Solana (SOL) is facing critical volatility, with its Total Fee Locked (TVL) falling under $9 billion for the first time since November 2024. This decline has raised issues about user self perception within the ecosystem.

No topic this, Solana remains one amongst essentially the most dominant chains by strategy of quantity, ranking second in the abet of Ethereum in the closing seven days. If user self perception returns and an uptrend emerges, SOL would per chance well reclaim values above $200 in March, however continued promoting strain would per chance well additionally push it under $100.

SOL TVL Fell Below $9 Billion For The First Time Since November 2024

SOL’s Total Fee Locked (TVL) is at the second at $8.5 billion, losing from its all-time excessive of $14.2 billion on January 18. TVL measures the total amount of sources locked in a blockchain’s decentralized finance (DeFi) protocols, reflecting user self perception and liquidity within the ecosystem.

It is a key indicator of network successfully being, as a rising TVL suggests rising adoption and capital inflows, while a declining TVL indicates reduced user engagement or capital outflows.

This is the first time SOL’s TVL has fallen under $9 billion since November 9, raising issues about the chain’s future. The decline coincides with rising team skepticism about the sustainability of foremost avid gamers esteem Pumpfun and Meterora, that are perceived as highly extractive.

Moreover, controversies surrounding the open of meme coin LIBRA absorb contributed to uncertainty within the ecosystem. If TVL continues to decrease, it would per chance well signal declining user self perception, doubtlessly ensuing in extra designate corrections for SOL.

Solana Is Easy A Dominant Community, No topic the Most favorite Corrections

No topic the solid designate correction SOL has confronted in recent weeks, it remains one amongst essentially the most dominant avid gamers in the crypto condominium.

Despite the truth that its volumes are no longer as excessive as they were about a months previously, Solana continues to worth critical user exercise and adoption.

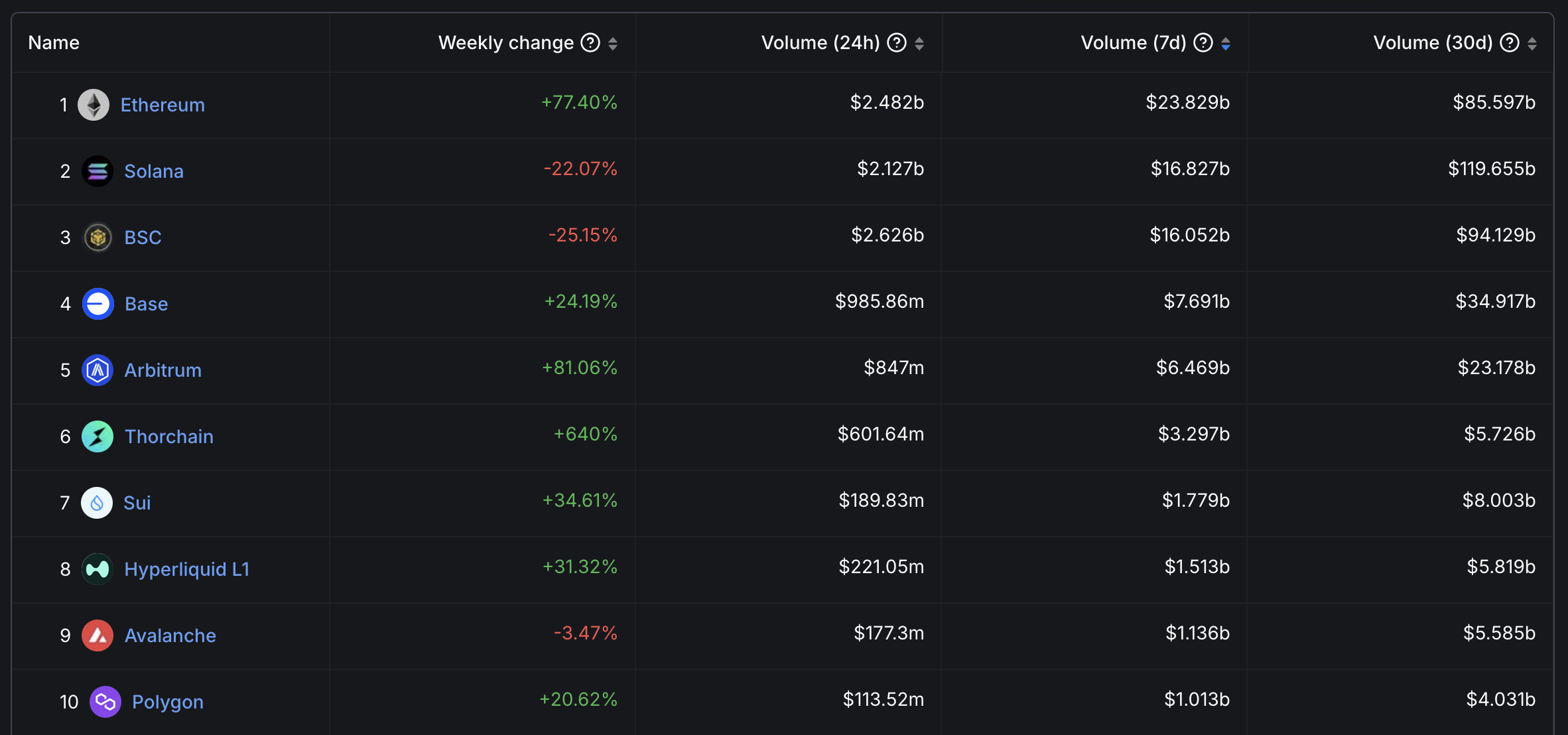

Among the many supreme chains, Solana at the second holds the second space by strategy of quantity over the closing seven days, most fascinating surpassed by Ethereum however carefully followed by BNB, which has been gaining momentum no longer too long previously.

Within the closing 30 days, Solana has led by strategy of quantity, reaching $120 billion when put next with $94 billion for BNB and $85 billion for Ethereum.

This reveals that despite the cost correction, Solana remains one amongst essentially the most veteran blockchains, with massive quantity.

Solana Can Reclaim $200 In March, However a Real Uptrend Would Be Wished

If essentially the most favorite correction continues, Solana designate would per chance well test the toughen at $120 rapidly.

If this stage is broken, the cost would per chance well decline extra to $110 and doubtlessly descend under $100 for the first time since December 2023.

On-chain metrics present that Solana remains one amongst essentially the most veteran chains on the market, suggesting solid underlying put apart a question to. If an uptrend emerges, SOL would per chance well test a resistance at $152.

“For Solana, I am looking out at the quite rising stage of shorts that are amassing across exchanges. This, blended with the truth that FUD dialogue charges absorb been rising, signals that a turnaround if truth be told is great for a sentiment-driven asset esteem SOL… Once markets are in a space to soar a little bit, don’t be surprised if Solana has a bigger soar than most due to the the total retail losing by the wayside,” said Brian, Lead Analyst at Santiment

Breaking this stage would per chance well result in a rally towards $183. If user self perception returns, SOL would per chance well even reach $205, reclaiming values above $200 in March.