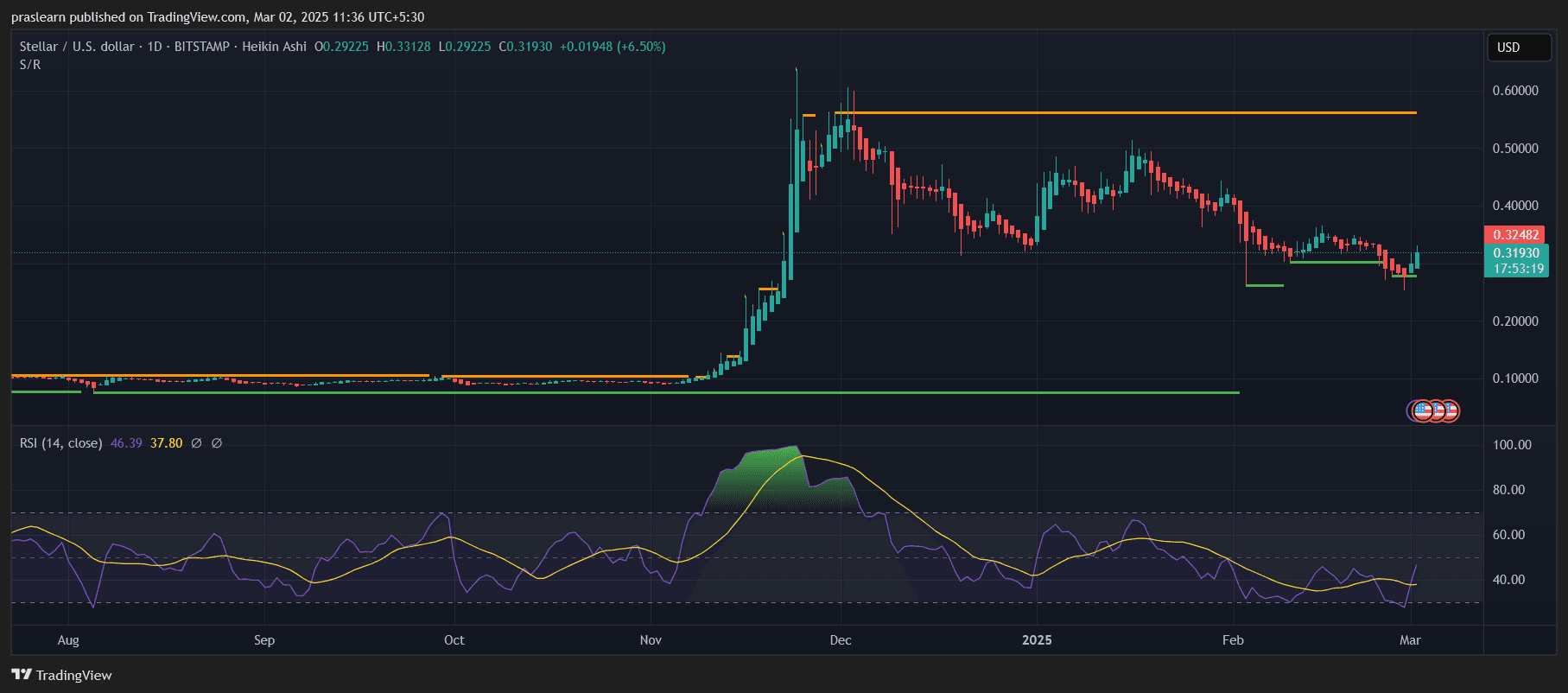

Stellar (XLM) has skilled a prime label trip over the past few months, first rallying strongly in late 2024 before entering a continual correction section. After reaching a excessive near $0.60, XLM has since retraced, no longer too prolonged within the past finding toughen around $0.28-$0.30. On the different hand, with a exiguous 6.50% leap within the latest session, merchants are actually asking: Is Stellar about to spoil out of its downtrend, or is that this handsome a non permanent support rally before one more leg down?

This Stellar label prediction will explore key toughen and resistance levels, technical indicators, and doubtless label scenarios to search out out whether or no longer XLM can care for its restoration or if additional declines are forward.

Stellar Notice Prediction: Is XLM Showing Signs of Recovery?

XLM’s latest label trip suggests early indicators of a imaginable restoration, as the coin has bounced from its recent toughen zone around $0.28-$0.30 and is now trading around $0.3193. The 6.50% each day carry out bigger would possibly perhaps well ticket renewed attempting to search out passion, nevertheless the total structure stays cautiously bearish, with decrease highs and decrease lows still intact.

One the biggest component to peep is whether or no longer this leap can retain. If XLM can care for beneficial properties and assign elevated toughen, it can well signal the initiating of a pattern reversal. On the different hand, if promoting rigidity increases at key resistance levels, this breeze would possibly perhaps well grow to be one more bull trap before additional declines.

What Is the RSI Indicating About XLM’s Momentum?

The Relative Strength Index (RSI) is on the second at 46.39, a critical restoration from its recent lows. Although this implies that XLM label is now no longer in oversold territory, it stays below the 50-goal level, which technique bullish momentum is never any longer yet confirmed.

For a handsome reversal, the RSI needs to spoil above 50 and care for a elevated pattern, signaling that patrons are taking care for an eye on. If RSI stays below 50, XLM would possibly perhaps well continue consolidating and even retest decrease helps before attempting a stronger rally.

What Are the Key Strengthen and Resistance Ranges?

Strengthen Ranges:

The most critical instant toughen for XLM is around $0.28-$0.30, where the worth no longer too prolonged within the past bounced. If this level holds, XLM would possibly perhaps well originate a unsuitable for added upward trip. On the different hand, a spoil below this vary would repeat the following predominant toughen at $0.20, which served as a old accumulation zone before the November rally.

Resistance Ranges:

On the upside, XLM must determined $0.35-$0.38 to substantiate a bullish breakout. This space has acted as sturdy resistance all thru the recent downtrend, rejecting label restoration makes an try. A decisive close above $0.38 would possibly perhaps well trigger a breeze in direction of $0.Forty five, the following predominant resistance.

Past $0.Forty five, the final resistance stands at $0.60, where XLM final peaked. Breaking past this level would ticket a plump pattern reversal, paving the top doubtless contrivance for a doubtless rally in direction of recent highs.

XLM Notice Prediction: Can XLM Absorb Its Rally or Will It Face One more Rejection?

While on the present time’s leap is encouraging, XLM still faces sturdy resistance forward. For a bullish continuation, the worth must spoil above $0.35-$0.38 and assign it as a recent toughen zone. If attempting to search out rigidity continues and volume increases, XLM would possibly perhaps well strive a bustle in direction of $0.Forty five and past.

On the different hand, failure to spoil above resistance levels would possibly perhaps well lead to one more rejection, sending XLM wait on in direction of its $0.28-$0.30 toughen. A breakdown below this level would birth the door for additional losses in direction of $0.20, delaying any doubtless bullish restoration.

What’s the Outlook for Stellar Notice within the Coming Weeks?

Given the present market conditions, two imaginable scenarios would possibly perhaps well unfold:

- Bullish Scenario: If XLM label holds above $0.30 and breaks past $0.38, a bullish breeze in direction of $0.Forty five-$0.50 would possibly perhaps well be aware. Sustained volume and RSI transferring above 50 would toughen this case.

- Bearish Scenario: If XLM label fails to spoil resistance and drops below $0.28, the following target can be $0.20, signaling persisted weak spot within the market.

XLM Notice Prediction: Will Stellar (XLM) Continue Rising or Descend Further?

Stellar label is on the second at a the biggest turning level, attempting to get better after a continual correction. While on the present time’s 6.50% leap suggests renewed attempting to search out passion, sturdy resistance at $0.35-$0.38 stays a serious hurdle.

For XLM to verify a pattern reversal, it must care for elevated label action and spoil key resistance zones. Till then, the market stays in a wait-and-peep mode, with the wretchedness of additional downside still present.

Merchants must care for an stare on volume, RSI trip, and worth action near toughen and resistance zones to evaluate XLM’s next doubtless breeze. Will Stellar reclaim its bullish momentum, or is one more leg down on the horizon? The next couple of weeks can be critical in shaping XLM’s future pattern.