Major Takeaways

In consequence of Binance Study, that you can presumably take wait on of exchange-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the most modern recordsdata from the arena of crypto compare.

This blog explores key Web3 trends in February 2025 to present a first-rate level thought of the ecosystem’s contemporary scream. We analyze the performance of crypto, DeFi, and NFT markets ahead of previewing major occasions to peer out for in March.Crypto Market Efficiency in February 2025

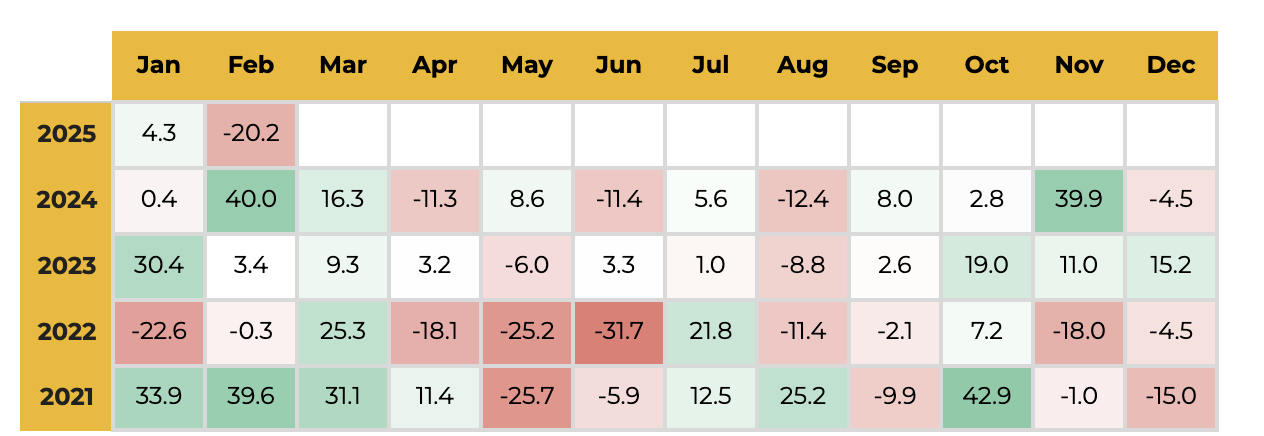

In February 2025, the cryptocurrency market seen a engaging 20.2% decline from the old month. This became once largely driven by the greatest digital hack in historical previous, where Bybit suffered losses exceeding US$1.5 billion, alongside a broader bearish sentiment in world monetary markets. The memecoin sector became once in particular affected, with investor self belief plummeting after the fallout of $LIBRA, a cryptocurrency previously suggested by high-profile figures.

The downturn in crypto mirrored weakening self belief in historical markets, where concerns over tech stock overvaluations and macroeconomic uncertainties fueled a possibility-off sentiment. Without reference to principal earnings forecasts, major tech shares equivalent to NVDA, GOOGL, and AMZN faced primary declines, while the S&P 500’s user discretionary and recordsdata abilities sectors dropped 6% and 3%, respectively. Extra dampening sentiment, President Trump confirmed 25% tariffs on Canadian and Mexican imports, effective from March, ensuing in a surge in U.S. Treasury costs and a decline in yields, pushing crypto liquidity into stablecoins and exact-world sources (RWAs).

Month-to-month crypto market capitalization reduced by 20.2% in February

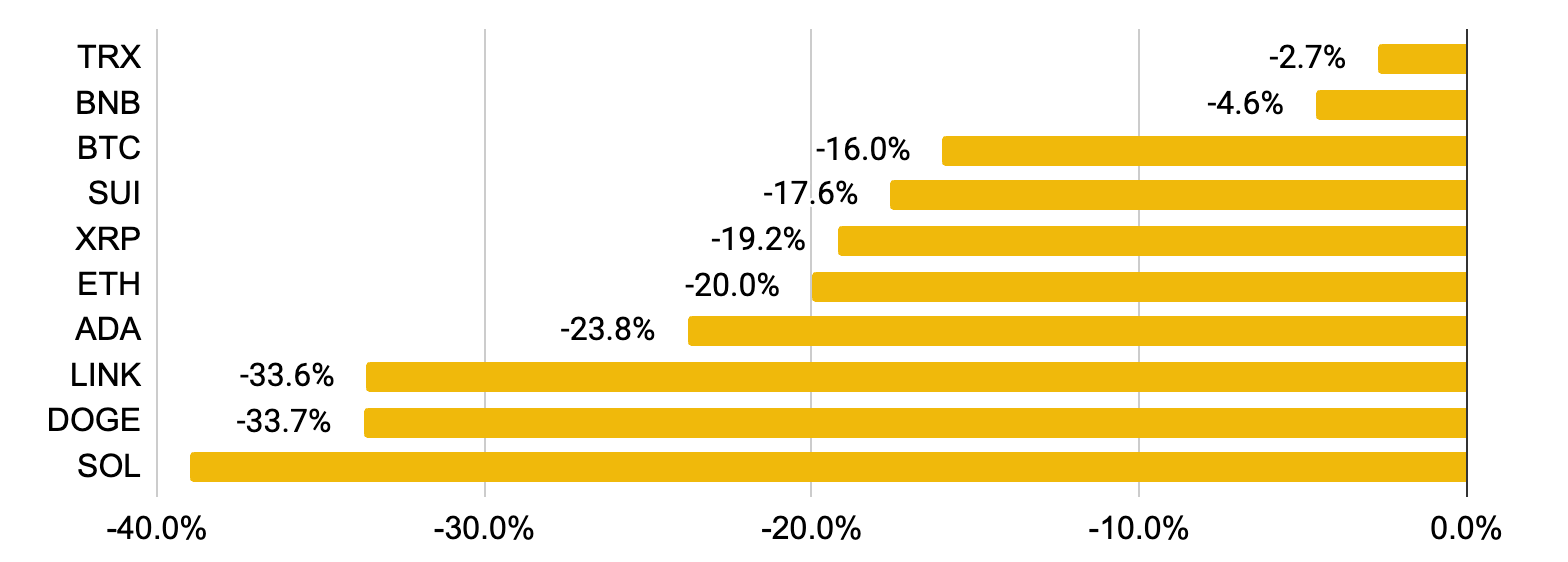

Month-to-month mark performance of the head 10 coins by market capitalization

Provide: CoinMarketCapAs of February 28, 2025

Whereas Tron’s TRX declined 2.7%, the community announced a indispensable exchange: starting in March, USDT transactions will be price-free. This “Gasoline Free” feature lets in USDT to quilt transaction costs, eradicating the need for TRX funds and accelerating Tron’s Q4 2024 diagram to simplify stablecoin transfers. With US$824M in USDT and USDC inflows in February and over US$2B in income closing year, Tron’s scalability continues to develop. Meanwhile, BNB dropped 4.6%, but BNB Chain published an heroic 2025 roadmap centered on mass adoption, featuring sub-2nd block times, AI-driven dazzling wallets, and a diagram of processing 100 million transactions day after day.

BTC seen a steep 16.0% decline, largely ensuing from broader equity market weak point and an absence of catalysts to protect momentum. Crude volatility hit between February 24-26, with nearly US$3B in liquidations marking Bitcoin’s greatest mark tumble since the FTX fall down in 2022. The downturn became once exacerbated by tightening fiat liquidity circumstances and delays within the Trump administration’s prospective nationwide BTC reserve. Meanwhile, SUI and XRP fell 17.6% and 19.2% respectively, as investors rotated liquidity into stablecoins amid rising market uncertainty.

ETH plunged 20%, impacted by the fable-breaking US$1.5 billion Bybit hack and a engaging decline in gasoline costs – down 98.5% from closing year’s height – as users shifted to replace L1s treasure Solana. Without reference to this, Ethereum seen a threefold enlarge in day after day contract deployments since February 1, signaling renewed developer exercise. Alternatively, ADA (-23.8%), LINK (-33.6%), DOGE (-33.7%), and SOL (-39%) had been amongst the greatest losers. Solana, in particular, suffered from uncertainty spherical its 11.2 million token unlock and the LIBRA memecoin fallout. Its TVL plunged by over 30% to its lowest stage since November 2024, as traders bridged nearly US$500M to Ethereum, Sonic, and Arbitrum.

Decentralized Finance (DeFi)

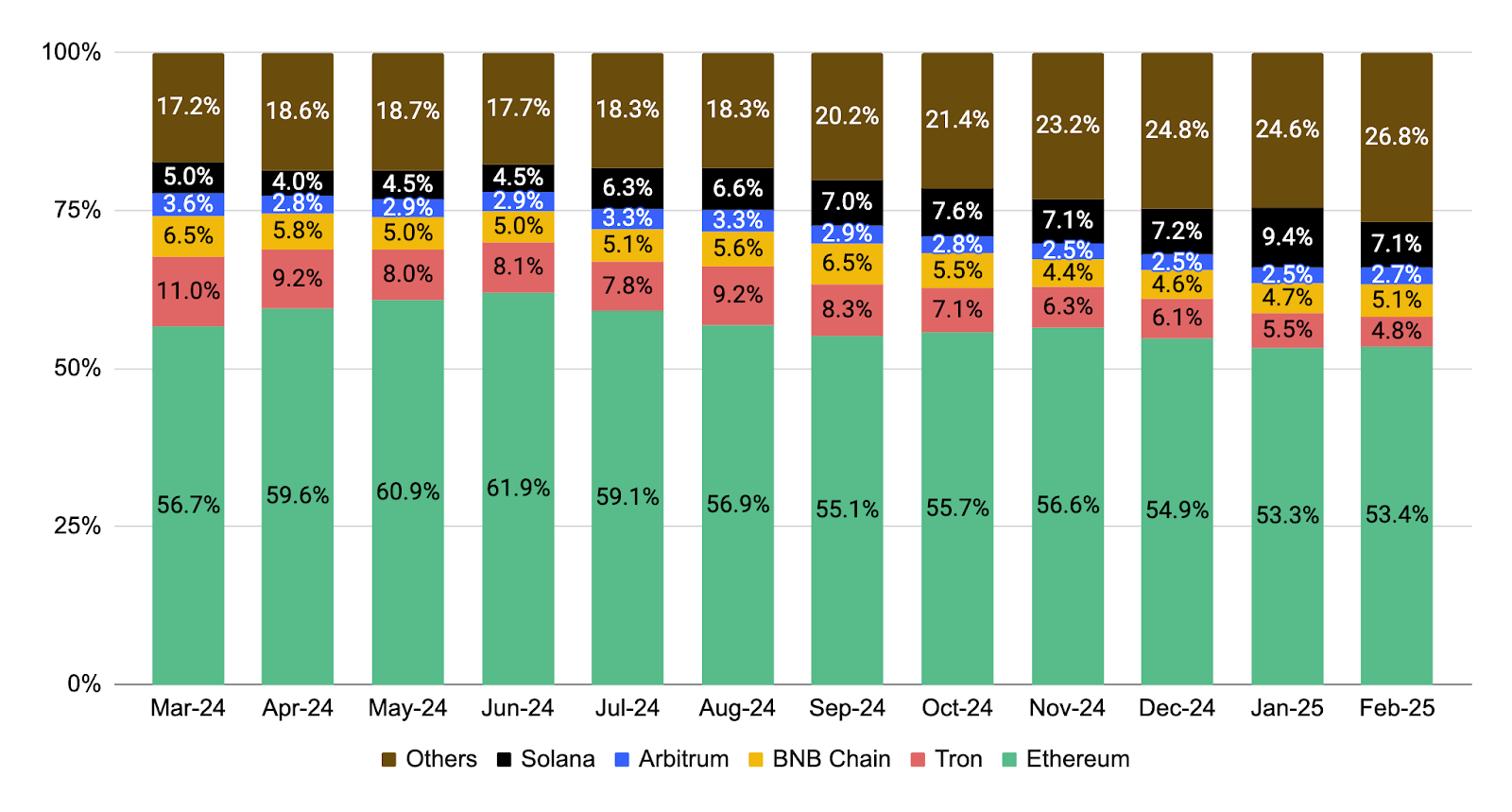

In February 2025, DeFi’s Total Worth Locked (TVL) declined by 14.6%, reflecting broader market turbulence. A indispensable regulatory shift took place as the U.S. SEC withdrew its allure in opposition to a Texas federal court ruling that struck down its broker-vendor rule, which aimed to classify DeFi platforms and liquidity suppliers as securities sellers. This rule would have imposed stringent compliance requirements, alongside with know-your-customer (KYC) and anti-money-laundering (AML) guidelines, but its removal signals a regulatory reprieve for the DeFi sector. Meanwhile, the stablecoin market cap rose by 3.5% to US$224.9B, with stablecoin dominance increasing by 1.4%. This shift suggests that investors are transferring liquidity into staunch sources, likely as a precautionary measure amid market uncertainty.

Solana’s TVL seen a indispensable 30% tumble, hitting its lowest stage since November as memecoin exercise collapsed. Files from Dune Analytics highlighted that memecoin shopping and selling volume on Pump.relaxing plummeted by 74.5% in a single day (February 24), with most tokens losing 80–90% of their value since birth. Amongst the head 10 greatest blockchains by DeFi TVL, BNB Chain became once the finest gainer, rising by 0.2%. Its resilience stands out within the contemporary downturn, driven by ongoing and announced technological advancements, alongside with sub-2nd block times, AI-powered dazzling wallets, and a diagram of processing 100 million transactions per day in its 2025 roadmap.

TVL portion of prime blockchains

Provide: DeFiLlamaAs of February 28, 2025

Non-Fungible Tokens (NFTs)

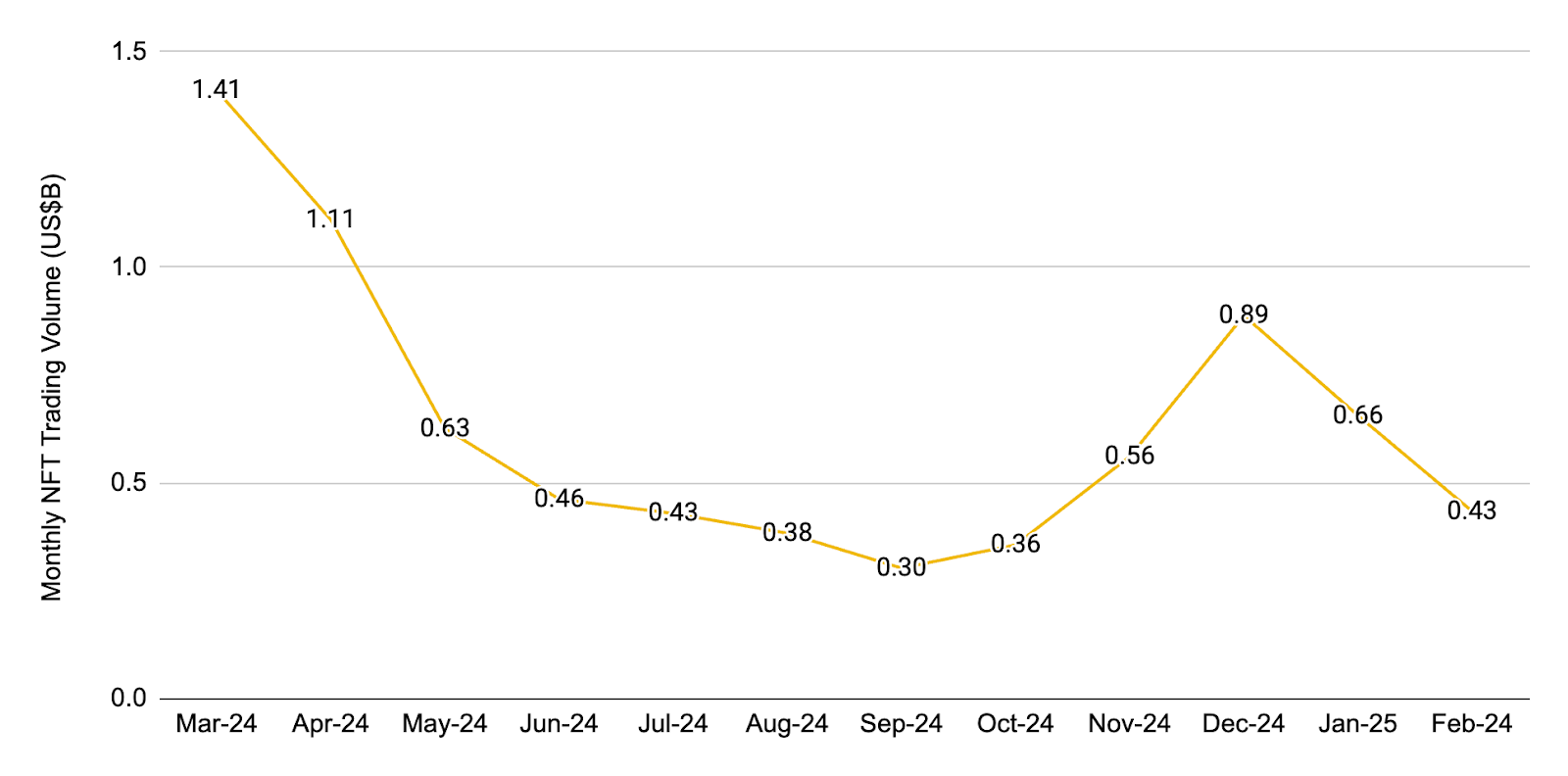

Month-to-month NFT shopping and selling volume

Provide: CryptoSlam As of February 28, 2025

In February 2025, the NFT market seen a engaging 41.2% decline in total gross sales volume all around the head 25 chains, with exceptional customers reaching their lowest stage since April 2021. This downturn became once driven by economic uncertainty, inflation concerns, and a pullback from speculative sources. Alternatively, OpenSea’s market portion surged to 71.5% from 25.5% in upright four weeks, buoyed by the announcement of its native token, SEA, and the starting up of its OS2 shopping and selling platform. A regulatory enhance adopted, as the SEC closed its investigation into OpenSea, confirming that NFTs would no longer be labeled as securities, which seriously eases compliance burden on issuers. Ethereum-essentially based NFT gross sales volume dropped 38.2%, with legacy projects treasure Plump Penguins, Azuki, and Cryptopunks seeing declines. Alternatively, despite decrease gross sales volume, transaction exercise elevated for a range of prime 10 NFT projects by market cap, signaling persevered engagement from collectors.

Upcoming Occasions and Token Unlocks

To succor users protect up up to now on the most modern Web3 news, the Binance Study crew has summarized primary occasions and token unlocks for the month to blueprint. Luxuriate in an glimpse on these upcoming trends within the blockchain house.

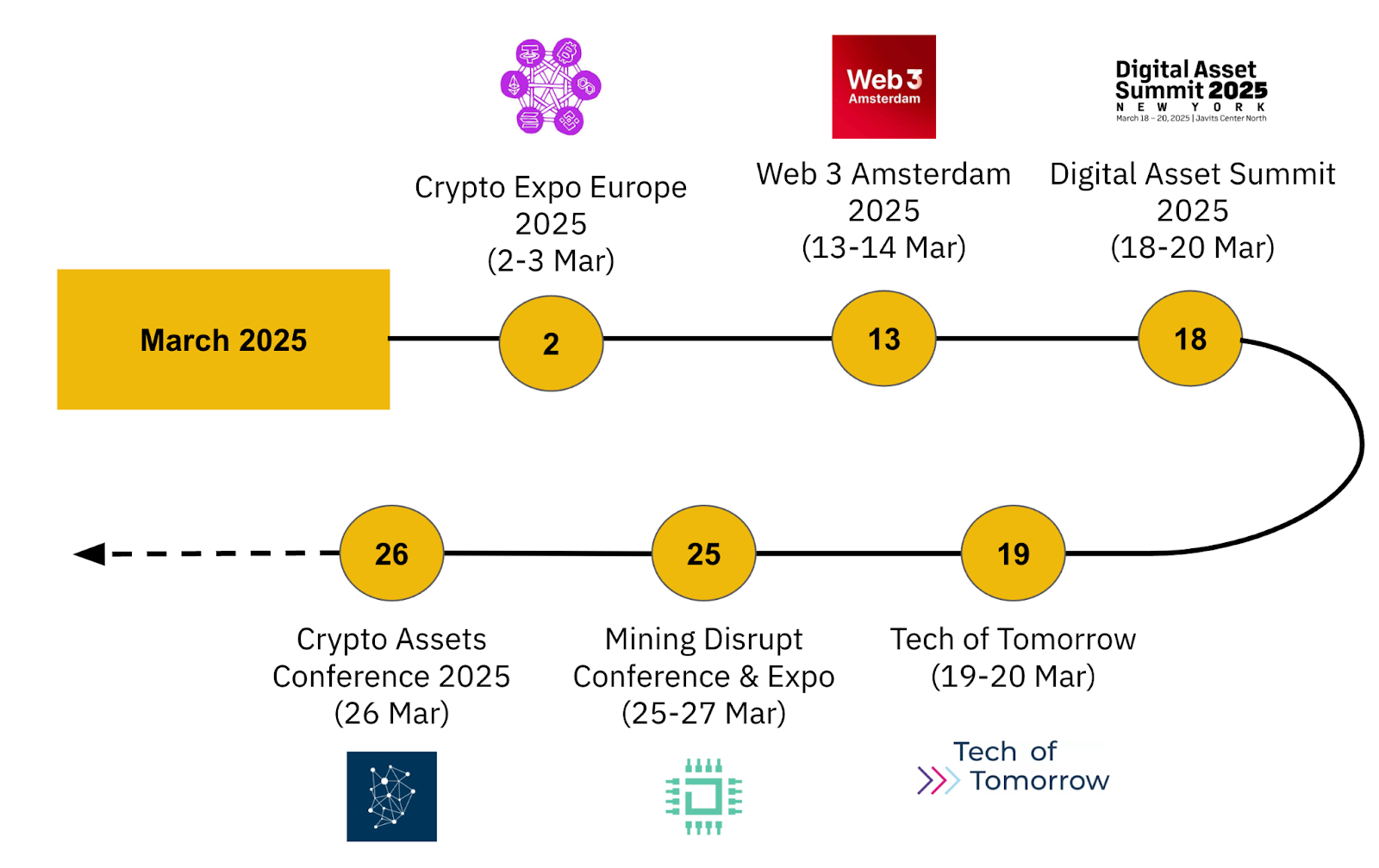

Indispensable Occasions in March 2025

Provide: Cryptoevents, Binance Study

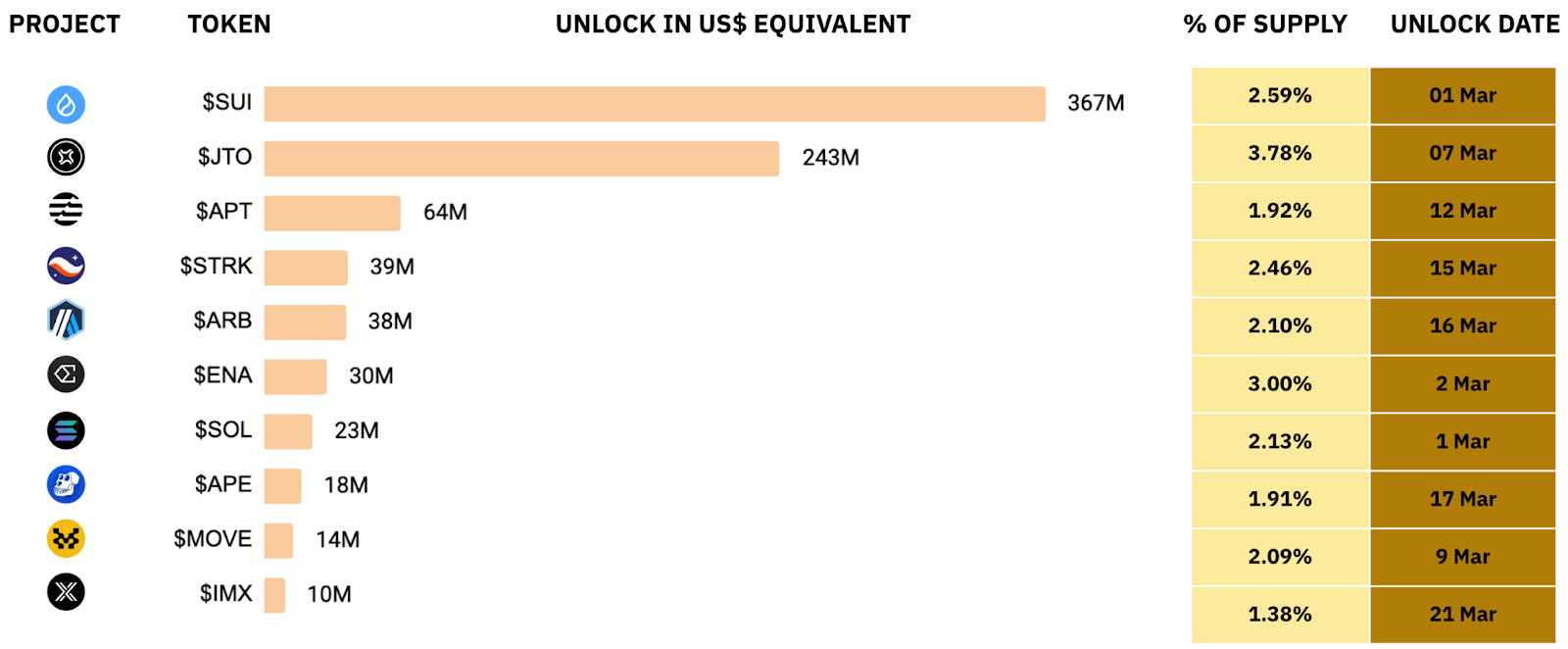

Largest token unlocks in US$ phrases

Provide: CryptoRank, Binance Study

Binance Study

The Binance Study crew is dedicated to delivering diagram, impartial, and complete analyses of the crypto house. We publish insightful takes on Web3 subject issues, alongside with but no longer small to the crypto ecosystem, blockchain capabilities, and the most modern market trends.

This text is more healthy a snapshot of the fat fable, which contains further analyses of the greatest charts from the previous month. The fat fable furthermore dives into explaining the impact of US tariffs on market turbulence, the plummet in Solana’s outflows, exercise, and TVL, the all-time high performance of stablecoins and exact-world sources, as smartly as Bybit security breach.

Be taught the fat model of this Binance Study fable right here.

Extra Reading

-

Binance Study: Key Inclinations in Crypto – February 2024

-

Binance Study: Key Inclinations in Crypto – January 2024

-

Binance Study: Key Inclinations in Crypto – December 2024

Disclaimer: This arena cloth is intelligent by Binance Study and is now not any longer supposed to be relied upon as a forecast or investment advice and is now not any longer a advice, provide, or solicitation to aquire or promote any securities or cryptocurrencies or to adopt any investment technique. Utilizing terminology and the views expressed are supposed to promote understanding and the to blame style of the sector and can merely no longer be interpreted as definitive pleasing views or those of Binance. The opinions expressed are as of the date confirmed above and are the opinions of the creator; they may perchance maybe furthermore merely alternate as subsequent circumstances range. The solutions and opinions contained in this arena cloth are derived from proprietary and non-proprietary sources deemed by Binance Study to be legit, are no longer necessarily all-inclusive, and are no longer assured as to accuracy. As such, no guarantee of accuracy or reliability is given, and no responsibility coming up in any a range of skill for errors and omissions (alongside with responsibility to any individual by motive of negligence) is licensed by Binance. This arena cloth may perchance maybe presumably furthermore merely possess ‘ahead-taking a peer’ recordsdata that is now not any longer purely historical in nature. Such recordsdata may perchance maybe presumably furthermore merely consist of, amongst a range of issues, projections and forecasts. There may perchance be now not one of these thing as a guarantee that any forecasts made will blueprint to pass. Reliance upon recordsdata in this arena cloth is on the sole discretion of the reader. This arena cloth is supposed for recordsdata capabilities finest and doesn’t constitute investment advice or a recommendation or solicitation to aquire or promote in any securities, cryptocurrencies, or any investment technique, nor shall any securities or cryptocurrency be provided or bought to any individual in any jurisdiction in which a recommendation, solicitation, aquire, or sale may perchance maybe presumably be illegal beneath the criminal pointers of such jurisdiction. Funding involves risks.