Hedera (HBAR) is down bigger than 4% within the closing 24 hours, with its market cap now at $8.4 billion. Despite a non everlasting spike earlier this day, HBAR’s BBTrend stays detrimental, signaling continual bearish momentum.

On the opposite hand, the Ichimoku Cloud signifies a possible bullish reversal if shopping curiosity strengthens. If non everlasting EMA traces injurious above lengthy-term ones, HBAR would perhaps take a look at resistance at $0.24 and presumably rise above $0.30 for the predominant time since February 1.

HBAR BBTrend Reveals a Failed Bullish Pattern Strive

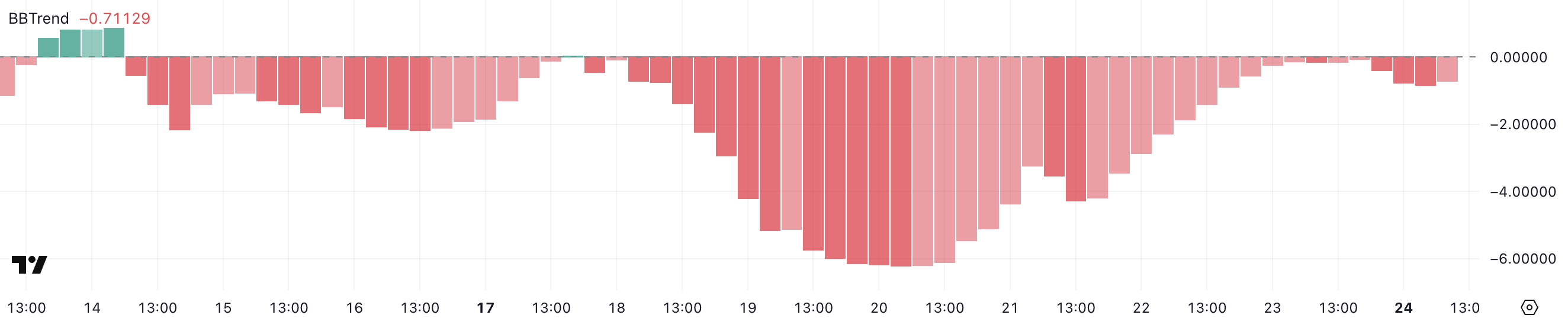

HBAR’s BBTrend is currently at -0.71 and has remained detrimental since February 18, indicating a continual bearish momentum. The indicator hit a detrimental top of -6.21 on February 20 sooner than gradually making improvements to to -0.06 the day gone by, most inspiring to drop again.

BBTrend, or Bollinger Band Pattern, measures the momentum and route of worth movements relative to the Bollinger Bands. A detrimental worth means that the associated price is trending toward the lower band, signaling bearish sentiment, while a undeniable worth signifies bullish momentum toward the upper band.

Hedera’s BBTrend at -0.71, dropping from -0.06 the day gone by, means that bearish momentum is regaining strength after a transient recovery try. This reversal signifies renewed promoting stress, presumably main to further worth declines if the detrimental pattern continues.

The inability to defend up a undeniable shift signals weakness in shopping curiosity, increasing the likelihood of continued downside motion for HBAR. If BBTrend stays detrimental, HBAR would perhaps face extra promoting stress unless a undeniable reversal emerges.

HBAR Ichimoku Cloud Reveals a Bullish Pattern Could perhaps presumably Produce, But It’s No longer Established Yet

The Ichimoku Cloud chart for HBAR reveals that the associated price has at the moment broken above the cloud, which is on the total a bullish signal. On the opposite hand, the cloud ahead is thin and fairly bearish, indicating historic resistance.

The blue Tenkan-sen line is above the red Kijun-sen line, suggesting non everlasting bullish momentum. Yet, the halt proximity of these traces signals a shortage of solid pattern conviction.

The golf green Chikou Span line is above the associated price, confirming bullish sentiment, but it completely is halt to the candles, indicating indecision. The breakout above the cloud wants to be sustained for a continued uptrend. If the associated price falls reduction below the cloud, it is going to invalidate the bullish breakout.

Overall, while the chart reveals a non everlasting bullish signal, the customary cloud and slender gap between the Tenkan-sen and Kijun-sen imply warning, as the pattern is now not strongly confirmed.

Hedera (HBAR) Could perhaps presumably Upward push Back To $0.3 If This Occurs

HBAR’s EMA traces dispute that the bearish pattern stays dominant, with non everlasting traces positioned above lengthy-term ones, signaling continued promoting stress.

On the opposite hand, the Ichimoku Cloud suggests the likelihood of a bullish reversal.

If the non everlasting EMA traces injurious above the lengthy-term ones, it is going to trigger shopping curiosity, main HBAR to take a look at the resistance at $0.24. Breaking above this level would perhaps push the associated price to $0.29, and if the momentum continues, HBAR would perhaps rise to $0.32, marking its first switch above $0.30 since February 1.

Conversely, if the fresh downtrend persists, HBAR worth would perhaps retest the toughen at $0.19. A atomize below this level would dispute elevated bearish momentum, presumably main to a drop to $0.179.