The leading coin, Bitcoin, has been trading within a slim differ since the muse of February. It has struggled to maneuver of consolidation as every buying for and selling pressures live subdued.

On-chain knowledge suggests that this era of sideways motion would possibly perhaps well maybe persist attributable to weakening project on the Bitcoin network.

Bitcoin Might more than seemingly well Face Prolonged Sideways Motion as Network Task Drops

Per a fresh anecdote by pseudonymous CryptoQuant analyst Avocado_onchain, Bitcoin network project has been gradually declining, contributing to BTC’s fresh slim impress movements. If this continues, “we have to possess in thoughts the chance of one more prolonged consolidation phase, the same to what started in March 2024,” the analyst says.

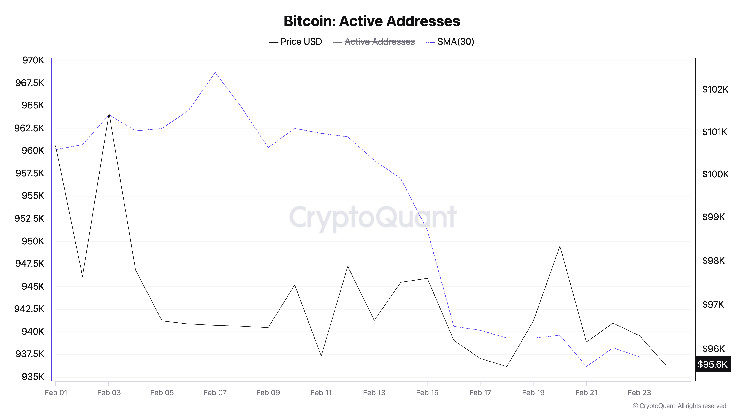

One such knowledge Avocado considers is the replace of on each day foundation active wallet addresses on the Bitcoin network. Per CryptoQuant’s knowledge, when noticed using a 30-day miniature intriguing moderate (SMA), the on each day foundation depend of addresses which have finished no longer no longer as a lot as one BTC transaction has plummeted by 2% since February 1.

A decline in active on each day foundation wallets on the Bitcoin network alerts decreased user quiz. This can make a contribution to downward impress rigidity on the coin, as decreased network project usually aligns with decrease buying for hobby.

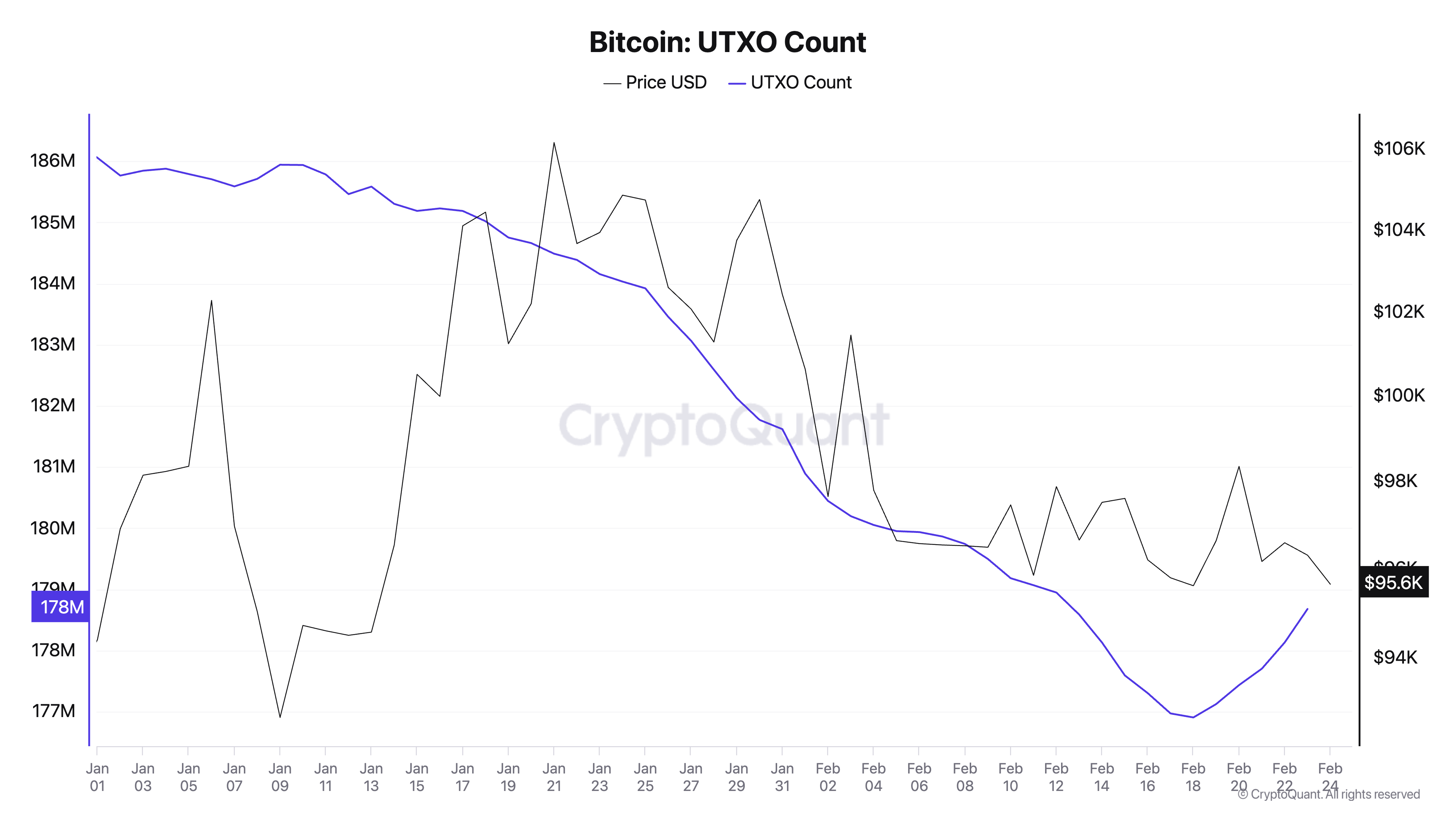

Moreover, Avocado experiences that “the replace of UTXOs is also lowering, with the magnitude of the decline the same to the correction duration in September 2023.”

Unspent Transaction Output (UTXO) tracks the quantity of Bitcoin left after a transaction, which is prepared to be aged as input for future transactions. It represents the on hand stability that can even be spent on the network. When the replace of UTXOs declines, fewer fresh coins are being dispensed or moved, suggesting decreased transaction project. This indicates a duration of consolidation, where merchants are conserving rather then spending their coins.

“If this pattern continues, we would possibly perhaps well maybe perceive indicators of investor exodus the same to the market cycle top of 2017. On the other hand, a straightforward decline in UTXOs on my own is no longer adequate to yelp the stop of the present cycle, as other indicators easy recommend a bullish outlook,” Avocado writes.

Bitcoin Hovers Attain Key Enhance—Will It Support or Spoil Lower?

As of this writing, BTC trades end to the toughen line of its horizontal channel at $95,527. If the Bitcoin network project wanes, extra affecting the quiz for the king coin, its impress would possibly perhaps well maybe break below this level. On this area, BTC would possibly perhaps well maybe fall to $92,325.

Alternatively, if market trends shift and the buying for rigidity positive factors momentum, the coin would possibly perhaps well maybe rally toward the resistance at $ninety nine,031 and strive a crossover. If worthwhile, BTC would possibly perhaps well maybe reach $102,665.