Blockchain analyst Jamie Coutts says that a particular on-chain indicator strongly means that Bitcoin ought to mild attain a minimal mark target of $100,000 by subsequent 365 days.

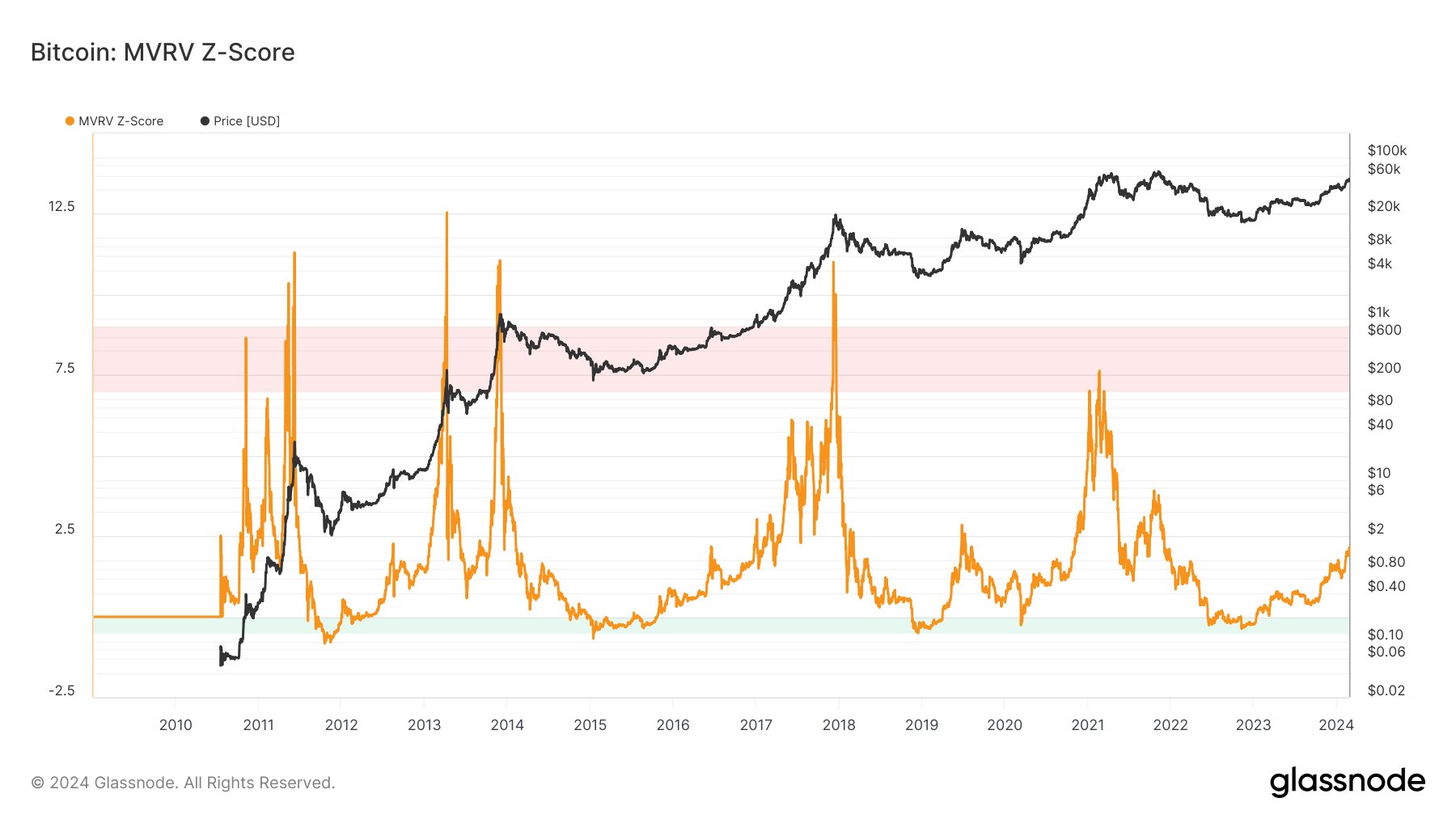

Coutts tells his followers on the social media platform X that he’s staring at Bitcoin’s MVRV Z-collect, which targets to measure whether or now not BTC is “undervalued” or “hyped up” by comparing its market payment to its realized payment.

According to Coutts, in response to the metric’s ancient cycles and the present Bitcoin mark, the MVRV Z-collect ought to mild top out four now not unique deviations above ravishing payment, implying as a minimal $100,000 per BTC by 2025.

“Last time MVRV Z-collect became rising >2 now not unique deviations in a recent cycle became November 2020, 6 months after the Halving. Bitcoin is now sooner than outdated 2 cycles on mark performance. MVRV Z-collect topped above 6 final cycle. If cycle moderation continues, then 4-5 now not unique deviations appears to be like ravishing this cycle, implying a BTC mark of $100k min by 2025.”

Coutts, a gentle Bloomberg analyst, additionally shares an Ethereum versus Bitcoin (ETH/BTC) chart that he says acts as a signal for the assorted phases of crypto bull markets.

According to the analyst, ETH/BTC’s 50-week uncomplicated curious common (SMA) curious above its 200-week SMA has – even though the pattern size is low – historically signaled the origin of a recent bull market chapter where capital rotates from Bitcoin into altcoins.

“My market regime [for] Ethereum vs. Bitcoin signal will likely trigger in the upcoming days, marking the next share in the crypto bull market.

The signal and rationale are uncomplicated;

In the first share of the bull market, BTC outperforms and the tombstone engravers procedure for ETH pushing the ratio to -3 now not unique deviation underneath the 200 SMA – witness blue chart (2019, 2022, and 2023).

What follows is a clawback that goes quite brushed off and then speeds up as the revenue takers transfer in pre-halving, rotating earnings into alts. This conservative procedure waits for the 50/200 SMA depraved sooner than it confirms.

Statistically critical? No. Simplest a handful of circumstances, but that’s all we wish to work with in crypto. Intuitively, it is sweet, mapping degen psychology. And it has guardrails in affirm that if it doesn’t work, the 50/200 SMA will signal by crossing in the opposite route, because it did in 2022, for most ceaselessly a little loss.”

Generated Image: Midjourney