Bitcoin label fleet dropped beneath $80,000 on Monday, hitting a four-month low of $77,393. This engaging decline prompted a wave of miner capitulation, prompting them to offload their holdings.

On-chain recordsdata has printed an uptick in miner promote-offs—a pattern that can enhance bearish sentiment within the market and locations more downward stress on BTC’s label.

Bitcoin Worth Drops to Multi-Month Low as Miners Flood Exchanges

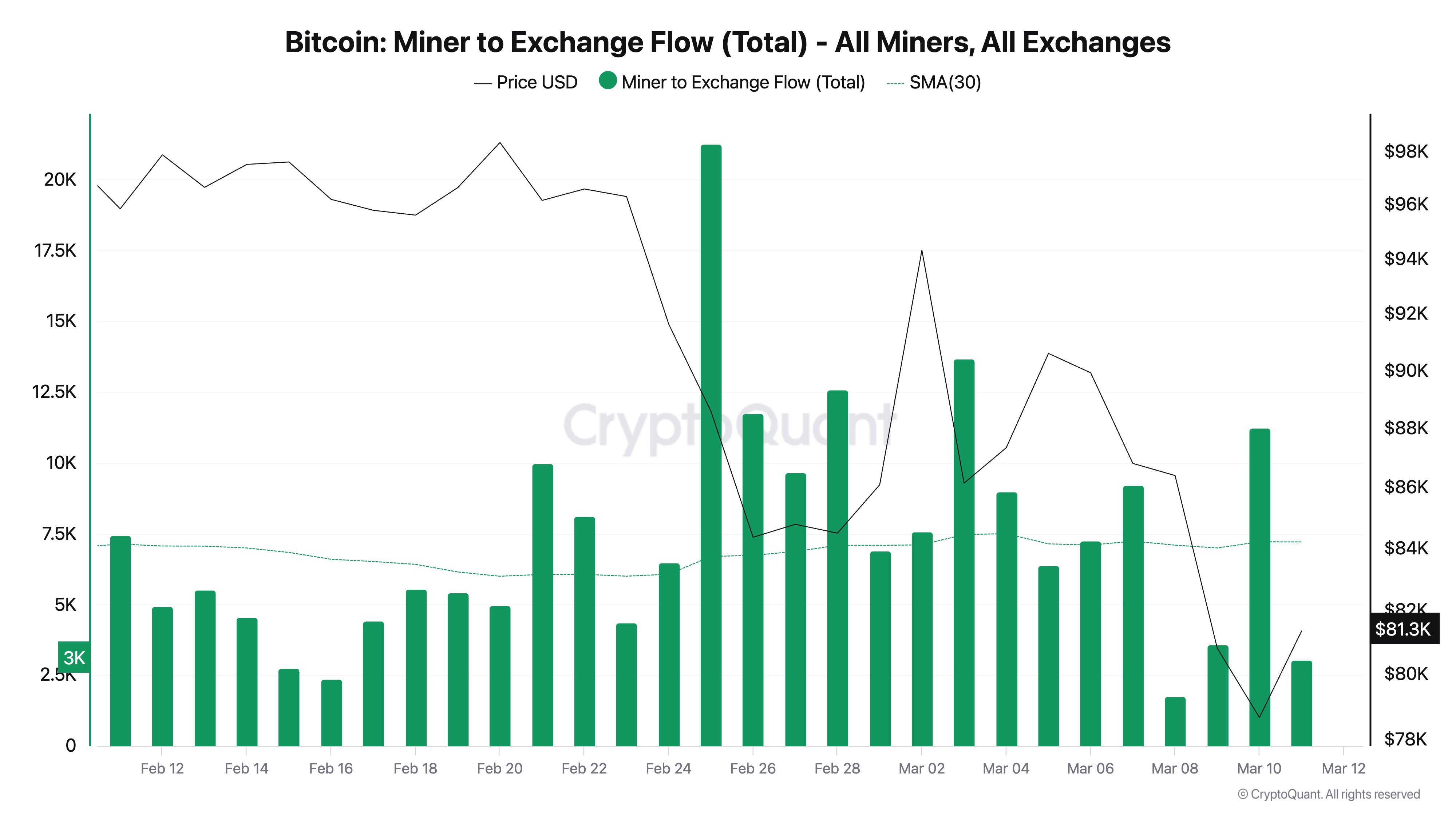

As Bitcoin fell to a multi-month low on Monday, miner transfers to exchanges surged sharply. Per CryptoQuant, BTC’s Miner-to-Alternate Waft—which measures the final amount of coins sent from miner wallets to exchanges—spiked to 11,250 BTC throughout this era.

When BTC’s Miner-to-Alternate Waft climbs like this, it suggests that miners are offloading their holdings, normally to cowl operational charges or mitigate losses. This increased promoting stress can weaken BTC’s label and hurry market downturns.

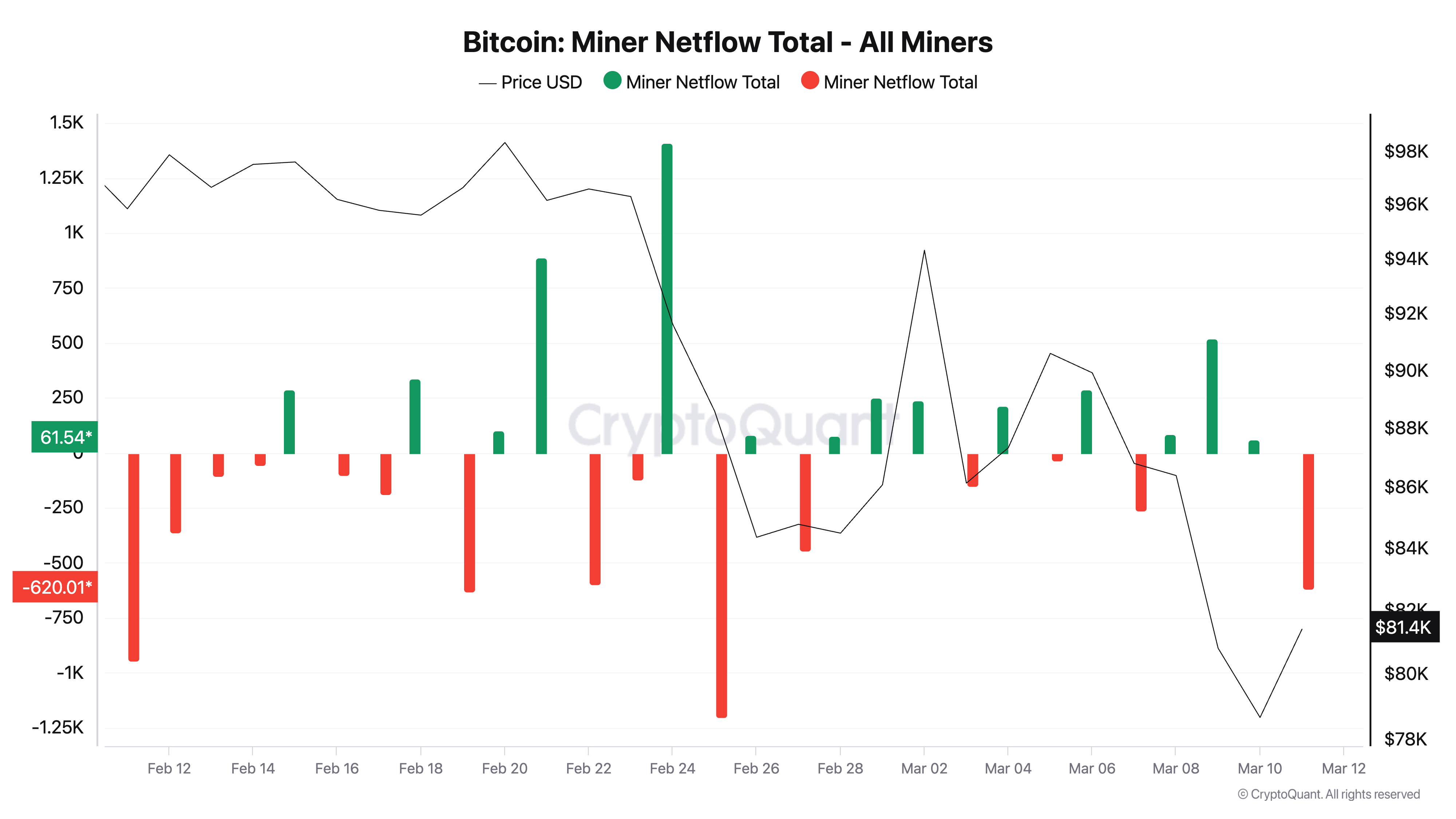

Additional, this day’s fall in BTC miner netflow confirms the coin promote-off pattern among miners on the Bitcoin community. At press time, the metric’s payment is harmful at -620.01.

Miner netflow tracks the catch amount of coins that miners are buying or promoting. It’s calculated by subtracting the amount of BTC miners are promoting from the amount they are buying.

When it is harmful like this, it indicates that miners are promoting more coins than they are buying. Here’s a bearish label and customarily a precursor to an prolonged downward pattern within the coin’s label.

BTC Struggles at $80K Amid Heavy Promoting

Traditionally, miners tend to promote more throughout label declines to cowl operational charges, which adds to promoting stress and may perhaps hurry market downturns. BTC for the time being trades at $81,686, shedding 1% of its payment at some level of the last 24 hours.

Throughout that length, its trading quantity has rocketed over 50%, reflecting the high promoting stutter within the market. If this promoting pattern continues, it can perhaps well hinder BTC’s shut to-time frame restoration, as the coin may perhaps well fall beneath $80,000 all but again to alternate at $73,631.

Nevertheless, if sturdy build a matter to steps in to soak up the extra present, it can perhaps well pressure BTC’s payment up to $86,601.