Cardano (ADA) has been in a consolidation section following a period of intense volatility. After rallying to unique local highs, ADA retraced and is now procuring and selling inside of a vital stamp vary, leaving merchants unsafe about the next transfer. With market sentiment racy and key technical indicators providing combined signals, will ADA protect its crimson meat up and aim elevated, or is one other leg down on the horizon? Let’s rob a nearer opinion on the stamp action and indicators to resolve ADA’s next doable route.

Cardano Be conscious Prediction: Is Cardano (ADA) Forming a Bottom?

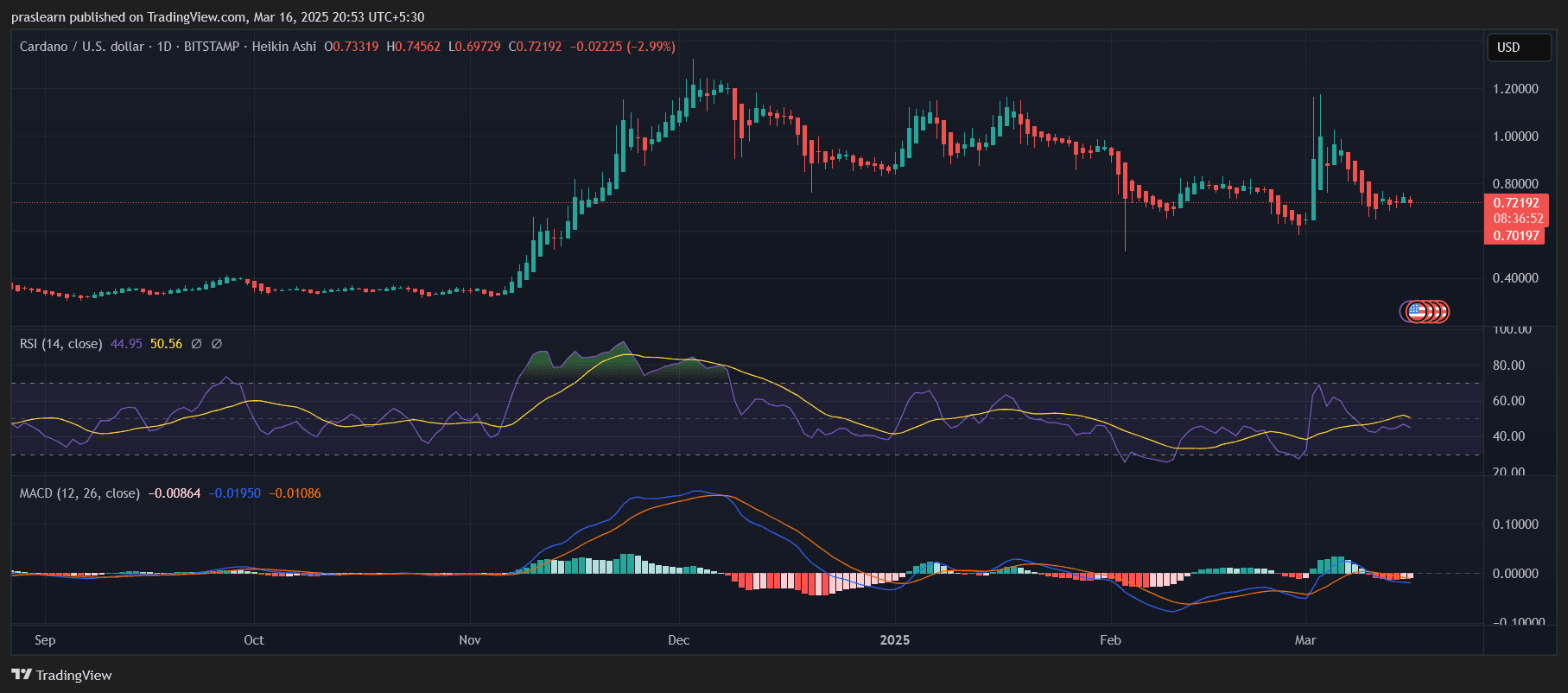

A nearer opinion at ADA’s every single day chart unearths that the asset has been procuring and selling inside of a outlined vary of $0.70 to $0.80, showing signs of consolidation. Traditionally, prolonged classes of sideways circulation in total precede astronomical stamp strikes, making this a vital inflection point.

The Relative Energy Index (RSI) for the time being stands at 44.95, reflecting unbiased to a minute of bearish momentum. This implies that while ADA is now no longer in oversold territory, it lacks the strength to trigger a stable upward thrust with out extra procuring for pressure. A transfer above 50 on the RSI might maybe most definitely stamp increasing bullish momentum, while a drop below 40 might maybe most definitely display further downside possibility.

Moreover, the Transferring Reasonable Convergence Divergence (MACD) presentations that the MACD line stays simply below the stamp line, reinforcing the dearth of stable bullish momentum. The histogram furthermore signifies minimal divergence, that draw the stamp might maybe most definitely continue consolidating except a primary catalyst sparks a breakout.

Can ADA Retain Above the $0.70 Enhance Degree?

The $0.70 level has acted as a stable crimson meat up zone, preventing further declines no topic a pair of retests. If bulls continue to protect this condominium, lets opinion ADA soar support in opposition to $0.80 or even $0.85 within the short term.

Alternatively, if selling pressure intensifies and ADA stamp falls below $0.70, the next major crimson meat up level lies around $0.65, which previously acted as a launchpad for a stamp rebound. A breakdown below $0.65 would verify a bearish continuation, doubtlessly pushing ADA in opposition to $0.60 or decrease within the come term.

One vital ingredient to track is procuring and selling quantity—a shortage of predominant procuring for hobby at unusual phases might maybe most definitely display that Cardano stamp will wrestle to push elevated with out renewed quiz.

What Are the Key Resistance Phases for ADA?

For Cardano stamp to keep a bullish breakout, it must first particular the $0.80 resistance, which has all any other time and all any other time rejected upward strikes. A decisive breakout above this level, accompanied by stable quantity, might maybe most definitely gas a rally in opposition to $0.90 and at closing $1.00.

The $1.00 effect stays a vital psychological resistance, as breaking above it can most definitely reignite broader market hobby and attract extra investors. If ADA stamp manages to reclaim this level, the next key aim would be $1.20, which aligns with old stamp action and Fibonacci retracement phases.

Alternatively, if ADA fails to particular resistance and stays trapped below $0.80, it can most definitely lengthen its consolidation section or even trigger one other correction in opposition to decrease crimson meat up zones.

Cardano Be conscious Prediction: What’s Next for ADA?

Cardano’s stamp action stays in limbo, with crimson meat up at $0.70 and resistance at $0.80 conserving stamp circulation restricted. A bullish breakout above $0.80 with stable quantity might maybe most definitely open the doorways for further upside, doubtlessly concentrated on $1.00 and past. Alternatively, if sellers secure retain watch over and push ADA below $0.70, the next crimson meat up phases at $0.65 and $0.60 might maybe most definitely strategy into play.

Traders might maybe most definitely unexcited carefully track procuring and selling quantity, RSI trends, and key resistance breakouts for confirmation of the next major transfer. Whereas ADA’s lengthy-term fundamentals remain stable, the non eternal outlook hinges on whether or now no longer bulls can form ample momentum to drive prices elevated.