Chainlink rate has crashed this year, continuing a vogue that began in December when it peaked at a multi-year excessive of $30.78.

Chainlink (LINK) dived to $17.4 on Saturday, down by 43% from its best seemingly degree in December. Its fracture mirrors the happenings amongst altcoins as most of them like retreated within the previous few months.

Peaceful, there are three key the causes why the LINK rate could possibly well leap assist later this year.

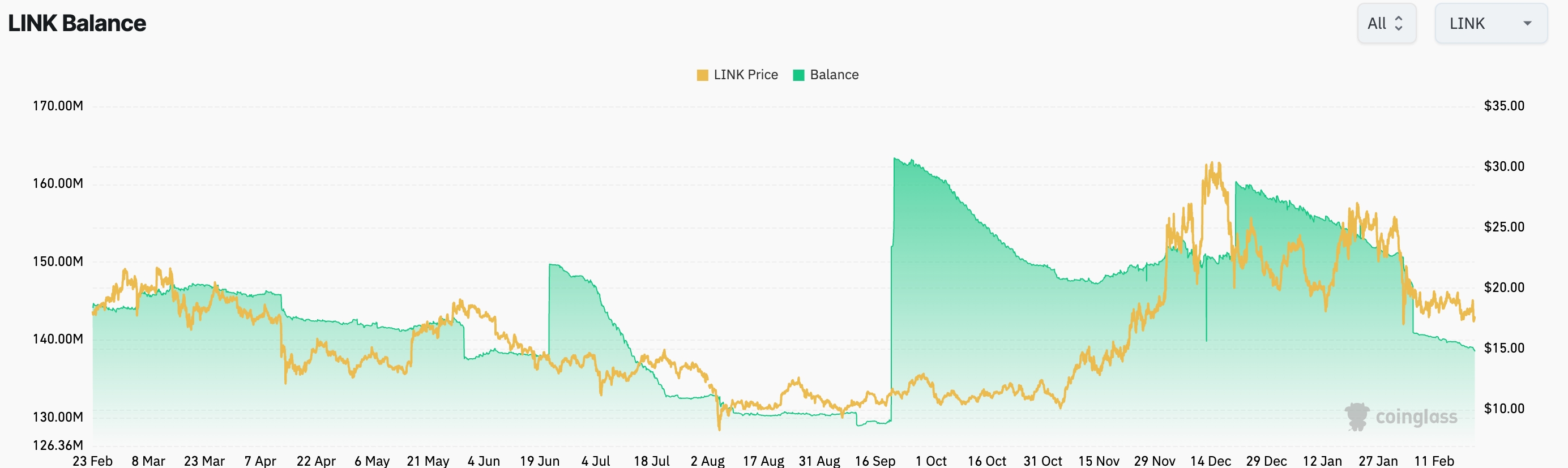

First, there are signs that many Chainlink holders are no longer promoting their coins. One piece of proof is that balances on exchanges like persisted falling this year. CoinGlass knowledge presentations that these balances like dropped to 138.8 million LINK coins, the lowest degree since September last year. They plunged from 160 million in December.

Falling centralized substitute balances is a designate that merchants are optimistic about the coin, with most of them preserving them actual in their self-custody wallets. In most periods, CEX balances jump when merchants are transferring them from their wallets to sell them.

The self belief amongst Chainlink holders is seemingly due to this of a couple of them demand that the Securities and Change Price will approve a region LINK ETF later this year. The form of fund would lead to extra inflows and boost its rate.

Chainlink rate could possibly well also rebound thanks to its positioning within the crypto commerce, where it’s the preferrred oracle community. It has a entire fee secured or TVS settle of $35 billion, making it mighty bigger than other oracles like Account, Pyth, and RedStone.

Chainlink is also a tall player within the Real World Asset tokenization commerce by its frightful-chain interoperability protocol. CCIP is a key ingredient within the commerce that offers solutions to perform, scale, join, and send resources all over various blockchains.

Chainlink rate prognosis

Third, Chainlink rate could possibly well leap assist thanks to its strong technicals. The weekly chart presentations that LINK has remained a small above the 100-week Exponential Transferring Averages even after crashing by 43% from its best seemingly point in November.

LINK has also fashioned a huge megaphone chart pattern, which is characterized by two diverging trendlines. In most periods, this pattern ends in a strong bullish breakout.

In LINK’s case, the preliminary plot of a rebound shall be the November excessive of $30 followed by the 61.8% retracement point of $35. A drop below the lower facet of the megaphone will invalidate the bullish LINK outlook.