Made in USA cryptos to see this week embody XRP, Pi Network (PI), Legend (IP), Jupiter (JUP), and Aerodrome Finance (AERO). XRP is main in market cap, whereas PI is coming off one of many ideal token launches in most neatly-liked historical previous.

IP has been one of many tip performers honest currently, whereas JUP and AERO are beneath stress regardless of mighty fundamentals. Here’s a breakdown of how these five Made in USA cryptos are developing for the third week of March.

XRP

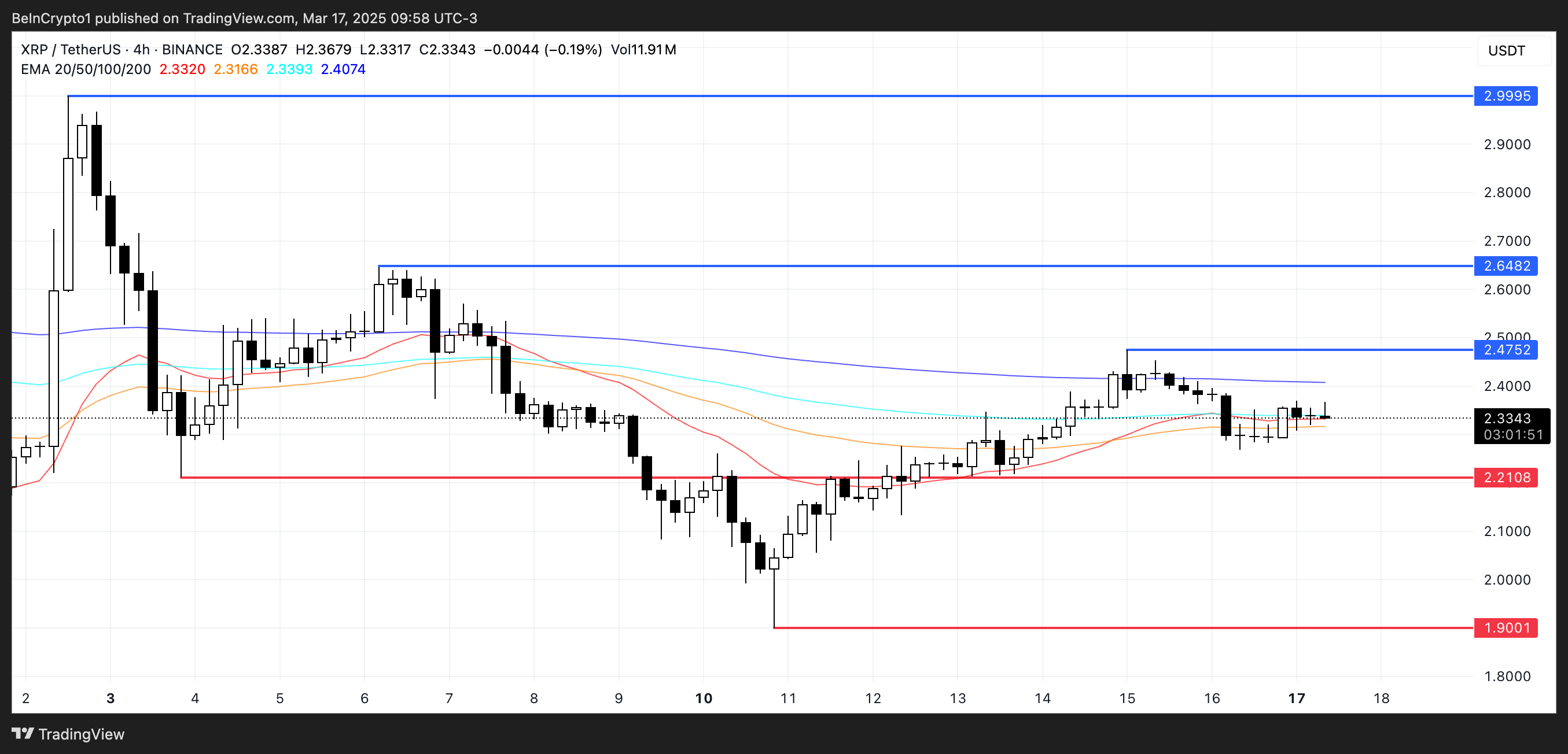

XRP is currently one of many ideal Made in USA cryptos by market cap. All over the last month, its impress has dropped honest about 17%, on the other hand it has rebounded in the last week with a make of practically 6%. This most neatly-liked recovery is attracting attention as merchants see for signs of a sustained trend reversal.

There is rising hypothesis that the SEC could well well maybe reclassify XRP as a commodity. Any obvious trends in the SEC vs XRP case could well well maybe serve as a famous bullish living off.

About a months in the past, identical recordsdata sparked a rally in XRP and boosted exercise across its ecosystem, along with intelligent beneficial properties in related meme cash.

If XRP can retain this momentum and earn an uptrend, it could maybe probably well well maybe target the resistance at $2.47. A breakout above this stage could well well maybe open the door for a switch in direction of $2.64, and doubtlessly even $3 if bullish sentiment strengthens.

On the downside, a return to bearish conditions could well well maybe push XRP serve to the $2.21 toughen, and if damaged, extra losses appropriate down to $1.90 are probably.

Pi Network (PI)

PI turned into as soon as one of many ideal crypto launches in most neatly-liked historical previous, swiftly reaching a market cap shut to $20 billion. On the other hand, the token has been beneath stress, correcting by over 20% in the previous 30 days. Its market cap has now dropped beneath $10 billion as bearish sentiment continues to weigh on impress bolt.

In most neatly-liked days, PI has faced rising criticism following the rollout of its .pi domains, which some in the neighborhood have puzzled.

Furthermore, a famous promote-off took place after the token’s mainnet migration, along with extra downside stress and contributing to its most neatly-liked decline.

If the present downtrend persists, PI impress could well well maybe test the toughen at $1.23, and a breakdown could well well maybe push it beneath $1.20, marking its lowest stage since February 22.

On the other hand, if the token manages to reverse momentum and receive an uptrend, it could maybe probably well well maybe scenario the resistance at $1.57, with extra upside probably in direction of $1.82. A formidable rally could well well maybe even take into consideration PI checking out $1.98 and maybe $2.35, breaking above $2 for the first time since March 1.

Legend (IP)

IP is currently one of many ideal-performing altcoins genuine via the last 30 days, with its impress surging honest about 235%. The rally has pushed its market cap to practically $1.4 billion, making it one of many standout tokens available in the market at some stage on this period.

In the last few days, IP has entered a consolidation segment, with impress bolt slowing down after its impressive trail. On the other hand, if momentum returns and an uptrend is established, IP could well well maybe scenario key resistance levels at $6.66 and $6.96.

A breakout above these levels could well well maybe open the door for a push in direction of $7.95 and maybe previous $8, atmosphere fresh all-time highs.

On the flip facet, if promoting stress will increase and a correction takes defend, IP could well well maybe first retest the $5 toughen stage. If this stage fails to defend, extra downside could well well maybe consequence in a decline in direction of $4.49, and in a deeper pullback, the worth could well well maybe even drop to $3.65.

Jupiter (JUP)

Jupiter, like most foremost Solana-basically based mostly tokens and deal of Made in USA cryptos, has experienced a intelligent correction genuine via the last 30 days, with its impress losing honest about Forty five%. This decline mirrors the broader promote-off considered across the Solana ecosystem as market conditions stay mighty.

Even with basically the most neatly-liked pullback, Jupiter remains to be one of basically the most a success corporations in the crypto space. As one of many ideal aggregators available in the market, it generated $27 million in earnings genuine via the last seven days, ranking precise uninteresting Tether and Circle as one of many ideal-incomes protocols.

If the Solana ecosystem levels a recovery, JUP could well well maybe earnings very much, with impress targets at $0.54, $0.598, and $0.63 as key resistance levels.

A formidable uptrend could well well maybe even push the token in direction of $0.86. On the other hand, if the downtrend persists, JUP could well well maybe furthermore retest the toughen at $0.forty eight and $0.44, and a further decline could well well maybe give it some idea drop beneath $0.40 for the first time ever.

Aerodrome Finance (AERO)

AERO is the ideal DEX inquisitive in regards to the Contaminated chain ecosystem and has honest currently benefited from the rising ardour on this network.

All over the last week, Aerodrome has generated $1 million in fees, outperforming principal avid gamers corresponding to Trokan, BONKbot, and GMGN, solidifying its place as a key player in the Contaminated ecosystem.

On the other hand, regardless of its sturdy fundamentals, AERO’s impress has been beneath stress, correcting more than 38% over the last 30 days. The token is now procuring and selling at its lowest stage since October 2024, reflecting the broader volatility across the market.

If the downtrend persists, AERO could well well maybe soon retest the toughen stage at $0.forty eight.

On the flip facet, if taking a survey momentum returns and AERO establishes an uptrend, it could maybe probably well well maybe switch in direction of resistance at $0.56 and $0.61. A breakout above these levels could well well maybe open the door for a rally in direction of $0.67 and doubtlessly $0.739.