PancakeSwap’s CAKE token is the market’s prime performer currently, surging 21% previously 24 hours. At press time, the altcoin trades at $2.56.

This rally comes as CAKE records its perfect day to day situation inflow in a month amid proper inquire and renewed investor curiosity in the token.

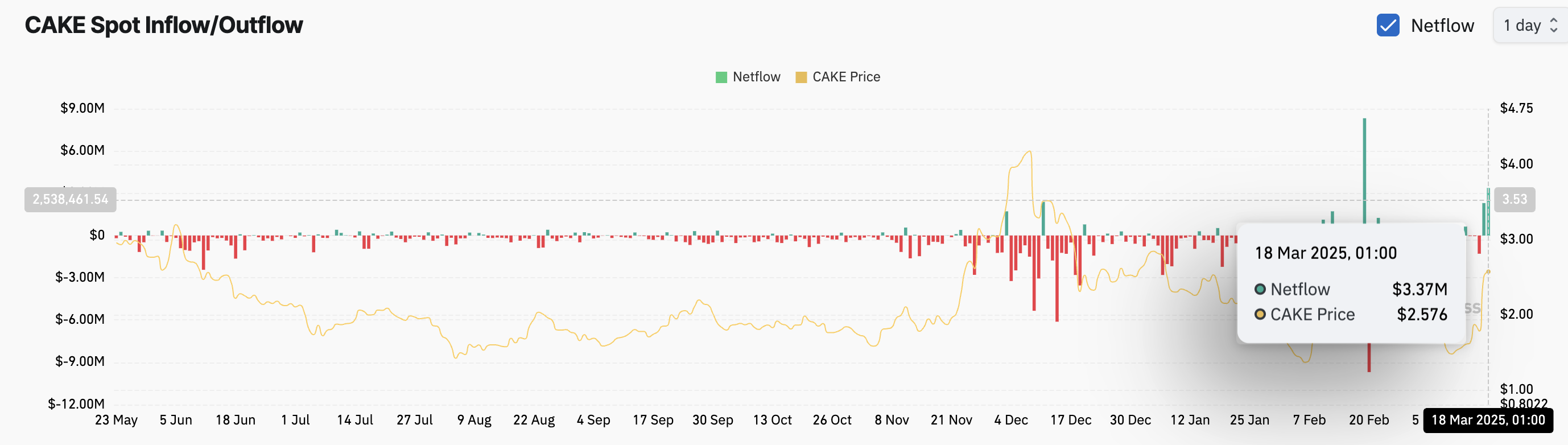

CAKE Rockets Better with $3.37 Million Inflows—Is More Upside Forward?

CAKE’s designate rally is primarily driven by the lively develop in trading project on the PancakeSwap decentralized alternate (DEX). Over the past few days, the platform has seen a critical uptick in day to day trading volume, outperforming Ethereum’s Uniswap and Solana’s Raydium.

The vogue has prompted a surge in inquire for the DEX’s native token, CAKE, causing its designate to flee by double digits. The uptick in procuring for rigidity is reflected by the token’s situation inflows, at the moment at $3.37 million, its single-day perfect figure previously month.

When an asset records situation inflows, the preference of tokens purchased and moved into situation markets has increased, indicating rising inquire. CAKE’s high situation inflows counsel that traders are actively amassing the asset. If this procuring for rigidity continues, it will drive additional designate appreciation.

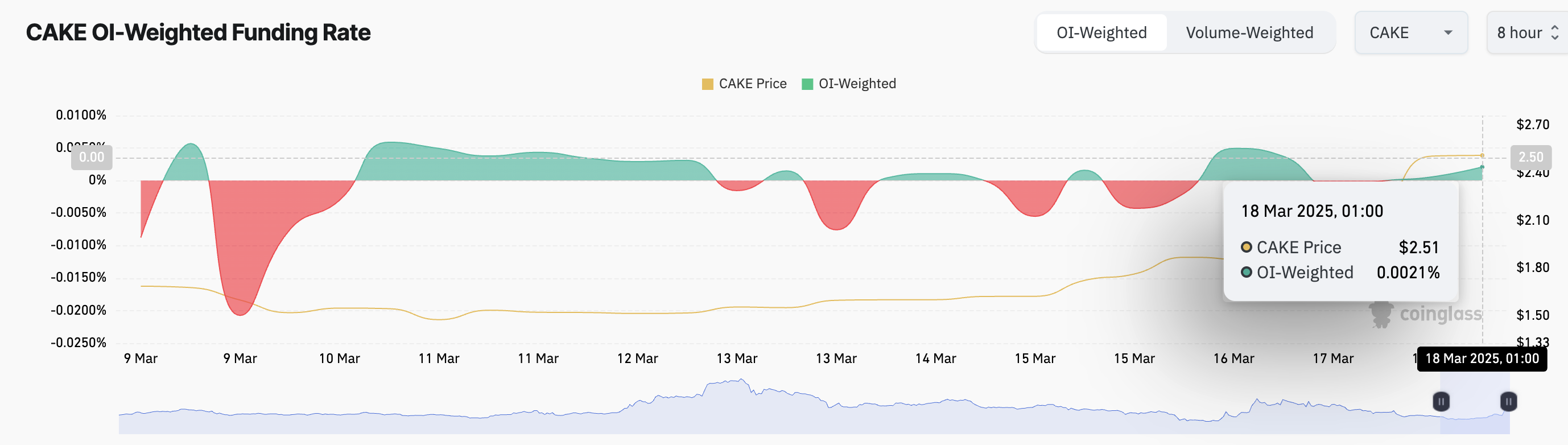

Right here’s a bullish signal, especially as it is accompanied by constructive market sentiment, as shown by the token’s funding payment, which is 0.0021% as of this writing.

The funding payment is a periodic price exchanged between long and immediate traders in perpetual futures contracts to withhold the contract designate aligned with the location market. A constructive funding payment methodology long traders are paying immediate traders, indicating proper inquire and bullish market sentiment for CAKE.

With rising inflows and rising inquire, CAKE’s designate efficiency means that traders are positioning for additional upside. If inquire continues at this lag, the token might perhaps well prolong its beneficial properties, drawing even more liquidity into PancakeSwap’s ecosystem.

CAKE Holds Stable Above 20-Day EMA—Bullish Momentum Builds

CAKE’s rally has pushed it deal above its 20-day exponential transferring moderate (EMA) which now kinds dynamic strengthen beneath its designate at $1.93.

This transferring moderate measures an asset’s moderate designate over the past 20 trading days. It affords more weight to most up-to-date designate knowledge, making it more responsive to designate actions than a straightforward transferring moderate.

When an asset’s designate climbs above the 20-day EMA, it indicators bullish momentum, suggesting that patrons are as much as the discover and the asset might perhaps well proceed its upward vogue.

If this vogue persists, CAKE might perhaps well prolong its uptrend to $2.90.

On the different hand, a resurgence in income-taking project might perhaps well prevent this from going down. If CAKE inquire stalls and it sheds its most up-to-date beneficial properties, its designate might perhaps well tumble to $2.41. If that strengthen level fails to withhold, the token’s designate might perhaps well drop to $2.01.