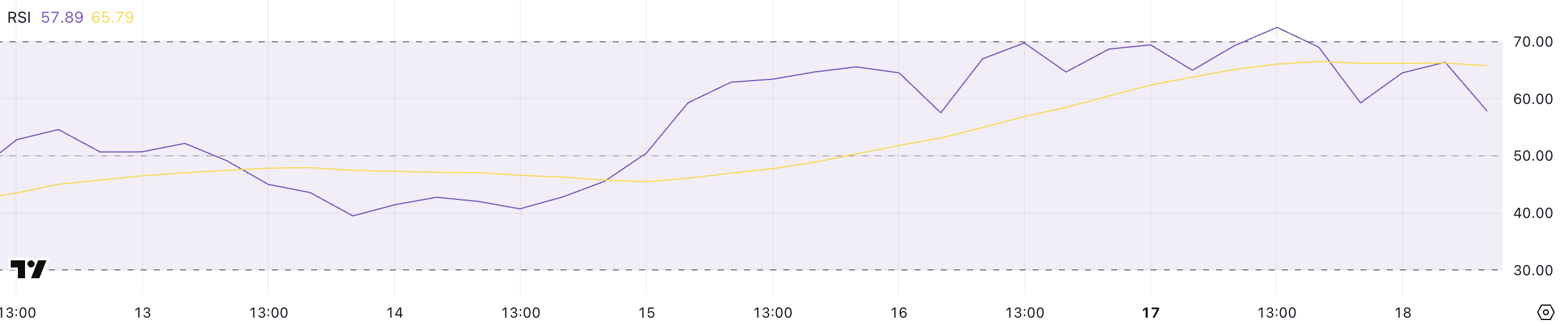

Mantra’s Relative Energy Index (RSI) reading is 57.89, asserting ranges above the 50 threshold since March 15.

The RSI temporarily reached 72.51 the day earlier than on the present time, signaling that OM approached overbought territory earlier than pulling back a chunk.

This sustained transfer above 50 means that OM has been in a bullish part, with momentum favoring investors over the previous a total lot of days.

The RSI is a momentum oscillator that measures the ride and magnitude of recent mark movements to steal into myth whether or no longer an asset is overbought or oversold.

Readings above 70 fundamentally speak overbought stipulations, signaling that an asset is probably going to be due for a pullback, while readings below 30 imply oversold stipulations, potentially signaling a shopping opportunity.

OM’s RSI at 57.89 means that while bullish momentum is silent latest, it is miles currently at reasonable ranges.

OM Ichimoku Cloud Presentations a Bullish Setup

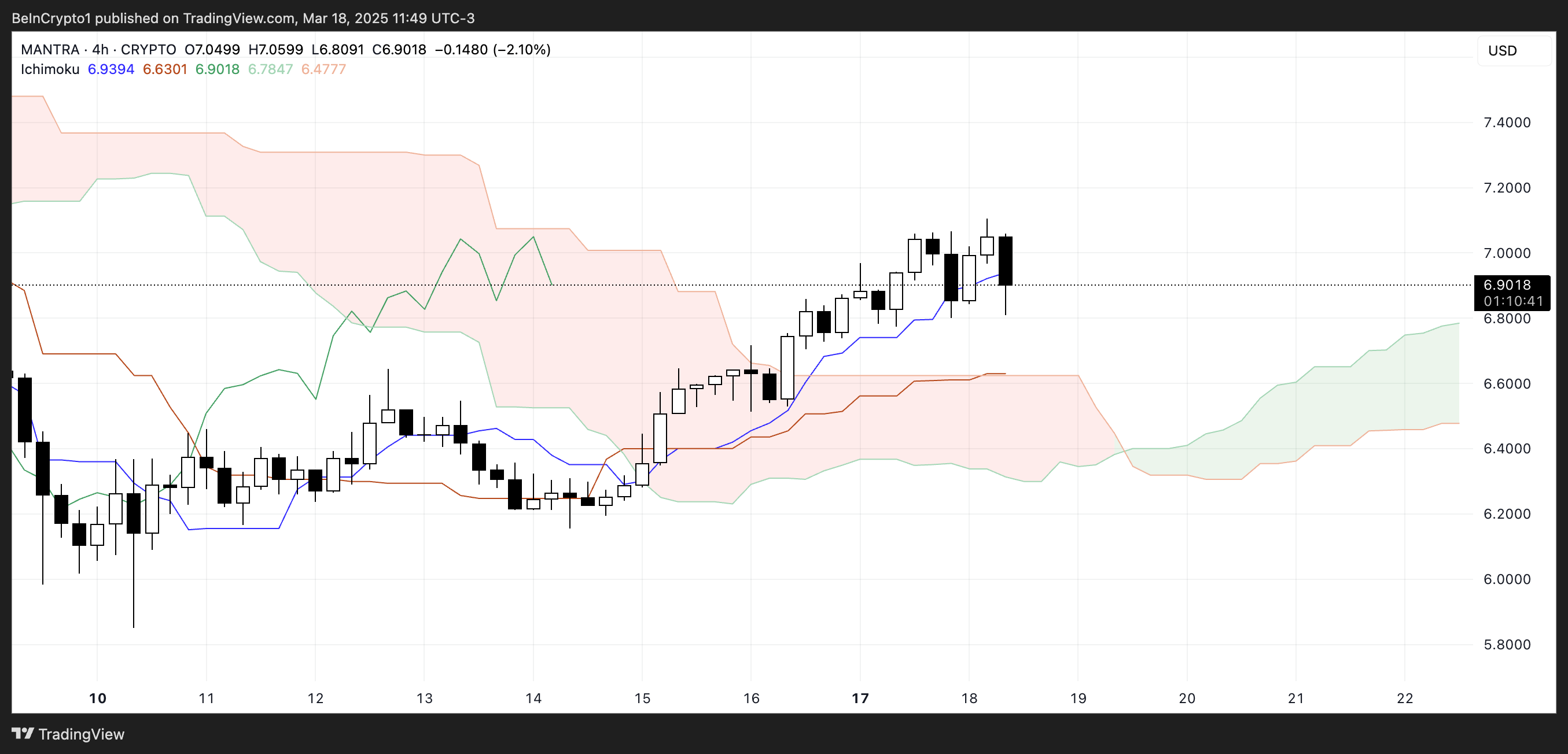

Mantra is currently exhibiting a bullish structure on the Ichimoku Cloud chart.

The price is trading above the cloud, which signifies that the overall vogue is silent bullish. This solidifies Mantra as one among the biggest RWA coins available within the market.

Furthermore, the cloud forward has flipped inexperienced, suggesting that if the structure holds, future momentum may perchance perchance continue to prefer investors.

The Tenkan-sen is positioned above the Kijun-sen, reinforcing short-timeframe bullish momentum, even though the price currently pulled back after some upward circulation.

The Chikou Span is additionally above the price action and the cloud, supporting the bullish outlook.

Nonetheless, if the price begins to consolidate or dip in opposition to the Tenkan-sen and Kijun-sen, it could perchance signal a capability cease in momentum or a shift in opposition to a more neutral vogue if these ranges fail to present toughen.

Will Mantra Uncover Original All-Time Highs In March?

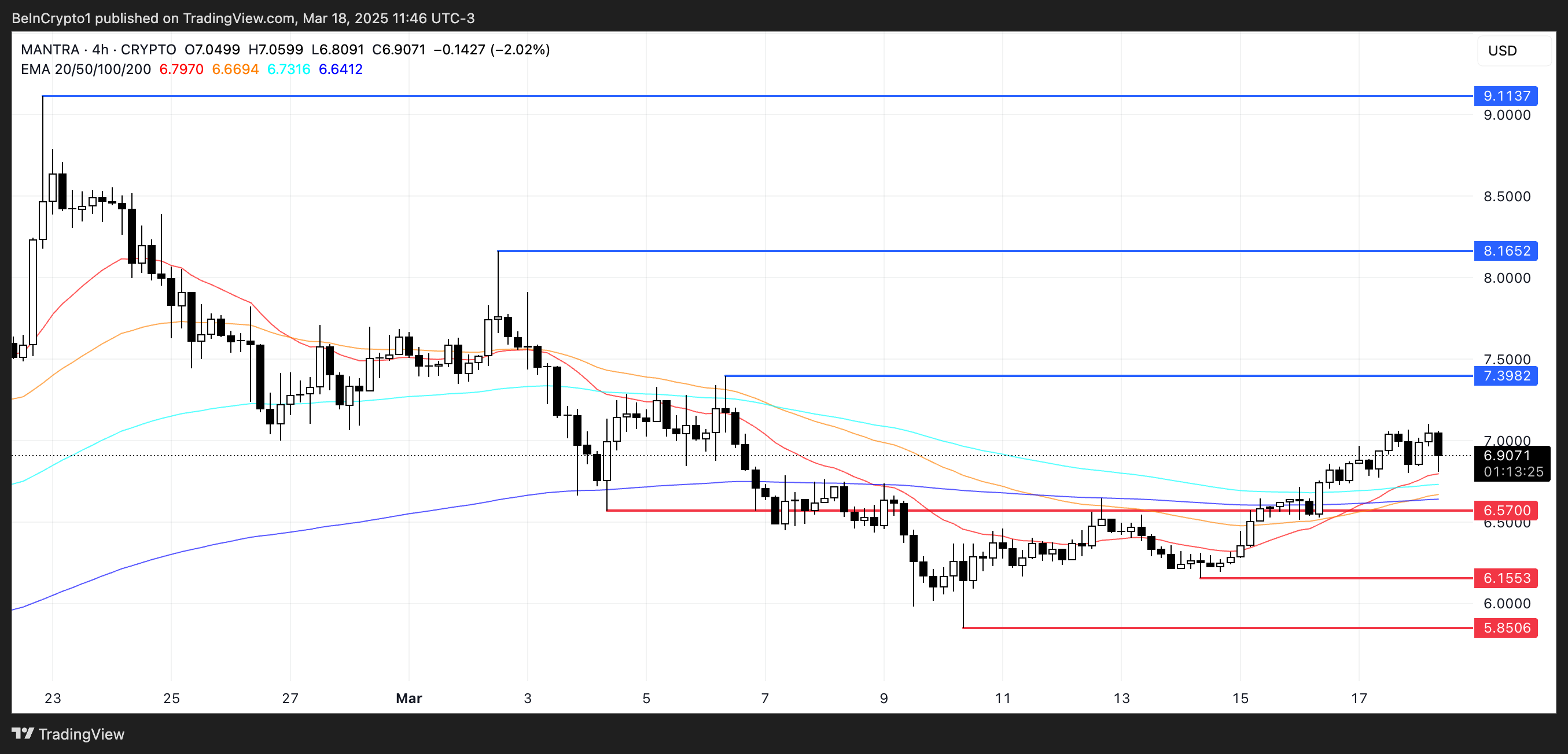

OM’s EMA traces are signaling that a golden immoral may perchance perchance soon intention, which would make stronger the bullish outlook.

If this sample is confirmed and Mantra can collect the solid uptrend seen in previous months, it could perchance rupture throughout the resistance ranges at $7.39 and $8.16.

A breakout above these areas may perchance perchance enable OM to examine mark ranges above $9 for the first time ever, potentially atmosphere new all-time highs and presumably making OM surpass Chainlink because the biggest RWA coin in market cap.

On the choice hand, if the latest bullish momentum fades, OM may perchance perchance decline in opposition to toughen at $6.57.

An absence of this level may perchance perchance problem off extra downside in opposition to $6.15, and if bearish stress persists, the price may perchance perchance fall as minute as $5.85.