Bitcoin designate chart is now firmly bearish, in step with former commodities vendor Peter Brandt.

The evaluation follows Bitcoin‘s weekend fall to $80,000 as geopolitical uncertainty continues to outweigh White Dwelling enhance. Namely, the asset has been caught up in broader uncertainty over President Donald Trump’s tariff policy, Russia-Ukraine battle stance, and government spending cuts, which fill additionally seen gentle bother markets plummet.

Bearish Bitcoin

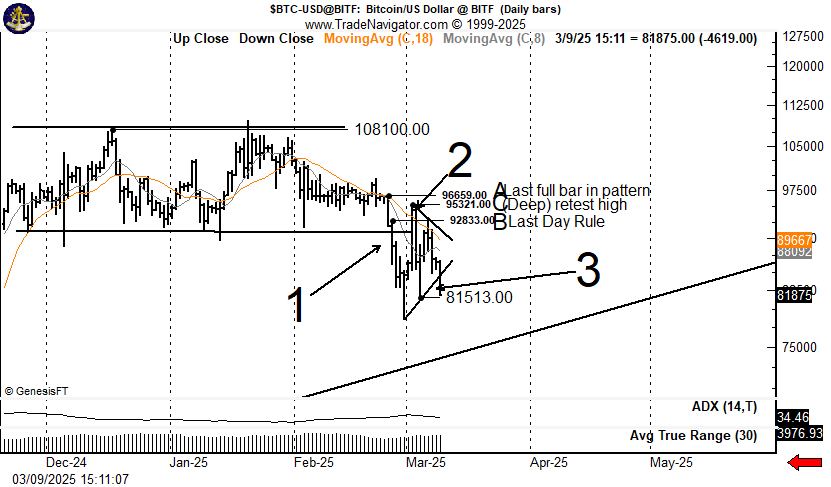

On Sunday, March 9, Brandt asserted that Bitcoin’s designate chart used to be bearish as it had executed a double-high sample forming on the day-to-day candle chart since mid-December 2024 and a pennant forming since gradual February 2025. The damaged-down is a classic designate reversal or bearish continuation sample, whereas the latter is a continuation sample.

To flip particular, the previous vendor contended that Bitcoin has to damage above the cease of the pennant all by technique of the $95,000 designate point.

Interestingly, as a minimal one different prominent analyst is having a bet on this particular reversal.

Looking ahead to a “tariff noise slowdown,” Customary Chartered Head of Digital Sources Compare Geoffrey Kendrick opined in a Friday, March 7 demonstrate that Bitcoin might perchance well well perchance damage above the $80,000 to $95,000 differ soon.

“Aquire weekend dip introduced on by lack of news from Trump tonight, glimpse for a breakout of the cease of this differ soon (particularly if the tariff noise can gradual down for a whereas),” he wrote.

However failure to contend with out this breakout soon might perchance well well perchance portray Bitcoin to vital downside bother. In the early stages of the double high formation on the asset’s day-to-day chart, Brandt had warned of a doubtless designate fall to $75,000.

On the time of writing, Bitcoin has pared about a of its weekend losses to trade at $82,500.