Treasury Secretary Howard Lutnick insists the U.S. financial system is on solid footing despite concerns from Wall Avenue that a recession is in the cards.

“Fully no longer,” he talked about on a Sunday edition of Meet the Press when requested if American citizens would possibly maybe well additionally light prepare for a downturn.

“There would possibly be going to be no recession in The United States,” he persisted. “Or no longer it’s bask in the same folks that thought Donald Trump wasn’t a winner a yr ago. Donald Trump is a winner. He goes to safe for the American folks.”

A recession is 2 consecutive quarters of financial contraction, induced by imbalances from external or interior components, or aggregate of both.

“President is on it and he is great on it, and he is no longer going to take hang of his foot off the gasoline.” These tariffs are part of a drug battle. Canada and Mexico must shut down the waft of fentanyl across our border and China must stop subsidizing the production. The Trump Administration… pic.twitter.com/nY9x7bx7Wu

— Howard Lutnick (@howardlutnick) March 9, 2025

This argument contradicts comments made by the President earlier, who didn’t rule out a recession, calling it part of a transition.

Lutnick argued that Trump’s tariff approach will power other nations to decrease their alternate barriers, unleashing American assert and driving $1.3 trillion in fresh funding.

“We’re going to unleash The United States out to the sector,” he talked about in step with warnings from JPMorgan and Goldman Sachs a pair of tariff-induced recession. “You’re going to have a look at over the following two years basically the most attention-grabbing put of assert coming from The United States.”

Whereas Lutnick acknowledged that tariffs would possibly maybe well invent international items more dear, he framed them as part of a broader effort to minimize the deficit and decrease borrowing costs.

“Once you happen to stability the finances… you power hobby rates down 150 foundation positive aspects. Mortgages reach smashing down. The worth of your discipline will reach smashing down,” he talked about.

Crypto traders, on the different hand, fabricate no longer appear to rep the same optimism.

Bitcoin (BTC) fell 7% on Sunday, shedding to $80,000 and nearing its 2025 low of $78,000.

Ether (ETH), Solana (SOL), and XRP (XRP) followed, while meme coins bask in Dogecoin (DOGE) and Cardano (ADA) tumbled practically 12%.

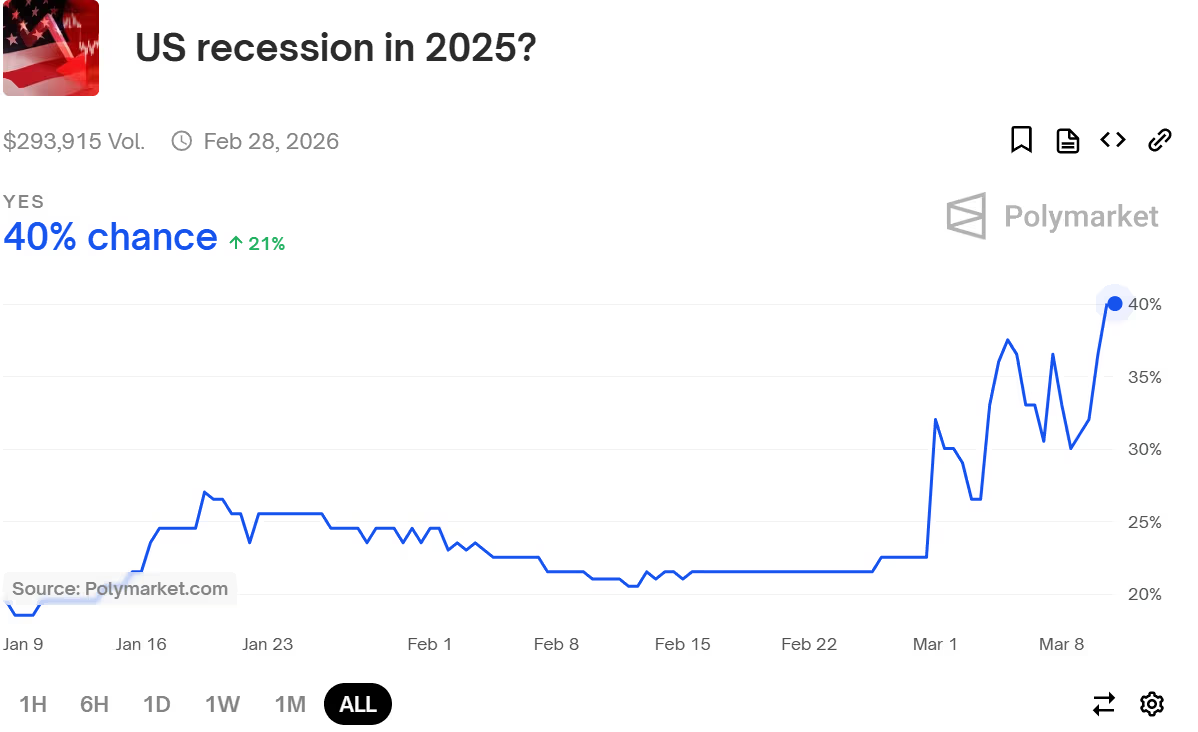

On Polymarket, bettors are an increasing form of bracing for a slowdown, even supposing the possibilities of one going down remain slim.

A contract asking in regards to the possibility of a U.S. recession in 2025 has considered the Yes odds bounce to 41%, a 16% enhance in fresh weeks.

Meanwhile, basically the most in sort U.S. jobs document showed 151,000 jobs added in February, CoinDesk currently reported, roughly in step with expectations, even supposing the unemployment price ticked up to 4.1% and January’s job beneficial properties had been revised decrease.

On the other hand, layoffs in the general public sector as part of the White Condo’s DOGE efforts would possibly maybe well additionally push these numbers up next quarter.

Whereas labor market resilience has kept recession calls at bay, signs of slowing assert are emerging, with the Atlanta Fed’s GDPNow mannequin forecasting a unfavorable 2.8% Q1 assert price.

On the other hand, one other contract provides good 3% chance of a recession going down ahead of Would maybe maybe. The first quarter ends March 31.