Here’s a segment from the Forward Steering newsletter. To read chubby editions, subscribe.

Given the old day’s stablecoin bill development and BlackRock’s tokenized cash market fund hitting $1 billion AUM, I design it’d be a apt time to highlight the anticipated development of these segments in tandem.

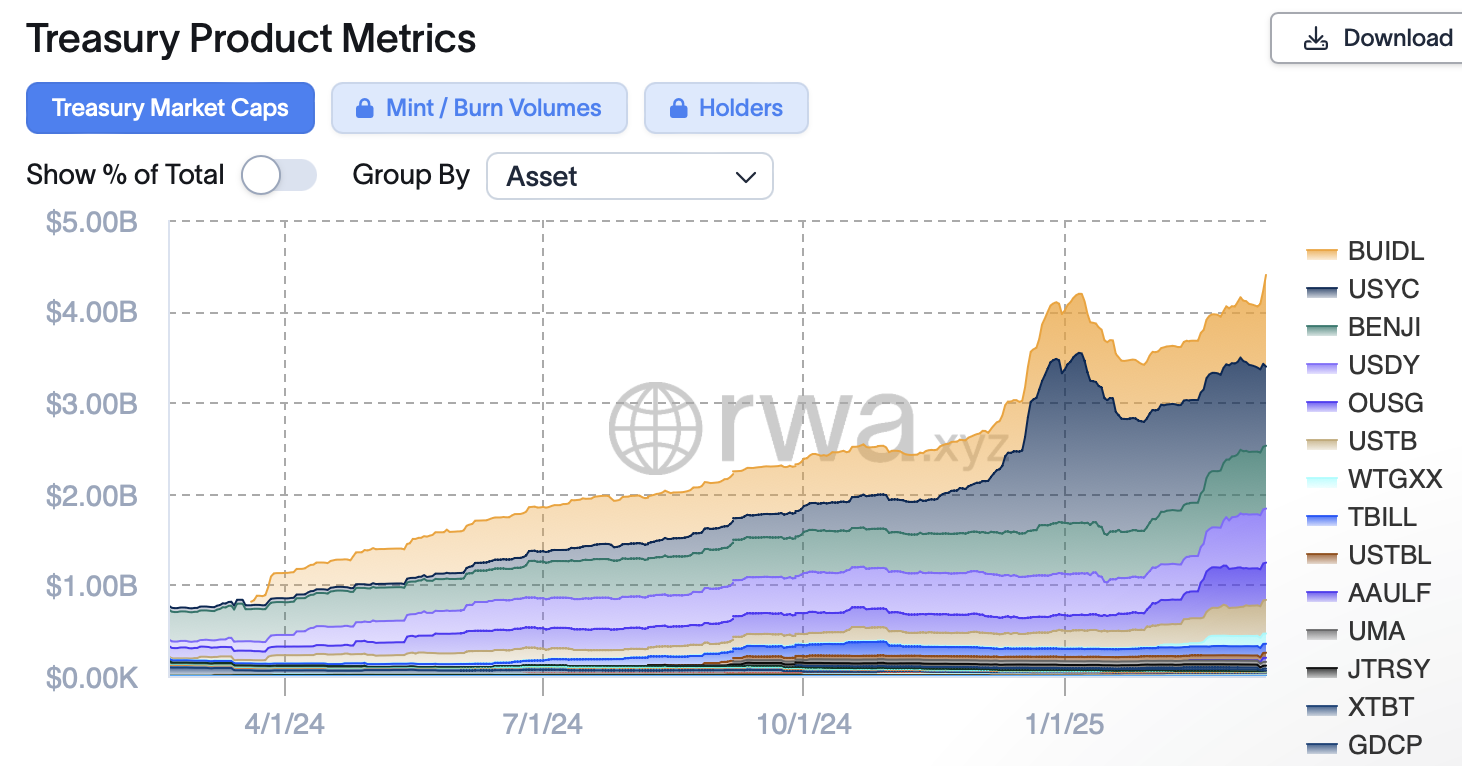

The asset milestone for BlackRock’s BUIDL — a fund investing in cash, US Treasury payments and repurchase agreements — comes per week sooner than its first birthday. The tokenized treasury category (with diversified contributors love Ondo, Hashnote and Franklin Templeton) has grown to roughly $4.4 billion.

BlackRock’s Robbie Mitchnick advised me one day of Wednesday’s Blockworks roundtable that a majority of these the utilization of BUIDL are crypto-native.

They’re companies, for instance, seeing the value prop in generating yield on preserving cash balances in an atmosphere pleasant yield-generating near. Maybe shuffling capital between worldwide locations or making hasty worldwide payments. And then getting liquidity quicker by stablecoin exit ramps.

Waqar Chaudry, Long-established Chartered’s head of digital sources, financing and securities companies and products, pointed to a pair business watchers first and major build believing tokenized cash market funds could possibly also change stablecoins.

Many could possibly favor tokenized funds for collateral administration, Chaudry added. However they’ll co-exist with stablecoins, as he’s seeing cash market funds being subscribed and redeemed by stablecoins on a 24/7 foundation.

“I’m not announcing it’s 50/50 or 80/20,” he talked about of the stablecoin/tokenized MMF mix. “We’ll peep how it develops over the next couple of years, however they’re indubitably complementary.”

Michnick agreed, noting he sees tokenized cash market funds as the predominant cash savings vehicle. Stablecoins, meanwhile, “will defend their dominance” as the instrument for fee and transaction.

“Both are a miniature bit bit greater than the diversified at these respective exercise cases, as lengthy as you defend the frictions down to an extremely low or shut to-zero stage so to cross between them,” Mitchnick talked about. “Then you definately can exercise them in duality in a terribly extremely effective near.”

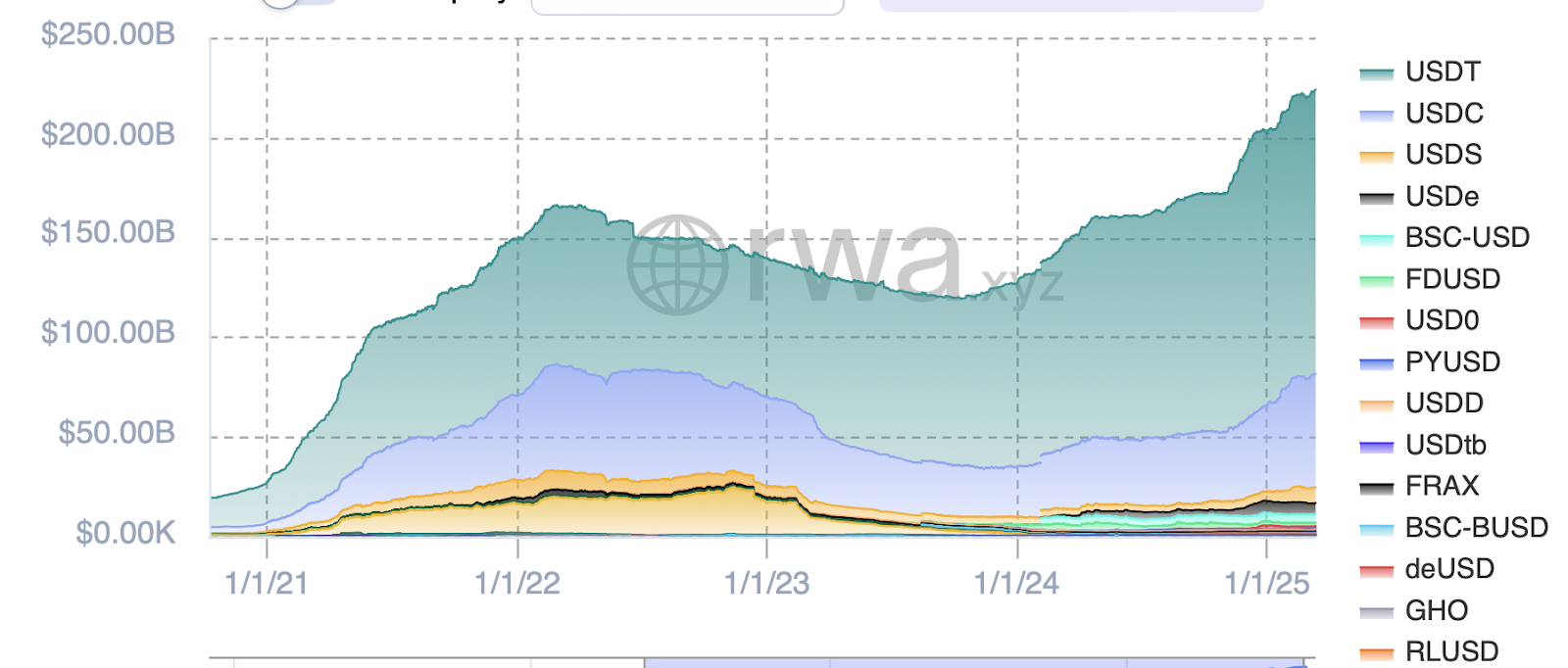

While tokenized treasurys are gaining steam, stablecoins are a considerable greater segment — sporting a roughly $220 billion market cap.

US lawmakers peep the value of stablecoins. Casey the old day detailed how a bill aiming to place regulatory guidelines for stablecoin issuers evolved to the Senate floor.

However Mitchnick eminent: “What we haven’t considered happen up to now in in actuality any arena of tokenization is gargantuan-primarily primarily based uptake from investors and holders who own repeatedly lived within the mature sources irascible and on these rails.”

That speaks to the doable development for BUIDL within the years ahead as the TAM expands.

Tokenized bonds’ myth is “serene not gelling successfully by near of business viability,” Chaudry talked about.

As for why there’s susceptible to be “restricted traction” for tokenized equities, Chaudry added, these markets are pretty atmosphere pleasant already. Then there are efforts to tokenize more illiquid asset lessons (i.e., valid property and interior most equity).

Professionals from BNY, Ondo Finance, Securitize (the company that worked with BlackRock on BUIDL), and Nomyx would possibly be a part of me on a Blockworks Digital Asset Summit panel called “Tokenization: Rebooting the World Financial Machine” to focus on more about this.

Look you there?